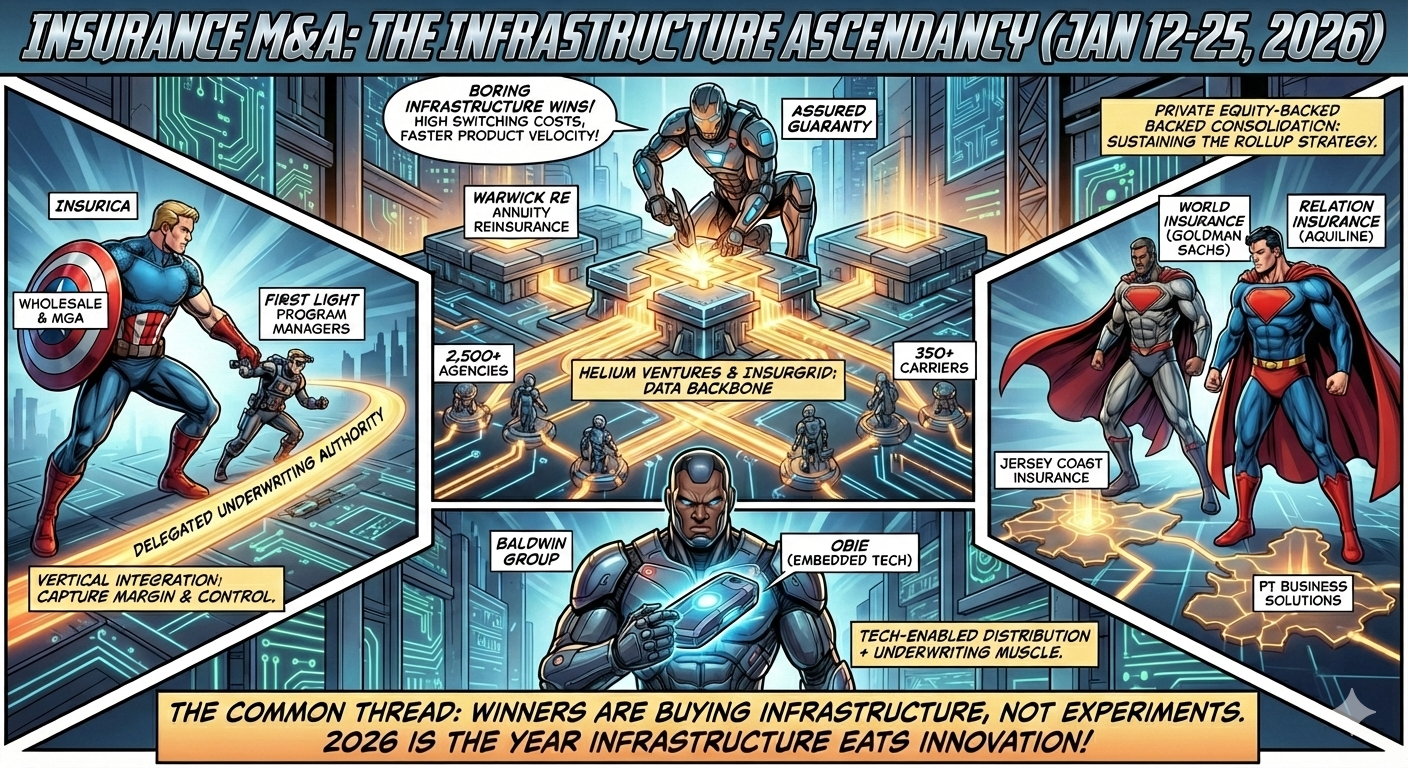

The two-week period from January 12–25, 2026 captured seven discrete insurance and InsurTech M&A transactions, spanning embedded distribution technology, regional brokerage consolidation, wholesale specialty platforms, and reinsurance infrastructure. Despite a 12% decline in overall 2025 insurance agency M&A volume—695 deals versus 787 in 2024—strategic acquirers sustained momentum in early 2026, targeting proven platforms with recurring revenue, specialty expertise, and geographic expansion opportunities.

