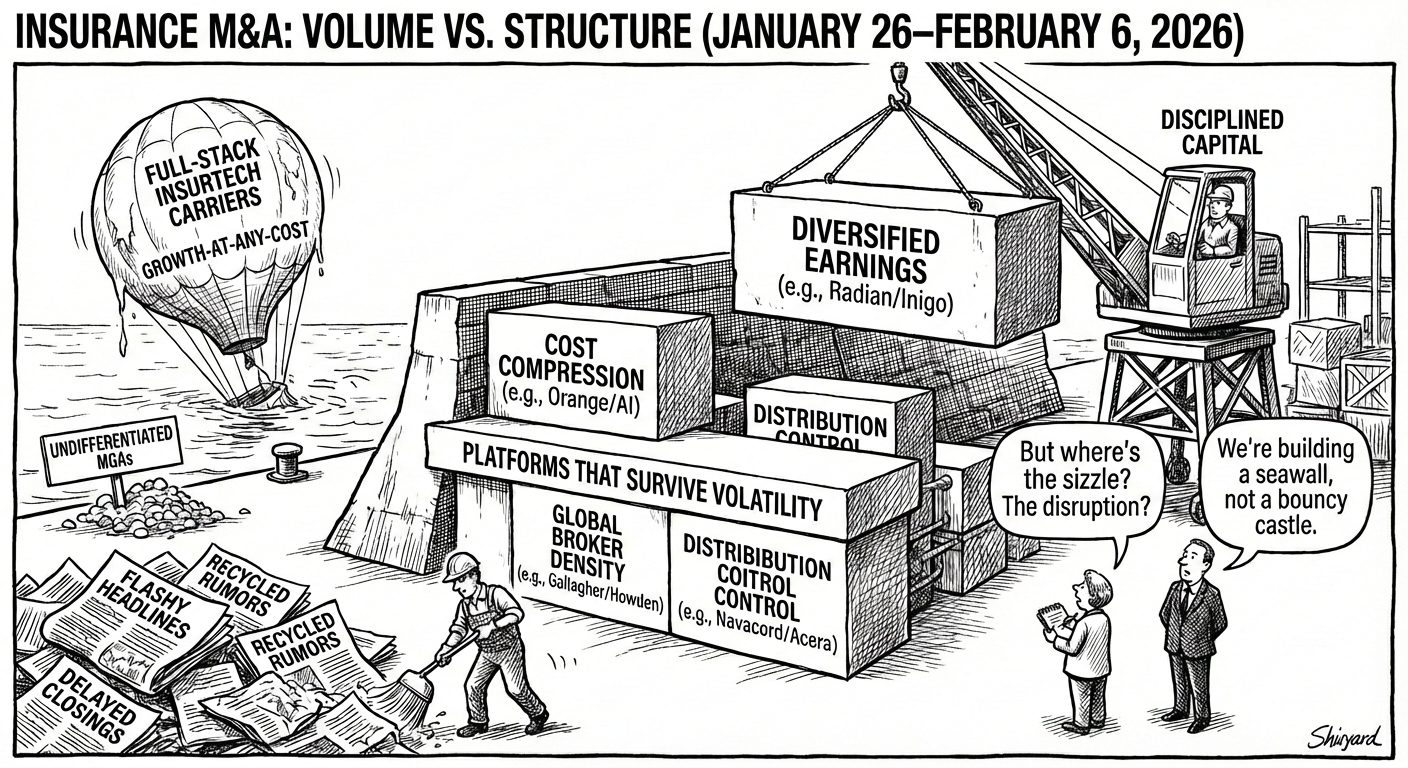

From January 26 to February 7, 2026, insurance and InsurTech M&A blended headline carrier moves with targeted distribution and tech plays. Meiji Yasuda and Radian closed multi‑billion‑dollar acquisitions that push them deeper into US term life and Lloyd’s specialty, while Zurich advanced an £8B bid for Beazley that could reshape the global cyber and specialty landscape. At the same time, WTW’s purchase of tech‑enabled broker Newfront, a string of regional roll‑ups by Hilb, WalkerHughes, Novacore, FMIG, Howden, Gallagher, Olea and K2, and intra‑InsurTech deals like HPN–Orange and Akur8–Matrisk show capital flowing toward distribution control, specialty underwriting and embedded AI capabilities

