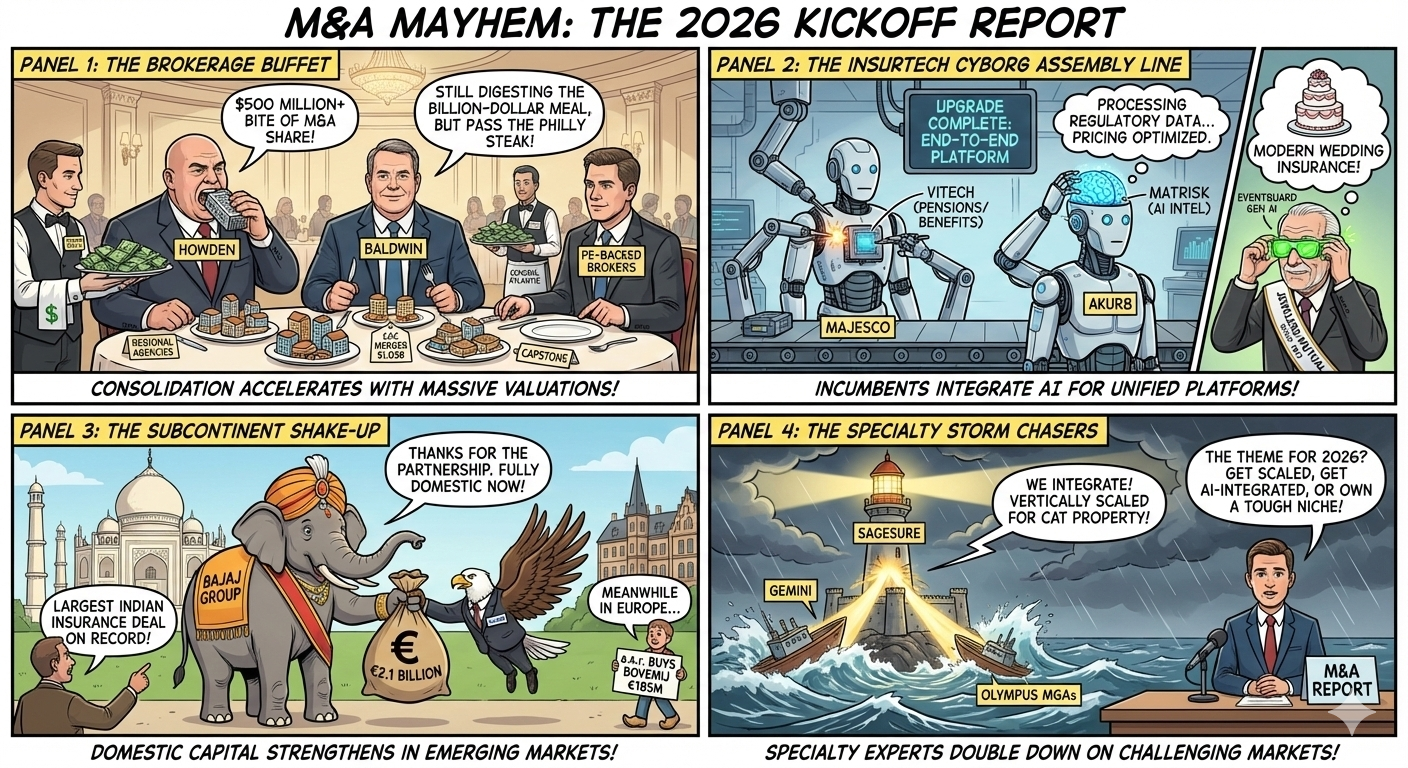

The first two weeks weeks of 2026 saw a diverse mix of insurance and InsurTech M&A activity spanning brokerage consolidation, platform technology acquisitions, specialty insurance, and major international stake transactions, with valuations disclosed for some deals reaching into the billions while many mid-market transactions remained undisclosed.