The transactions reflect three enduring strategic priorities: (1) infrastructure consolidation in InsurTech (Helium Ventures acquiring InsurGrid's multi-carrier data connectivity platform serving 2,500+ agencies); (2) vertical integration in specialty underwriting (Insurica's acquisition of First Light Program Managers, its largest deal in 67 years, extending into wholesale MGA capabilities); and (3) regional brokerage rollup by private equity-backed platforms (World Insurance Associates, Relation Insurance) seeking scale, cross-selling synergies, and talent retention through employee ownership models.

Notably, the period included Assured Guaranty's strategic $158 million entry into annuity reinsurance via Warwick Re, positioning the financial guarantor as a new AA-rated competitor in MYGA and pension risk transfer—a rare example of an insurer pivoting into a high-growth reinsurance segment with structural differentiation.

This report provides transaction-by-transaction analysis with deal dates, buyer/seller profiles, financial backers and their insurance portfolios, strategic rationale, and competitive impact assessments, concluding with market context and a LinkedIn-ready summary for industry distribution.

1. Assured Guaranty Acquires Warwick Re: Strategic Entry into Annuity Reinsurance

Date: January 21, 2026 (transaction closed)

Parties and Structure

Assured Guaranty Ltd. (NYSE: AGO), via a holding-company subsidiary, acquired 100% of Warwick Re Limited, a Bermuda-domiciled life and annuity reinsurer, along with its UK parent Warwick Company (UK) Limited (Warwick Holdings) and affiliated subsidiaries, for approximately $158 million, subject to customary post-closing adjustments. The acquisition included the balance sheet, operating platform, employees, and corporate parent entities, which were renamed Assured Life Reinsurance Ltd.

Transaction Backers and Insurance Holdings

The acquisition was self-funded by Assured Guaranty. Insurance Advisory Partners LLC served as exclusive financial advisor to AGL, with legal counsel provided by Debevoise & Plimpton LLP and Conyers Dill & Pearman Limited.

Assured Guaranty is a leading financial guarantor with over 40 years in the sector and more than 20 years serving the life and annuity insurance industry through capital management transactions, including life insurance securitizations and structured financing. The firm previously had not owned a dedicated annuity reinsurance operating platform; this acquisition creates a new business line under the Assured Life Reinsurance brand.

Strategic Impact on Assured Guaranty

The acquisition represents a deliberate strategic expansion into annuity reinsurance, targeting two high-growth segments: US multi-year guaranteed annuities (MYGA) and UK bulk purchase annuities (pension risk transfer). Rather than building capabilities organically—a multi-year, capital-intensive process—AGL acquired an established operating base with staff, systems, product expertise, and existing relationships with ceding insurers, accelerating time-to-market in segments experiencing structural demand from aging demographics, defined-benefit plan de-risking, and yield-seeking retail investors.

A key structural differentiator is the guarantee mechanism: for certain assumed risks, obligations to ceding insurers may be supported by a guaranty from Assured Guaranty Re Overseas Ltd., an AA-rated affiliate. This creates a unique counterparty credit profile in the annuity reinsurance market, potentially appealing to cedents that prioritize balance-sheet strength, regulatory capital relief, and credit quality over pure pricing. Few annuity reinsurers can offer AA-rated support combined with financial guaranty structuring expertise.

Competitive Landscape Impact

The entry of Assured Life Re adds a new, AA-linked platform to a segment historically dominated by a small cohort of specialist reinsurers and private equity-backed annuity platforms (e.g., Apollo's Athene, KKR's Global Atlantic, Ares' Aspida, Brookfield's American Equity). AGL's dual capability in structured finance and capital markets—honed through decades of financial guaranty and insurance securitizations—positions it to offer hybrid solutions that blend traditional reinsurance with capital markets execution, a value proposition that few pure-play annuity reinsurers can replicate.