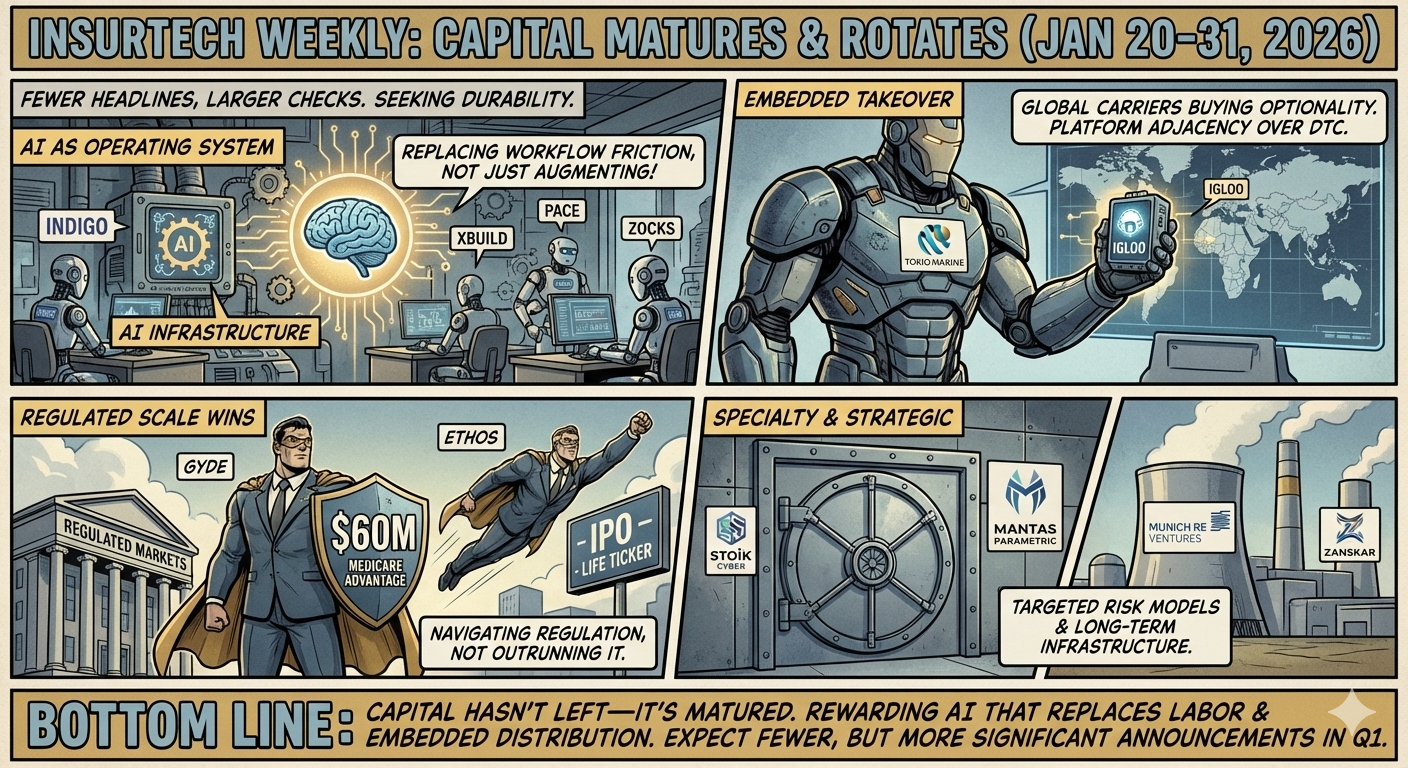

Investment Activity InsurTech & Insurance Report: January 19–31, 2026 (Week 4–5)

