January 1–16, 2026 (WW1-WW3)

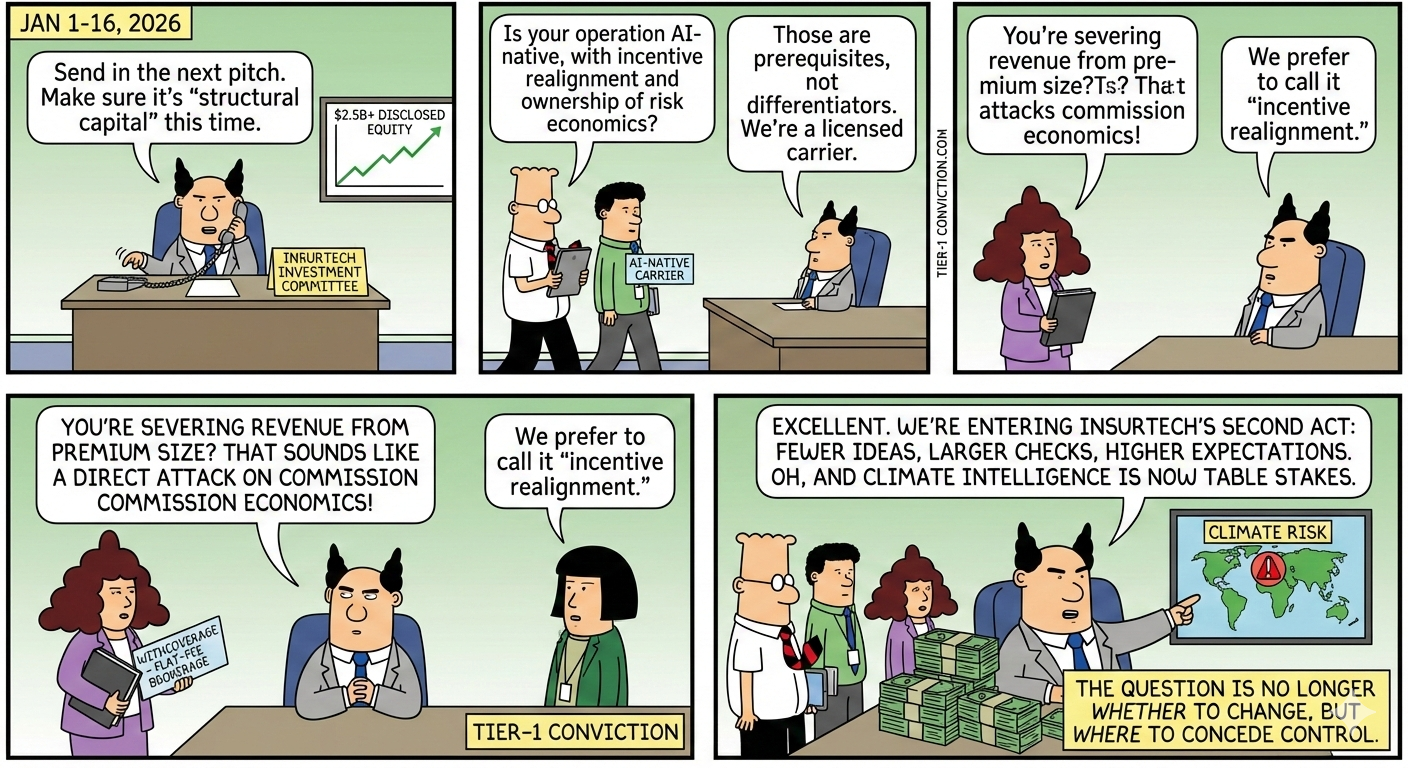

Capital returned to insurance and insurtech decisively in early January. Over $2.5B of disclosed equity, credit, and fundraises flowed into the sector, spanning full-stack carriers, distribution insurgents, risk intelligence, benefits orchestration, and private credit-backed scale plays.

This is not speculative capital. It is structural capital.

The common thread across deals is clear: AI-native operations, incentive realignment, and ownership of risk economics are no longer differentiators—they are prerequisites. InsurTech has entered its second act: fewer ideas, larger checks, higher expectations.

1. CORGI — The Return of the Venture-Backed Carrier

$108M | Full-stack, AI-native carrier | Startups & tech risk

Corgi is the most strategically important investment of the period—not because of its size, but because of its structure.

This is a licensed carrier, not an MGA or tooling layer, with AI embedded across underwriting, claims, and policy lifecycle. That matters.

Why it matters

- Capital + license = control. Corgi can price, iterate, and launch new products (e.g., AI liability) without carrier constraints.

- Distribution moat via venture networks. YC and VC-channel distribution bypasses brokers entirely for a critical founder segment.