Given the growing pipeline of pension risk transfer transactions in the UK (driven by defined-benefit plan de-risking) and stable MYGA demand in the US (driven by higher interest rates and retirement income needs), the addition of Assured Life Re may exert pricing pressure on incumbents, particularly in segments where cedents value AA-rated counterparty support and innovative structuring over commoditized capacity. For competitors, the transaction signals that non-traditional entrants with adjacent capabilities (financial guaranty, structured finance, capital markets) can credibly compete in annuity reinsurance, raising the bar for product innovation and counterparty differentiation.

2. Helium Ventures Acquires InsurGrid: Consolidating P&C Agency Data Infrastructure

Date: January 21–22, 2026 (announcement published January 22)

Parties and Structure

Helium Ventures, an AI-native holding company focused on acquiring and scaling software businesses with product-market fit in large, underserved markets, completed the acquisition of InsurGrid, a leading InsurTech platform for insurance policy data collection and verification. InsurGrid connects more than 2,500 property and casualty insurance agents across the US to over 350 insurance carriers through carrier-agnostic connectivity and digital workflows that eliminate manual data entry and back-and-forth between agents and insurers.

Financial terms were not disclosed. The deal is positioned as an acceleration play, with Helium committing to heavy investment in product development, team expansion, and feature velocity.

Transaction Backers and Holdings

Helium Ventures is described as a B2B software buyer targeting proven platforms in large addressable markets; no external financial sponsor (e.g., private equity fund) was named in the announcement. InsurGrid's core capabilities include digitally collecting declaration pages, policy details, and coverage information via client links, replacing email and phone-based workflows with structured, API-driven data exchange.

Strategic Impact on InsurGrid and Helium

Under Helium's ownership, InsurGrid is being positioned as the "definitive P&C data platform for agencies of all sizes," signaling an ambition to become the standard intake and connectivity layer across the independent agent channel. Post-acquisition, the platform has already shipped features long-requested by users, indicating an operational boost and faster product velocity under new ownership.

For Helium, InsurGrid represents a classic infrastructure play: a boring, essential workflow tool with high switching costs, network effects (more carriers = more valuable to agents; more agents = more valuable to carriers), and recurring revenue tied to policy volume rather than risky underwriting exposure. This aligns with the broader thesis that InsurTech exits increasingly favor infrastructure over flashy consumer-facing apps—platforms that sit at critical workflow choke points with defensible moats are commanding premium valuations and strategic buyer interest.

Competitive Landscape Impact

The acquisition consolidates a widely adopted connectivity layer under a software holding company with patient capital and a long-term operational playbook, intensifying competitive pressure on smaller, single-purpose policy data or forms automation vendors. As Helium deepens InsurGrid's integrations and potentially adds analytics, workflow automation, or compliance modules, the multi-carrier connectivity moat becomes more defensible, raising the bar for new entrants attempting to displace InsurGrid at agencies that have standardized on its platform.

For carriers and MGAs, a stronger, better-capitalized InsurGrid may evolve into a de facto distribution-data utility, which could shift bargaining power dynamics in the agent-carrier relationship. Carriers relying on InsurGrid's infrastructure may need to integrate more tightly with its APIs and data standards, effectively ceding some control over the agent onboarding and policy intake experience. For agents, InsurGrid's enhanced capabilities under Helium's ownership improve efficiency and reduce administrative burden, but also create switching costs that lock agencies into the platform long-term—a classic "picks and shovels" dynamic in InsurTech infrastructure.

3. Insurica Acquires First Light Program Managers: Expanding into Wholesale MGA

Date: January 12–19, 2026 (announced; effective January 1, 2026)

Parties and Structure

Insurica, one of the largest US insurance brokerages (ranked among the top 50 by revenue, placing over $2 billion in annual premiums), completed the acquisition of First Light Program Managers, LLC, a Florida-based wholesale brokerage and delegated underwriter specializing in trucking and marine coverage. The acquisition, effective January 1, 2026, is described as the largest in Insurica's 67-year history, reflecting strategic ambition to expand into wholesale and managing general underwriting (MGU/MGA) capabilities.