Excerpt

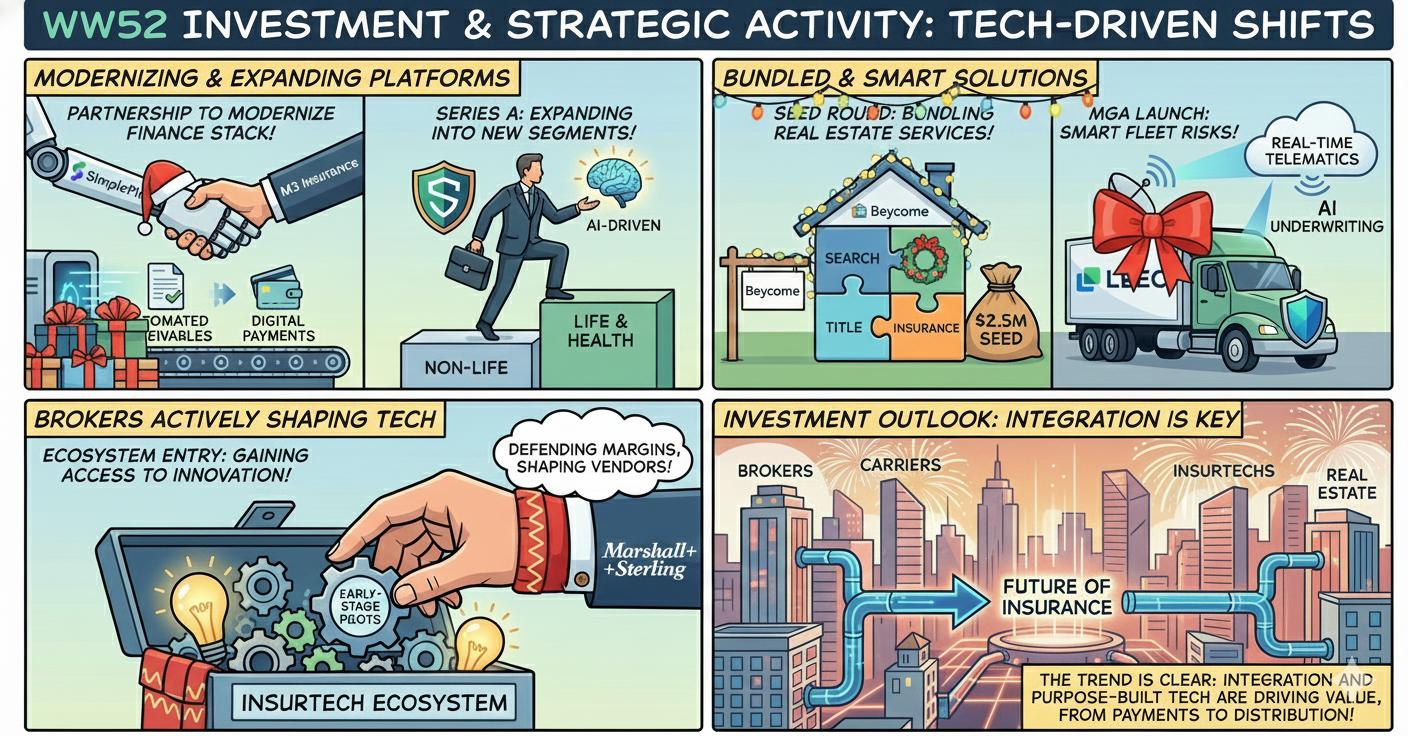

The last two weeks of January made one thing clear: insurance isn’t being “disrupted” anymore—it’s being rewired. Capital flowed decisively toward AI-native platforms, vertical specialists, and embedded distribution models, while full-stack replacement narratives continued to lose oxygen. From Gyde and Indigo redefining brokerage and underwriting economics, to Zurich backing embedded auto insurance via TrueCar, the signal is consistent: advantage now comes from infrastructure, not ambition.