Howden Acquires Atlantic Global Risk (Transaction Liability Broker)

Date: Announced January 4, 2026; expected to close Q1 2026

Buyer: Howden Group Holdings, London-based global insurance broker Target: Atlantic Global Risk LLC (Atlantic Group), a New York-based M&A protection and transaction liability broker founded in 2017 with over 110 employees

Transaction & Backing:

The deal values Atlantic Group at more than $500 million. Howden is owned by 5,300 employee-shareholders and institutional investors including General Atlantic, HgCapital, and CDPQ (Caisse de dépôt et placement du Québec, Canada's pension fund).

Backer Profile – General Atlantic:

General Atlantic is a leading global growth equity firm with over $77 billion in assets under management across multiple sectors. In insurance, General Atlantic invested in Howden (then Hyperion Insurance Group) in 2013, acquiring just over 30% of shares at an initial £250 million equity valuation. The firm has a long-term investment horizon and focuses on scalable, high-growth distribution platforms. General Atlantic also backed other insurance distribution and services plays, including Hyperion Insurance Group (prior to Howden rebranding), deploying capital to support buy-and-build strategies in specialty and retail broking.

HgCapital joined as a third minority investor in 2021 with an initial £500 million investment, alongside General Atlantic and CDPQ, and all three committed a further £300 million to support Howden's acquisition of UK broker Aston Lark. HgCapital specializes in software and services, and its backing of Howden reflects insurance distribution's tech-enablement opportunities.

Impact on Howden:

The acquisition creates a "global powerhouse" in transactional liability insurance by combining Howden's existing international book (already the largest transaction liability broker outside the US) with Atlantic's deep US M&A and private equity relationships. Founders Richard French, Joe O'Brien, and David Haigh will reinvest a substantial portion of their equity and become Howden shareholders, ensuring continuity and alignment.

Competitive Impact:

The deal intensifies competition in high-margin transactional liability (including representations and warranties, tax, and credit risk insurance) against the "Big Four" global brokers: Marsh, Aon, Arthur J. Gallagher, and Willis Towers Watson. Smaller, niche R&W brokers lacking global scale and PE relationships will face pressure as Howden gains market share with world-leading private equity houses and their portfolio companies.

Majesco Closes Acquisition of Vitech (InsurTech Core Platform)

Date: Announced closure January 8, 2026

Buyer: Majesco, a cloud-native and AI-native insurance technology provider serving P&C and life/annuity/health markets Target: Vitech, a provider of cloud-native pension and benefits administration solutions focused on retirement, pension, and group/benefits markets

Transaction & Backing:

Transaction value was not disclosed. Majesco is private-equity owned (though the specific sponsor is not named in the announcement), and the firm emphasizes a strategy to become the "category leader" for next-generation core platforms across P&C, L&AH, and retirement/pensions, including a commitment to quadruple AI investment.

Impact on Majesco:

The acquisition extends Majesco from P&C and L&AH into Group Benefits and Retirement & Pension, broadening its product set and enabling cross-sell opportunities across core and AI-enabled platforms. This positions Majesco as a more comprehensive platform provider capable of serving carriers' full spectrum of lines and administration needs.

Competitive Impact:

The combination raises the bar for other core-systems and administration vendors (including pension/benefits specialists such as Guidewire, Duck Creek, EIS, Sapiens, and Socotra) by pairing end-to-end insurance plus pension capabilities with a strong AI roadmap. Competitors will need to enhance their AI-native offerings and expand into adjacent lines to keep pace with Majesco's integrated, cloud-native solution set.

Akur8 Acquires Matrisk (AI Pricing & Filings Intelligence InsurTech)

Date: Announced January 6, 2026

Buyer: Akur8, an insurance pricing and reserving platform built on transparent machine learning, founded in 2019 and based in Paris, France Target: Matrisk, an AI-driven platform that turns unstructured insurance regulatory filings into searchable, on-demand market intelligence

Transaction & Backing:

Purchase price and financial sponsors were not disclosed. Akur8's strategy is to launch "Akur8 Discover," integrating Matrisk's LLM-based filings search and competitive intelligence with its pricing suite to create a more complete pricing and market-intelligence platform.