First Light was founded by the late Anthony L. Johnson in 2007 and operates both traditional wholesale brokerage and delegated underwriting authority, with a national reputation in the transportation sector (trucking and marine). The company is led by Janet Fender, President, CEO, and Chief Underwriting Officer, who views the transaction as positioning First Light for continued growth while preserving its underwriting culture and client focus.

Financial terms were not disclosed. The transaction was facilitated by Mystic Capital Advisors, a New York-based M&A advisory firm specializing in insurance brokerage transactions.

Transaction Backers and Insurance Holdings

Insurica is majority-owned by the Cameron Family, an Oklahoma City-based family office with holdings in insurance, banking, real estate, and professional sports. The remaining equity is owned by 103 employee-owners, with average ownership value of $1.2 million per employee and individual stakes ranging from $50,000 to over $15 million. This employee ownership model differentiates Insurica from private equity-backed brokers, enabling long-term decision-making and strong retention of top producers.

Insurica's insurance holdings now include:

- 36 retail brokerage offices across the southern United States, with over 900 employees

- First Light Program Managers: Wholesale and MGA capabilities in trucking and marine (newly acquired)

- Specialty expertise: Transportation, construction, energy, healthcare, and other verticals

- Assurex Global membership: Access to global network and resources

Insurica provides buyer financing for employee ownership through BMO Financial Group and internal financing, enabling producers to purchase equity stakes when they reach $500,000 in book of business and $150,000 in two-year new business production.

Strategic Impact on Insurica and First Light

For Insurica, the acquisition extends its capabilities into wholesale distribution and delegated underwriting authority, vertically integrating upstream into program business and specialty underwriting—capabilities that retail brokers typically access through third-party wholesalers. The move capitalizes on a structural trend: managing general underwriters (MGUs) saw net written premiums increase 40% in the last year, driven by carrier appetite for delegated authority in hard-to-place specialty classes.

Insurica leadership believes the trend toward delegated underwriting and program structures in difficult-to-place classes (e.g., long-haul trucking, marine cargo, high-risk property) will continue, making First Light a strategic platform for growth in specialty lines where traditional carriers lack underwriting expertise or appetite. The acquisition also deepens Insurica's transportation sector specialization, a core vertical for both companies, enabling cross-selling of retail brokerage services to First Light's wholesale clients and vice versa.

For First Light, joining Insurica provides access to capital, operational infrastructure, technology investments, and a broader product suite (personal lines, employee benefits, workers' compensation), while maintaining the entrepreneurial culture and underwriting discipline that built its reputation in the transportation sector. First Light will continue to operate under its brand and leadership, with Janet Fender remaining as CEO.

Competitive Landscape Impact

The acquisition positions Insurica to compete more effectively against larger brokers with integrated wholesale and MGA platforms (e.g., Ryan Specialty, AmWINS, CRC Group, Hub International's wholesale division), particularly in the transportation sector where First Light's delegated underwriting authority and carrier relationships provide differentiated access to capacity.

For competitors, the transaction underscores the strategic value of vertical integration: owning wholesale and MGA capabilities allows retail brokers to capture additional margin, control underwriting decisions, and offer differentiated solutions in specialty classes where carrier appetite is limited. Regional brokers lacking similar capabilities may face pressure to acquire or partner with wholesalers to remain competitive in specialty verticals, or risk losing business to integrated platforms that can bundle retail placement, wholesale access, and program underwriting in a single relationship.

The 40% increase in MGU net written premiums signals that carriers are increasingly comfortable delegating underwriting authority to specialized program managers with proven track records, deep sector expertise, and sophisticated data/analytics capabilities—raising the bar for new MGU entrants and rewarding established platforms like First Light with premium valuations and strategic buyer interest.