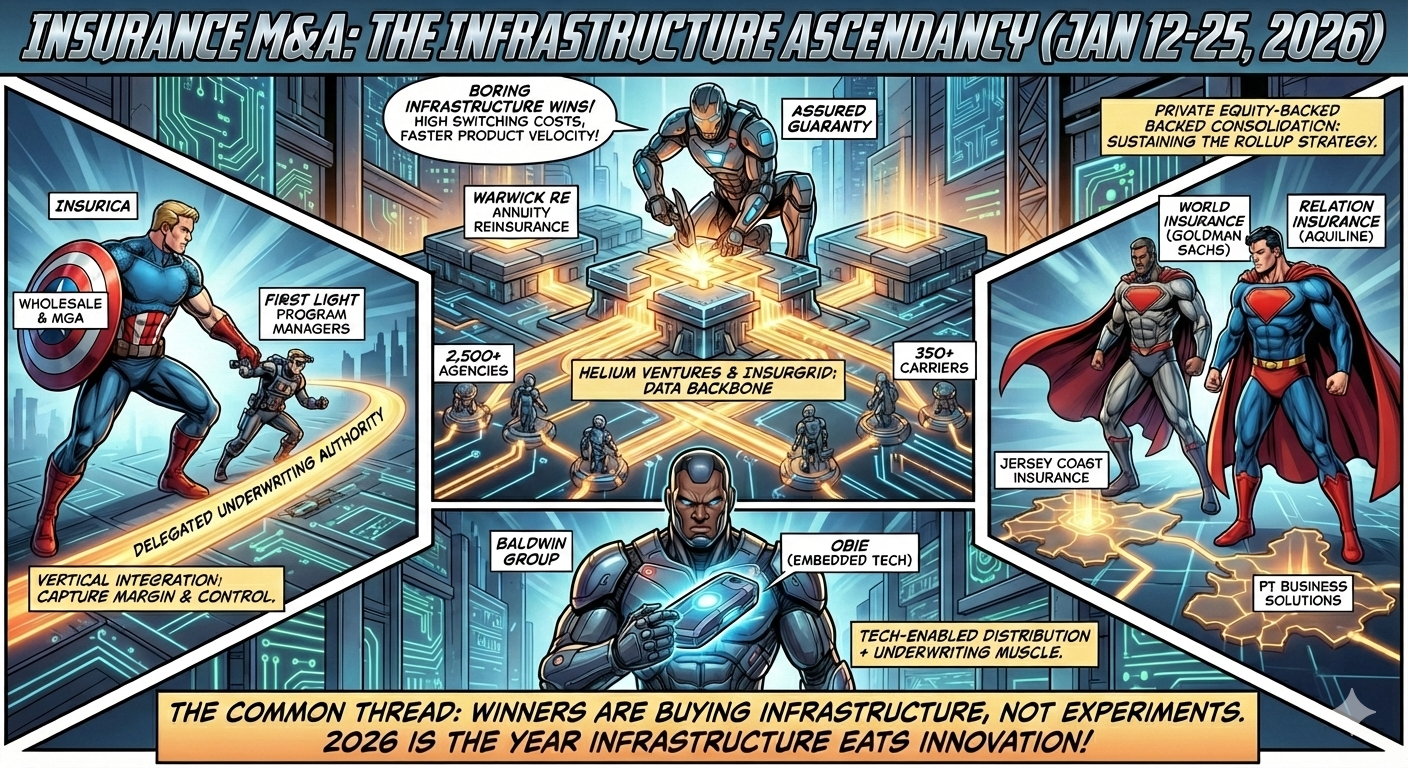

M&A Insurance & InsurTech Weekly Report: January 12–25, 2026

The two-week period from January 12–25, 2026 captured seven discrete insurance and InsurTech M&A transactions, spanning embedded distribution technology, regional brokerage consolidation, wholesale specialty platforms, and reinsurance infrastructure. Despite a 12% decline in overall 2025 insurance agency M&A volume—695 deals versus 787 in 2024—strategic acquirers sustained momentum in early 2026, targeting proven platforms with recurring revenue, specialty expertise, and geographic expansion opportunities.