- A valuation reset risk. If Corgi proves loss-ratio discipline, it will reset how markets price startup insurance—and what “real” insurtech looks like.

Competitive impact

- Traditional specialty carriers serving tech (Hiscox, Hartford, Beazley) face pressure on speed, product agility, and pricing sophistication.

- Venture-focused brokers risk disintermediation unless they move upstream into true risk advisory.

Bottom line: Full-stack is back—but only for teams with capital, regulatory stamina, and underwriting discipline.

2. WithCoverage — Commission Economics Under Direct Attack

$42M Series B | Flat-fee commercial brokerage

WithCoverage is not “digitizing brokerage.” It is challenging its incentive structure.

By severing revenue from premium size, WithCoverage reframes the broker’s role from sales intermediary to cost-reduction and risk-optimization partner.

Why it matters

- Commission is insurance’s original sin. This is the first venture-scale attempt to remove it.

- Tier-1 conviction. Sequoia + Khosla don’t fund marginal model tweaks; they fund structural bets.

- Vertical expansion is the test. Construction and aerospace will prove whether the model scales beyond tech-forward buyers.

Competitive impact

- Mid-market brokers face margin compression and forced transparency.

- Expect incumbents to experiment with fee-based or hybrid pricing—quietly, then rapidly.

Bottom line: Brokerage economics are no longer sacrosanct.

3. SelectQuote — Private Credit Replaces Venture Capital

$415M credit facility | Senior health distribution

SelectQuote’s refinancing is a signal, not a headline.

Choosing long-dated private credit over equity in today’s market says one thing: confidence in cash flow and unit economics.

Why it matters

- Runway to 2031 reduces existential risk in a volatile regulatory segment.

- Private credit is now growth capital for profitable insurtechs—not just a rescue tool.

- Sets a template for scaled distributors avoiding dilution.

Competitive impact

- Smaller senior-health platforms without balance-sheet strength will struggle.

- Expect accelerated consolidation in Medicare Advantage distribution.

Bottom line: The insurtech survivors are refinancing, not fundraising.

4. Ben — Benefits Orchestration as Infrastructure

$27.5M | Cross-border benefits & insurance platform

Ben sits at the intersection of HR, benefits, insurance, and compliance—a convergence incumbents struggle to own cleanly.

Why it matters

- Data aggregation = power. Multi-jurisdiction benefits data creates switching costs brokers can’t match.

- Broker-lite future. Advisory becomes optional when orchestration is embedded.

- Enterprise wedge. Benefits is the Trojan horse into broader insurance control.

Bottom line: Benefits platforms are quietly becoming insurance platforms.

5. BirdsEyeView — Climate Models Go from Edge Case to Core

Undisclosed (est. $5–10M) | Climate & parametric risk

Climate modeling is no longer a reinsurer-only conversation.

BirdsEyeView’s funding accelerates third-party adoption of wildfire and hazard analytics across primary carriers and MGAs.

Why it matters

- Risk pricing is being externalized. Proprietary models lose their edge.

- Wildfire underwriting is being standardized—and that reshapes capacity allocation.

Bottom line: Climate intelligence is now table stakes, not a premium feature.

6. Amplify Life — Signal, Not Scale

$6.2M | Digital life & wealth

This is not a category-defining round. It is a persistence signal.

Despite consolidation and pullbacks, investors still fund teams modernizing life insurance—selectively.

Bottom line: Life insurtech isn’t dead; it’s just capital-disciplined.

7. Mega-Funds: The Capital Backdrop

- a16z: $15B — AI, fintech, insurtech explicitly prioritized

- Warburg Pincus: $3B — Buyouts and scaled platforms

What this means

- Capital is abundant—but filtered.

- Late-stage and platform-scale winners will be overfunded.

- Subscale, undifferentiated insurtechs will starve.

Cross-Deal Themes

| Theme | What Changed |

|---|---|

| Full-stack returns | Owning risk economics matters again |

| Brokerage unbundles | Pricing incentives are under scrutiny |

| Private credit rises | Growth without dilution is viable |

| AI is assumed | No longer a pitch—just infrastructure |

| Climate risk mainstreamed | Underwriting inputs are standardizing |

Forward View: 2026 Is a Sorting Year

- Expect 2–3 new AI-native carriers to launch or spin out.

- Brokerage will fracture into advisory vs. distribution.

- Private credit will fund the winners; M&A will absorb the rest.

- AI won’t disrupt insurance—it will reprice it.

The question for incumbents and founders is no longer whether to change, but where to concede control.

On a different note, Scott Adams passed away this week on January 13, 2026. Throughout his career, he brought me countless laughs with his engineering humor and insights into organizational behavior.