4. World Insurance Associates Acquires Jersey Coast Insurance

Date: January 19–20, 2026 (announced publicly; effective October 1, 2025)

Parties and Structure

World Insurance Associates LLC (World), a Top 50 US insurance brokerage with over 300 offices across the US and UK, acquired the business of Jersey Coast Insurance, a Margate City, New Jersey-based independent agency specializing in coastal property insurance, including coastal homes, condominiums, and flood risks. The transaction was effective October 1, 2025, but announced publicly in January 2026.

Financial terms were not disclosed. Giordano, Halleran & Ciesla provided legal counsel to World; Fox Rothschild LLP provided legal counsel to Jersey Coast.

Jersey Coast is led by Stephen Popovich, President, who highlighted the agency's nearly two-decade track record of building trust and reliability with local and surrounding communities, focusing on matching clients with the right coverage at the lowest premium available.

Transaction Backers and Insurance Holdings

World Insurance Associates is backed by Charlesbank Capital Partners and Goldman Sachs Asset Management as co-lead equity investors, following a $1 billion+ investment by Goldman Sachs in 2023 at an approximately $3.4 billion enterprise valuation. Charlesbank first invested in World in March 2020 as the company's first private equity sponsor, enabling accelerated M&A, management team expansion, and operational standardization. In 2023, World completed a significant recapitalization and liquidity event, with Charlesbank retaining half its stake and continuing as co-lead investor alongside Goldman Sachs.

World's management team and employee shareholders remain major investors alongside Charlesbank and Goldman Sachs. The company has completed nearly 200 acquisitions since its founding in 2011, building a comprehensive network of brokers and specialists serving commercial and personal insurance, employee and executive benefits, wealth management, retirement plan services, private client services, and payroll & HR solutions.

Strategic Impact on World and Jersey Coast

For World, the acquisition expands its coastal property footprint in the strategically important New Jersey Shore market, adding specialized expertise in flood insurance, coastal homeowners, and condominium coverage—products requiring deep carrier relationships, regulatory knowledge, and catastrophe modeling sophistication. Jersey Coast's local market presence and client relationships complement World's national platform, enabling cross-selling of commercial lines, employee benefits, and private client services to Jersey Coast's existing customer base.

For Jersey Coast, joining World provides access to a national platform with enhanced capabilities, broader product offerings, and the operational and technology resources of a Top 50 brokerage, while preserving local leadership and community ties. Jersey Coast's clients gain access to World's full suite of services, including data-driven analytics, modernized benefits programs, and wealth management solutions.

Competitive Landscape Impact

The acquisition reflects World's aggressive geographic expansion strategy, targeting regional agencies with specialized expertise in underserved or high-value niches (in this case, coastal property in a catastrophe-exposed market). For smaller regional brokers in New Jersey and adjacent coastal markets, World's combination of national scale, private equity capital, and local specialization raises the competitive bar, making it difficult for standalone agencies to compete on product breadth, technology investments, and employee compensation/equity opportunities.

World's Goldman Sachs-backed capital base—over $1 billion in equity and subordinated debt—enables aggressive acquisition velocity while maintaining financial flexibility, positioning World to outbid competitors for high-quality regional targets and consolidate fragmented coastal property markets where succession challenges and capital constraints are driving seller activity. For private equity-backed competitors (e.g., Hub International, AssuredPartners, Acrisure), World's valuation and capital structure underscore the premium multiples being paid for well-capitalized, rapidly growing brokerage platforms with employee ownership models that attract top talent.

5. Relation Insurance Acquires PT Business Solutions

Date: January 21–22, 2026 (announced publicly; effective October 31, 2025)

Parties and Structure

Relation Insurance Services, a Top 25 US insurance brokerage by revenue with approximately 1,350 employees across 100+ locations nationwide, acquired the assets of PT Business Solutions, a South Pasadena, California-based full-service provider of employee benefits, HR, payroll, workers' compensation, and group retirement plans. The transaction was effective October 31, 2025, but announced publicly in January 2026.