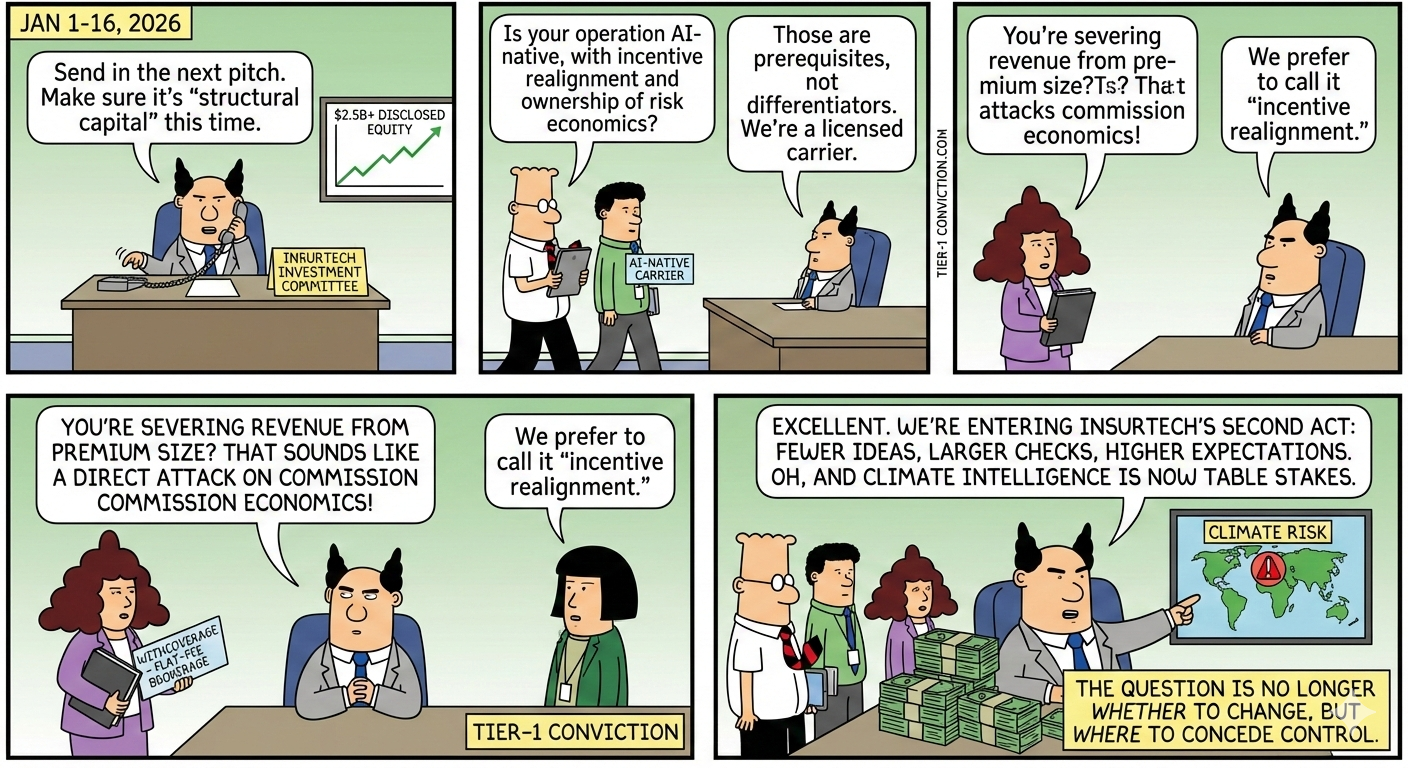

Funding Insurance & Insurtech Report: January 1-16 2026

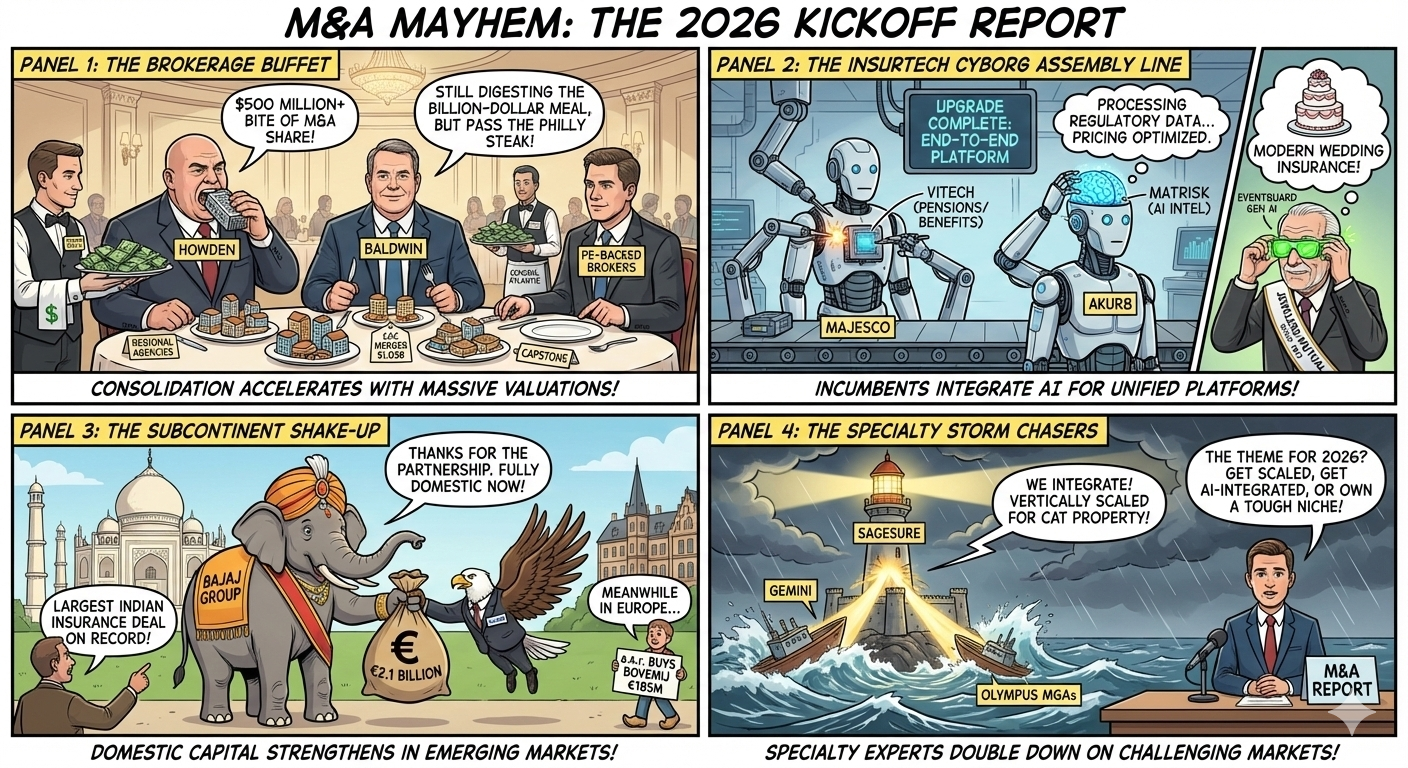

M&A Insurance & InsurTech Weekly Report January 1–11, 2026

Another blockbuster week in insurance M&A: Howden drops $500M+ on US transactional liability powerhouse Atlantic Group, while Majesco and Akur8 double down on AI with Vitech and Matrisk acquisitions—fusing core platforms, pricing intelligence, and next-gen tech into operating systems for carriers. Bajaj closes India's largest-ever insurance deal (₹21,390 crore) to buy out Allianz and take full control of its insurance subs, while a.s.r. grabs Dutch mobility specialist Bovemij for €185M. On the distribution side, Baldwin (fresh off a $1B CAC merger) and Trucordia keep the consolidation flywheel spinning. And in a sign of the times: Jewelers Mutual acquires AI-powered MGA EventGuard, proving generative-AI distribution is no longer a concept—it's a growth lever for 110-year-old mutuals. The message? Scale, tech, and capability-driven M&A are rewriting the playbook across broking, tech, and underwriting.

#InsuranceMandA #InsurTech #PrivateEquity #Brokers #AI #India