Impact on Akur8:

Akur8 gains advanced AI capabilities in unstructured-data processing and a new market-intelligence module covering P&C rate and rule filings, demand modeling, and financial forecasting, positioning the firm more as an end-to-end decision platform than just a modeling tool. This move differentiates Akur8 by embedding regulatory and competitive intelligence directly into actuarial pricing workflows.

Competitive Impact:

The acquisition sharpens competition in pricing/analytics InsurTech against both actuarial modeling tools (such as Earnix, Quantee, Addactis) and broader analytics players (including Quantemplate, Verisk, Milliman). Competitors—particularly Earnix (a leader in pricing optimization founded in 2001 with full cloud deployment)—will face pressure to enhance their AI and market-data offerings to match Akur8's integrated filings-intelligence capabilities. Earnix, Quantee, and others will need to invest in LLM-powered regulatory data or partner with data providers to remain competitive.

IMA Financial Group Acquires The Richards Group (New England Brokerage)

Date: Announced January 5, 2026; effective December 31, 2025

Buyer: IMA Financial Group, the 20th-largest US broker, a Denver-based integrated financial services company owned by private equity firm SkyKnight Capital Target: The Richards Group, a multi-line independent insurance brokerage with 160 employees and 13 offices across Vermont and New Hampshire, serving 28,000 clients in healthcare, education, nonprofit, and commercial sectors

Transaction & Backing:

Purchase price was not disclosed. IMA has been active in M&A, acquiring multiple brokers and MGAs (including RiskPoint Insurance Partners and FC Underwriters in 2024) and RedRidge Diligence Services in 2023 to expand its M&A-related services. SkyKnight Capital, IMA's private equity owner, has backed the firm's buy-and-build strategy to create a comprehensive insurance, risk management, wholesale brokerage, and wealth management platform with ~2,300 employees across all 50 US states.

Impact on IMA:

The acquisition strengthens IMA's New England footprint and adds specialty expertise in healthcare, education, and nonprofit sectors—segments where Richards Group has deep local relationships and specialized risk-management capabilities. IMA also offers M&A insurance products (representations and warranties, transactional liability) to private equity and corporate clients, so the Richards acquisition enhances its distribution and origination capacity in the Northeast.

Competitive Impact:

The deal contributes to ongoing consolidation of mid-market US brokerages, raising competitive pressure on smaller independent brokerages in Vermont, New Hampshire, and the broader New England region that lack the scale, capital access, and specialty capabilities of a Top 20 national platform.

Baldwin Group Acquires Capstone Group (Philadelphia Brokerage)

Date: Announced January 9, 2026; closed January 8, 2026

Buyer: The Baldwin Group (NASDAQ: BWIN), a Florida-based global insurance broker and advisory platform Target: Capstone Group, a multi-line independent insurance brokerage in Lower Gwynedd Township, Pennsylvania (Philadelphia area), established in 2013 and offering risk management, group benefits, and P&C insurance

Transaction & Backing:

Purchase price was not disclosed. Baldwin recently completed its merger with CAC Group on January 2, 2026, in a transaction initially announced in December 2025 with a purchase price of approximately $1.03 billion (consisting of $438 million in cash and $589 million in stock, plus a performance-based earnout of up to $250 million and a $70 million deferred payment). The combined Baldwin-CAC entity is expected to generate $2 billion in gross revenue in 2026, with nearly 5,000 employees and a footprint across all major US markets serving retail, specialty, reinsurance, and MGA platforms.

Impact on Baldwin:

The Capstone acquisition adds regional scale and multi-line capabilities in the Mid-Atlantic, while the larger CAC merger expands Baldwin's Insurance Advisory Solutions segment by leveraging CAC's expertise in financial lines, transactional liability, cyber, and surety products, and in sectors such as natural resources, private equity, real estate, senior living, education, and construction. Following the CAC merger, all combined employees will be shareholders and hold a majority of the company's equity ownership—an employee-ownership structure that Baldwin believes drives alignment and retention.

