In the week of February 23–28, 2026, the insurtech sector resembled a gold rush where artificial intelligence was the only metal worth mining. White Mountains poured $125 million of structured capital into Bishop Street Underwriters, turning an MGA platform into something resembling a private-equity heavyweight. Meanwhile, carriers edged closer to the action: RLI took a strategic equity stake in Kettle, the AI-savvy MGA specialising in wildfire-exposed commercial property, securing both capacity and a front-row seat to better catastrophe models.

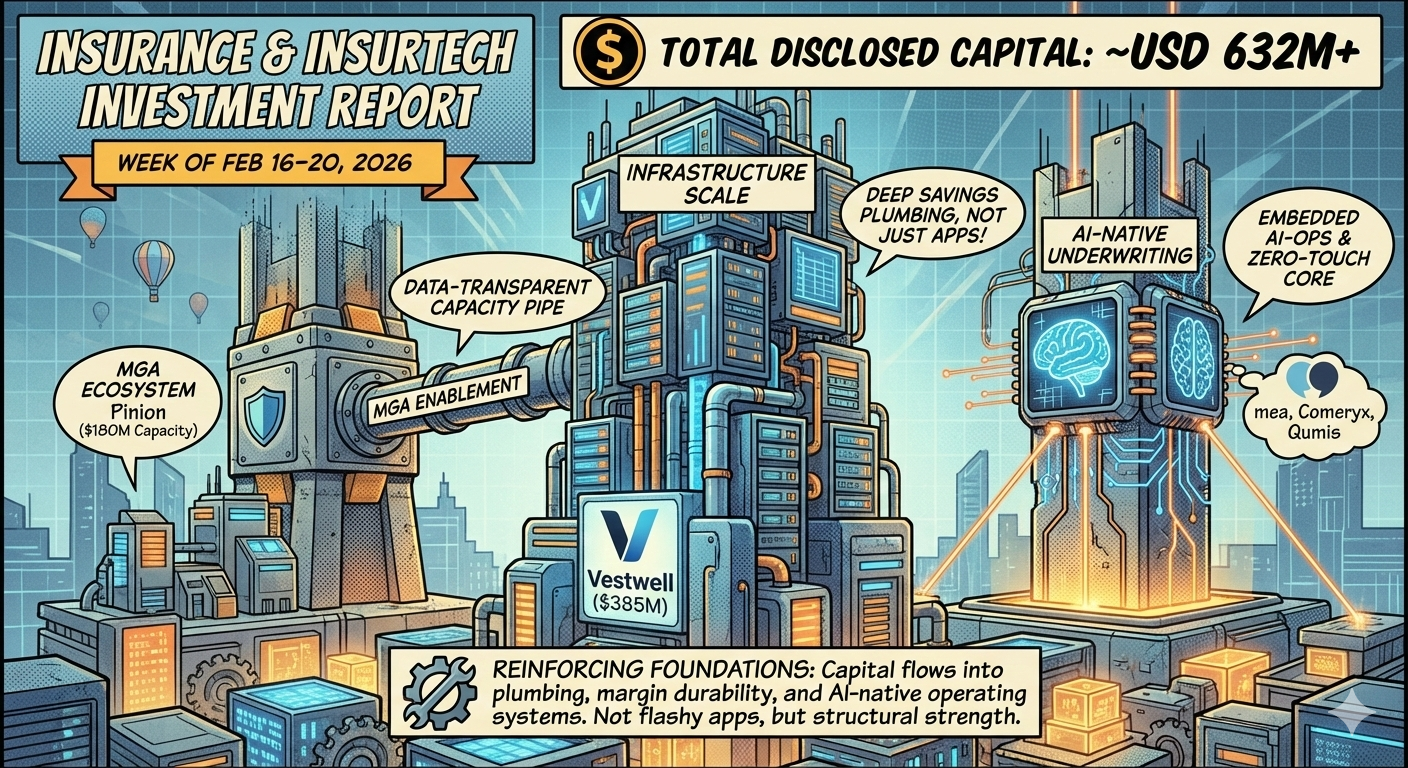

Over $632M deployed.

No consumer hype. No distribution theatrics.

This week’s insurance capital moved into infrastructure, MGA capacity, and underwriting intelligence. Vestwell’s $385M raise signaled institutional conviction in savings plumbing. Pinion’s $180M launch injected tech-enabled carrier capacity into the MGA ecosystem. Meanwhile, AI-native MGAs and coverage intelligence platforms continued targeting margin inefficiencies in small commercial.

The signal is clear: the industry is reinforcing its operating core.

The biggest opportunity in insurance isn’t selling policies.

It’s selling the software insurers can’t run without.

For years InsurTech tried to reinvent distribution.

But this week’s funding tells a different story:

the real battle is for the operating system of insurance.