PT Business Solutions was founded more than 22 years ago (circa 2003) by Chris Pontrelli and Raphy Timour, who built the firm with a focus on superior service and understanding clients' unique needs to deliver better solutions for both business owners and their employees. In 2020, the founders changed the company's name and business model to offer a "soup to nuts" solution helping clients attract and retain top talent while mitigating risks—a comprehensive HR, benefits, and compliance platform targeting small and mid-sized businesses.

Financial terms were not disclosed.

Transaction Backers and Insurance Holdings

Relation Insurance Services is a privately held corporation backed by Aquiline Capital Partners, a New York and London-based private equity firm investing in businesses globally across financial services and technology. Aquiline first acquired a majority stake in Relation in 2019, providing capital to support the brokerage's growth-through-acquisition strategy and operational expansion.

Aquiline Capital Partners' insurance holdings are extensive, spanning reinsurance, specialty underwriting, Lloyd's platforms, InsurTech, and distribution. Key portfolio companies include:

- Relation Insurance Services: Top 25 US brokerage focused on risk management and benefits consulting

- Ark Insurance Holdings: Lloyd's Syndicate managing agency underwriting marine, energy, property, casualty, specialty, and reinsurance

- Core Specialty Insurance Holdings: Property and casualty insurance holding company offering niche products for small to mid-sized businesses

- Corvus Insurance: Digital InsurTech MGA focused on cyber protection with risk management insights

- Distinguished Programs: One of the largest independent program managers in the US, underwriting and distributing insurance across 14 programs with a technology-centric approach

- IQUW (formerly IQE): Lloyd's Syndicate specializing in agile underwriting using data and intelligent automation

- TigerRisk Partners: Leading reinsurance broker and risk/capital management advisor

- Validus Holdings: Reinsurance and insurance holding company (exited; acquired by AIG)

- Wellington Underwriting Managers: Texas residential property MGA with a tech-enabled, multi-carrier platform

Aquiline's portfolio reflects a diversified insurance strategy spanning underwriting capacity, reinsurance intermediation, specialty program business, InsurTech innovation, and distribution—positioning Relation within a broader ecosystem of insurance operating companies and capital providers.

Strategic Impact on Relation and PT Business Solutions

For Relation, the acquisition expands its California presence and deepens capabilities in integrated HR, payroll, and benefits administration—a high-margin, recurring-revenue segment serving small and mid-sized businesses that value comprehensive outsourcing solutions. PT Business Solutions' "soup to nuts" approach aligns with Relation's strategy of offering risk management, employee benefits, HR consulting, payroll, and retirement plan services as a bundled platform, enabling cross-selling and wallet-share expansion with existing clients.

For PT Business Solutions, joining Relation provides access to nationwide resources and capabilities, including Relation's scale, technology infrastructure, carrier relationships, and broader product suite, while preserving the client-centric culture and entrepreneurial approach that built the firm's reputation over two decades. Founders Chris Pontrelli and Raphy Timour emphasized that the partnership enables the firm to meet client needs "like never before," leveraging Relation's national footprint and operational resources.

Competitive Landscape Impact

The acquisition underscores the continued consolidation of the benefits consulting and HR outsourcing segment, where standalone local and regional firms face competitive pressure from national platforms offering integrated benefits, payroll, HR compliance, and retirement plan administration through technology-enabled workflows. For smaller benefits consultants in California and adjacent markets, Relation's combination of national scale, private equity backing (Aquiline), and integrated service delivery raises the bar for technology investments, carrier access, and comprehensive platform capabilities.

Relation's aggressive M&A strategy—actively seeking partnerships to expand offerings, industry expertise, and geographic footprint—positions it to continue consolidating fragmented regional markets, particularly in high-value segments like California where regulatory complexity (e.g., CalSavers, CA-specific employment laws) and employer demand for outsourced HR/benefits solutions create opportunities for well-capitalized platforms to capture market share from smaller, resource-constrained competitors. For private equity-backed competitors in the benefits consulting space (e.g., Hub International's benefits division, NFP, Acrisure), the transaction highlights the strategic value of integrated HR/payroll/benefits platforms that create switching costs and recurring revenue streams less sensitive to premium rate cycles than traditional property and casualty brokerage.