Competitive Impact:

The dual transactions (CAC merger plus Capstone acquisition) reinforce ongoing consolidation of US mid-market brokerages and raise competitive pressure on smaller independent brokerages in the Philadelphia/Mid-Atlantic region and nationally. The combined Baldwin-CAC platform competes directly with other Top 10–20 US brokers (including Gallagher, Brown & Brown, Truist/McGriff, Hub International, and Acrisure) and puts pressure on smaller independents that lack scale, specialty capabilities, and access to large PE or public-market capital.

Trucordia Acquires First Texas Agency Business (Texas Expansion)

Date: Announced January 6, 2026

Buyer: Trucordia, a Top 20 US insurance brokerage headquartered in Utah Target: First Texas Agency business, a Houston-based insurance agency operation

Transaction & Backing:

Transaction terms and PE sponsors were not disclosed. The acquisition is part of Trucordia's strategy to expand its national footprint, particularly in Texas, by adding local teams and client relationships.

Impact on Trucordia:

The deal strengthens Trucordia's Texas presence and supports "bold growth goals" through integration of First Texas Agency's team and book into Trucordia's broader platform.

Competitive Impact:

Regionally, the acquisition tightens competition for commercial and personal lines accounts in Texas, particularly for mid-sized and small agencies that may face a scaled competitor with broader resources and product access.

Bajaj Group Completes €2.1 Billion Allianz Stake Buyout (India)

Date: Transaction closed January 7, 2026; originally announced March 2025

Buyer: Bajaj Group (Bajaj Finserv, Bajaj Holdings & Investment, and Jamnalal Sons Private Limited) Target/Seller: Allianz SE's 23% equity stake in Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance

Transaction & Backing:

The purchase price was ₹21,390 crore (approximately €2.1–2.6 billion), split as ₹12,190 crore for the general insurance stake and ₹9,200 crore for the life insurance stake. This is the largest-ever deal in the Indian insurance sector and one of the most significant acquisitions of a global joint-venture partner by an Indian business group. The deal was funded entirely by the Bajaj Group without leverage, demonstrating the strength of domestic capital. Regulatory approvals from the Competition Commission of India and the Insurance Regulatory and Development Authority of India were received within four months.

Backer Profile – Allianz (exiting investor):

Allianz SE, the German global insurer, held its 26% stake in the two Bajaj insurance joint ventures (originally established in the early 2000s) for over two decades. Despite exiting the joint ventures, Allianz states it remains committed to India as a growth market and will "explore new opportunities that strengthen its position in the market and expand its potential to serve not only as an investor but also as an operator." Speculation includes preliminary discussions with Reliance Industries' Jio for a new insurance joint venture.

Impact on Bajaj Group:

Bajaj Finserv's ownership in the two insurance subsidiaries rises from 74% to 97% (with a plan to buy back the residual 3% stake by July 31, 2026, bringing ownership to 100%). The transaction is transformative, enabling Bajaj to contribute more strongly to India's "Insurance for All" vision ("Made in India, Made for India, Made by India"), and providing strategic flexibility to access new markets, introduce new products, build scale, and advance growth as insurance penetration in India grows exponentially over the next two decades. There is no impact on the operations of the insurance companies or the interests of policyholders and business partners.

Competitive Impact:

With full control, Bajaj Finserv is expected to pursue more aggressive expansion and innovation strategies, focusing on underpenetrated markets, digital transformation, and product diversification—particularly critical in a country where insurance penetration remains far below global averages. For competitors (including ICICI Prudential, HDFC Life, SBI Life, and other private and public insurers in India), Bajaj's newfound autonomy and capital firepower will intensify competitive pressure across both general and life insurance. Allianz's stated intent to re-enter India "as an operator" signals potential new competition, possibly through new partnerships or majority-owned entities, which could reshape the competitive landscape further.

a.s.r. Acquires Bovemij Insurance Activities (Netherlands Mobility Sector)

Date: Announced January 8, 2026

Buyer: ASR Nederland N.V. (a.s.r.), a Dutch insurance company Target/Seller: Bovemij N.V.'s insurance activities (from BOVAG, the Dutch trade association for mobility businesses)

Transaction & Backing:

Purchase price: €185 million in cash. a.s.r. acquires 100% of Bovemij's insurance activities, representing approximately €400 million in gross written premiums (2024). For the distribution of insurance products, a.s.r. and BOVAG will establish a 50/50 joint venture, ensuring customers continue to receive advisory and distribution services under the trusted Bovemij and ENRA brands. The transaction's impact on a.s.r.'s Solvency II ratio is expected to be approximately 3.5 percentage points, and the transaction exceeds a.s.r.'s minimum return requirement of >12% on invested capital.

Impact on a.s.r.:

The acquisition aligns with a.s.r.'s strategy to grow organically and through targeted acquisitions, strengthening its position as a non-life insurer and securing a strong foothold in the mobility sector with the well-established Bovemij and ENRA brands, trusted by entrepreneurs and consumers for decades. Bovemij specializes in insurance and additional services for the mobility sector and has been active since 1963.

Competitive Impact:

The deal positions a.s.r. more competitively in the Dutch mobility insurance market (covering auto, commercial vehicle, fleet, and related risks) against other major Dutch and European insurers (such as Achmea, Nationale Nederlanden/NN Group, and Allianz). The joint venture with BOVAG ensures sector-specific knowledge and a strong connection to the practical needs of mobility businesses, which may be difficult for generalist insurers to replicate.

SageSure Closes Acquisition of Gemini Financial & Olympus MGAs (Catastrophe Property)

Date: Announced closure January 5, 2026; original agreement signed September 2025

Buyer: SageSure, one of the largest managing general underwriters (MGUs) focused on catastrophe-exposed property markets in the US Target: Gemini Financial Holdings and Olympus subsidiaries, both MGAs

Transaction & Backing:

Transaction value was not disclosed. SageSure operates in 16 states, protects more than 850,000 policyholders, manages over $2.5 billion of inforce premium, and is backed by significant private equity capital (though the specific sponsor is not named in the announcement). SageSure has been highly active in the catastrophe bond market, issuing more than $2 billion in cat bond–backed reinsurance in recent years through its Gateway Re series of transactions.

Impact on SageSure:

The acquisition completes SageSure's expansion via Gemini Financial and Olympus MGAs, adding underwriting capacity, distribution, and specialty expertise in catastrophe-exposed property insurance (primarily coastal homeowners). SageSure's vertically integrated model—combining proprietary underwriting, technology platforms, claims management, and ILS/cat bond reinsurance capacity—positions the firm as a dominant player in challenging coastal and wildfire-exposed markets.

Competitive Impact:

The deal intensifies competition for MGAs, carriers, and brokers in catastrophe property insurance, particularly in states such as Florida, Texas, Louisiana, South Carolina, and California, where traditional carriers have retrenched. SageSure's scale (largest residential property MGU in the US), modern technology, and access to alternative capital via cat bonds and ILS give it a competitive edge over smaller MGAs and state-run residual markets (such as Citizens Property Insurance in Florida).

Jewelers Mutual Group Acquires EventGuard (Event Insurance / AI-Powered MGA)

Date: Announced January 8, 2026

Buyer: Jewelers Mutual Group, the insurance and business solutions provider dedicated to the jewelry industry since 1913, headquartered in Neenah, Wisconsin Target: EventGuard, a division previously part of the licensed insurance agency Indemn, specializing in event insurance coverage in the event and wedding space

Transaction & Backing:

Purchase price was not disclosed. JM Insurance Agency Partners (part of Jewelers Mutual Group) will operate the EventGuard program through insurance carrier Markel Group Inc., harnessing generative AI to expand its InsurTech solutions and offer best-in-class event liability and cancellation insurance, including wedding coverage. EventGuard has a unique history as one of the first insurance programs sold through GPT-based AI, built and launched by Indemn in 2021–22. Indemn, now a leading AI agent builder in the insurance industry, developed EventGuard as a real-world test for Generative AI in insurance and is now focusing on its broader mission of enabling specialty insurance access through AI agents.