6. Baldwin Group Acquires Obie (Completion within Target Window)

Date: January 13–14, 2026 (completion announced)

Parties and Structure

The Baldwin Group (NASDAQ: BWIN) completed the acquisition of Creisoft, Inc. and its subsidiaries, collectively known as "Obie," a Chicago-based embedded insurance distribution business specializing in landlord and investment property insurance. The transaction was announced in late 2025 but formally completed in mid-January 2026, falling within the target analysis window.

Obie serves real estate investors through multiple channels, including direct-to-investor digital experiences and integrated partner platforms, leveraging embedded technology to integrate insurance into real estate transactions. The platform achieved revenue growth exceeding 2,100% since 2021 while maintaining a fully reserved loss ratio below 50%, demonstrating both growth velocity and disciplined underwriting.

Financial terms were not disclosed.

Transaction Backers and Insurance Holdings

Baldwin is a publicly traded independent insurance brokerage that recently completed the $1.03 billion merger with CAC Group (closing January 1, 2026), creating one of the largest majority colleague-owned, publicly traded insurance brokers in the United States. Baldwin does not have an external private equity sponsor for the Obie acquisition; the company is financing growth through public equity markets and operational cash flow.

Baldwin's insurance holdings include:

- MSI (Millennial Specialty Insurance): One of the largest independent MGAs in the US, offering 20+ products across personal, commercial, and professional lines, serving 1.5 million+ customers

- CAC Group: Recently merged specialty and transactional liability platform (as of January 1, 2026)

- Obie: Embedded property insurance for landlords and real estate investors (newly acquired)

- Reinsurance and capacity platforms: Proprietary reinsurance operations supporting program business

- Specialty expertise: Natural resources, private equity, real estate, senior living, education, construction, financial lines, transactional liability, cyber, and surety

Strategic Impact and Competitive Landscape

For Baldwin, the Obie acquisition strengthens embedded insurance distribution capabilities and expands reach in the rapidly growing real estate investor market, integrating insurance at the point of transaction where landlords and investors are already operating. By embedding Obie's technology into MSI's product stack, Baldwin gains a modern, tech-forward distribution channel that captures customers earlier in the purchase journey than traditional agent-based models.

For competitors, the transaction signals that large brokers are moving beyond partnerships and acquiring proven embedded distribution platforms outright, reducing the greenfield opportunity for standalone embedded InsurTechs in the landlord and real estate investor segment. Baldwin's combination of embedded distribution (Obie), deep underwriting capabilities (MSI), and public-company scale creates a formidable competitive position in property insurance for real estate investors—a high-growth segment where tech-enabled distribution and underwriting excellence drive sustainable profitability.

7. Starkweather & Shepley Acquires DiMatteo Insurance Brokers

Date: January 12, 2026 (announced; effective January 1, 2026)

Parties and Structure

Starkweather & Shepley Insurance Brokerage Inc. acquired DiMatteo Insurance Brokers, an independent insurance agency based in East Hartford, Connecticut, founded in 2010. The transaction was effective January 1, 2026, and announced publicly on January 12, 2026.

Financial and operational details were limited in the public announcement. DiMatteo Insurance Brokers operates as an independent agency serving commercial and personal lines clients in Connecticut.

Transaction Backers and Holdings

Starkweather & Shepley is a New England-based insurance brokerage with deep roots in the Connecticut market. Ownership structure and financial backers were not disclosed in the announcement.

Strategic Impact and Competitive Landscape

The acquisition reflects ongoing consolidation of small, founder-owned independent agencies in New England, driven by succession challenges, capital constraints, and competitive pressure from larger regional and national platforms. For Starkweather & Shepley, the transaction expands market share in Connecticut and adds experienced producers and client relationships to its platform. For DiMatteo Insurance Brokers, joining a larger regional platform provides access to enhanced capabilities, technology, and carrier relationships while preserving local service and community ties.