Impact on Jewelers Mutual Group:

The acquisition diversifies Jewelers Mutual Group beyond jewelry insurance into adjacent verticals (events and weddings), enhances JM Insurance Agency Partners' core capabilities, and supports its strategy to diversify, grow profitability, and ensure sustainability. It positions Jewelers Mutual as a market leader in protecting both valuable items and meaningful experiences through modern platforms and intuitive customer experiences.

Competitive Impact:

The deal signals the viability of AI-driven MGA distribution as a meaningful growth lever for established insurers, even 110-year-old mutual insurers. For event and wedding insurance competitors (including Travelers, The Hartford, Progressive, and specialty event insurers like WedSafe), the AI-powered, embedded-distribution model pioneered by EventGuard raises the bar for customer experience, speed to quote/bind, and distribution efficiency. The acquisition is also a strong endorsement of generative AI's role in insurance distribution and a signal that traditional insurers are willing to acquire and integrate AI-native MGAs to modernize their capabilities.

Health Insurer / Payer Affiliations and Restructurings

The week also saw multiple health insurer M&A and affiliation announcements in the US, signaling structural changes in the nonprofit and payer landscape:

- Mass General Brigham Health Plan – Fallon Health (announced January 8, 2026): Nonprofit insurer Fallon Health joins Mass General Brigham Health Plan, another nonprofit insurer.

- Hawaii Pacific Health / One Health Hawaii – Hawaii Medical Service Association (HMSA) (announced January 7, 2026): BCBS licensee HMSA affiliates with Hawaii Pacific Health under new nonprofit parent One Health Hawaii.

- Priority Health – Health Cooperative of Eau Claire (finalized January 1, 2026): Priority Health becomes sole governing group of Health Cooperative of Eau Claire, which has 61,000+ members.

- Council for Affordable Quality Healthcare (CAQH) – transition to insurer ownership (announced January 8, 2026): CAQH, a nonprofit healthcare data and technology services organization, is transitioning away from nonprofit structure; shareholders include UnitedHealth Group, Centene, Aetna (CVS Health), Elevance Health, Cigna, Humana, and regional BCBS insurers.

These transactions reflect consolidation and vertical integration in US health insurance, with nonprofit insurers affiliating with health systems or transitioning to insurer ownership to achieve scale, operational efficiency, and better alignment of care delivery and financing.

Key Themes & Takeaways

Brokerage Consolidation Accelerates:

Multiple US brokerage deals (Howden–Atlantic, Baldwin–Capstone plus CAC merger at $1.03 billion, IMA–Richards, Trucordia–First Texas) reflect ongoing rollup of mid-market and specialty brokers by scaled platforms backed by PE and strategic investors, with valuations (where disclosed) remaining robust despite higher interest rates.

InsurTech M&A Pivots to Strategic Capabilities:

Majesco–Vitech and Akur8–Matrisk are not pure "fintech disruption" deals but rather incumbent platforms acquiring AI, data, and integrated-solution capabilities to compete in next-generation insurance operations, signaling a maturation of InsurTech M&A toward platform consolidation and capability acquisition.

International Large-Deal Activity:

Bajaj's ₹21,390-crore Allianz buyout is the largest Indian insurance sector deal on record and signals growing confidence of domestic capital in emerging markets; a.s.r.'s €185-million Bovemij acquisition continues European consolidation momentum in specialty lines.

AI-Driven Distribution Gains Credibility:

Jewelers Mutual's acquisition of AI-powered MGA EventGuard is a strong endorsement of generative AI's role in insurance distribution, and a signal that traditional insurers are willing to acquire and integrate AI-native MGAs to modernize distribution and customer experience.

Health Insurer Structural Changes:

Multiple nonprofit health insurer affiliations (with health systems and each other) and CAQH's shift away from nonprofit status signal structural changes in the US healthcare payer landscape, driven by scale imperatives, value-based care integration, and regulatory/competitive pressures.