The transaction underscores a broader trend: small independent agencies (typically under $5 million in revenue) face existential pressure to merge or sell as they lack the scale to compete on technology investments, employee compensation, and product breadth against private equity-backed national platforms and well-capitalized regional brokers.

Competitive and Strategic Implications

Infrastructure Beats Innovation in InsurTech

The Helium Ventures–InsurGrid transaction confirms a structural shift in InsurTech M&A: buyers prioritize proven infrastructure over experimental innovation. Data connectivity platforms, core systems, analytics engines, and workflow automation tools—"boring" infrastructure that sits at critical workflow junctures—command premium valuations because they generate recurring revenue, have high switching costs, and create network effects that defensibly lock in customers.

Consumer-facing InsurTechs without defensible moats, proven unit economics, or sustainable competitive advantages are increasingly unattractive to strategic buyers, forcing founders to either pivot to infrastructure plays, sell at distressed valuations, or shut down.

Vertical Integration in Specialty Underwriting

Insurica's acquisition of First Light Program Managers exemplifies a strategic priority among large brokers: vertical integration into wholesale and MGA capabilities to control underwriting decisions, capture additional margin, and differentiate in specialty classes where carrier appetite is limited. Managing general underwriters saw net written premiums increase 40% in the last year, reflecting carrier comfort delegating underwriting authority to specialized platforms with proven track records and sophisticated data/analytics.

For competitors, the implication is clear: retail brokers lacking integrated wholesale and MGA capabilities risk losing business to platforms that can bundle retail placement, wholesale access, and program underwriting in a single relationship—raising the bar for specialty expertise and operational complexity.

Private Equity Dominance in Brokerage Consolidation

Private equity-backed brokers (World Insurance Associates, Relation Insurance) continue to dominate M&A volume, leveraging patient capital, operational playbooks, and aggressive acquisition strategies to consolidate fragmented regional markets. These platforms offer employee equity, technology investments, and comprehensive product suites that smaller independent agencies cannot match, creating existential pressure for regional brokers to merge or sell rather than compete as standalone businesses.

For smaller brokers, the decision calculus is stark: sell now at attractive multiples (7–12x EBITDA for high-quality agencies) while private equity capital is abundant, or risk compressed valuations in future years as buyer competition intensifies and organic growth becomes harder to achieve.

Conclusion: Strategic Takeaways for Executives and Investors

The January 12–25, 2026 M&A snapshot reveals three enduring themes shaping insurance capital allocation and competitive dynamics:

Infrastructure consolidation drives InsurTech exits: Proven platforms with recurring revenue, high switching costs, and network effects (e.g., InsurGrid's 2,500+ agency connectivity layer) command premium valuations, while consumer-facing apps without defensible moats struggle to attract buyers.

Vertical integration creates competitive moats: Brokers acquiring wholesale and MGA capabilities (e.g., Insurica / First Light) capture additional margin, control underwriting decisions, and differentiate in specialty classes—raising the bar for competitors lacking similar integrated platforms.

Private equity capital sustains brokerage consolidation: Despite a 12% decline in overall deal volume, well-capitalized platforms backed by Charlesbank, Goldman Sachs, and Aquiline continue aggressive rollup strategies, consolidating fragmented regional markets and creating existential pressure for smaller independent agencies.

For insurance executives, the message is clear: scale, specialization, and infrastructure are the new table stakes. For investors, the opportunity lies in backing platforms with defensible moats, proven unit economics, and management teams capable of executing complex integrations while preserving entrepreneurial culture.

2026 is shaping up to be the year infrastructure eats innovation—and private equity consolidates the fragments.

#InsuranceMandA #InsurTech #BrokerageConsolidation #PrivateEquity #SpecialtyInsurance #MGAs #EmbeddedInsurance #AnnuityReinsurance #InfrastructureWins