Week of Dec 22–28, 2025 (WW52)

Late December is typically a dead zone for announcements. This year was different.

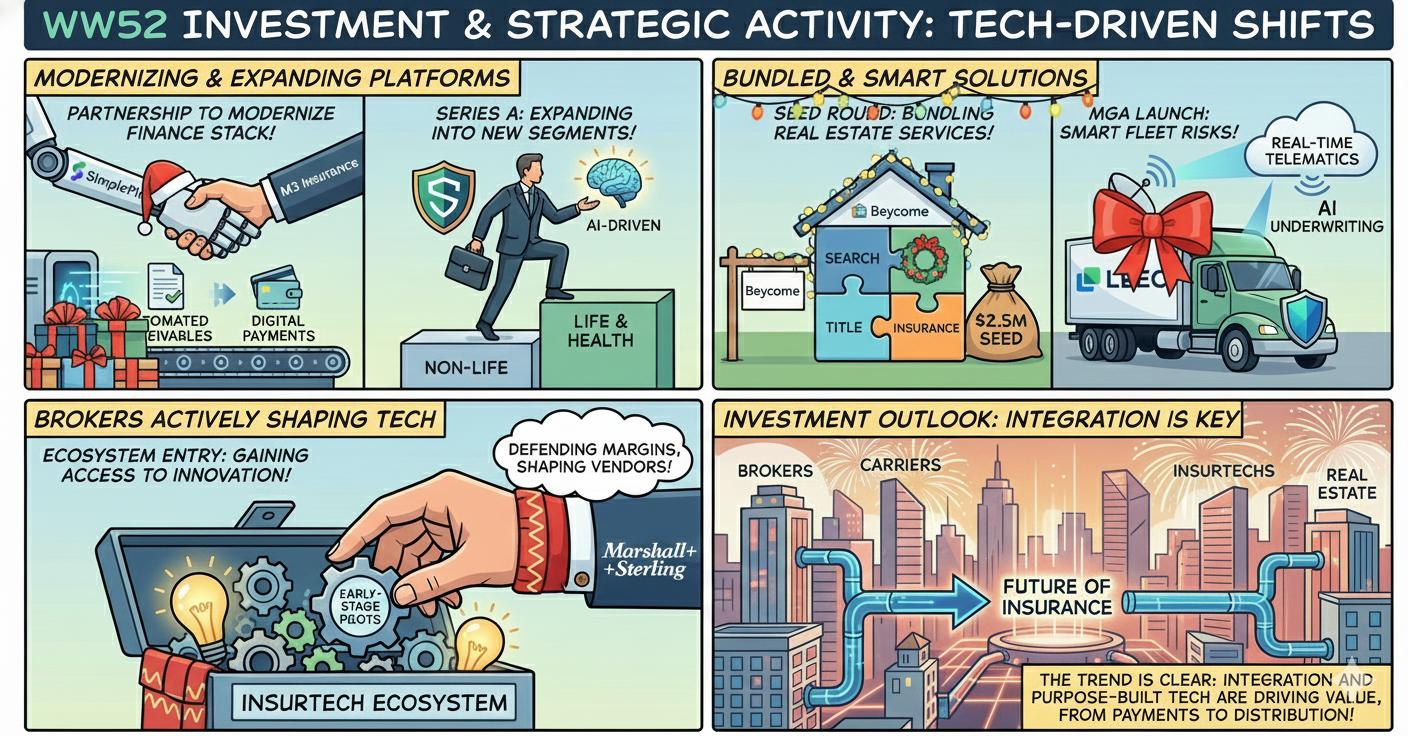

While primary dealmaking slowed, several material funding rounds, strategic partnerships, and ecosystem moves were formalized or surfaced during the holiday window—particularly across embedded real-estate insurance, commercial auto MGAs, and insurance-specific financial automation.

The pattern is consistent with broader 2025 dynamics: fewer announcements, but higher signal per deal, and capital continuing to flow toward platforms that control workflow, data, or distribution.

Weekly Investment & Strategic Activity

• Dec 29 (Announced) — SimplePin | Strategic Partnership with M3 Insurance SimplePin partnered with M3 Insurance to modernize M3’s finance stack, automating receivables, reconciliation, and digital payments across both carrier and client channels. Competitive set: ePayPolicy, Input 1, Vertafore Pay, traditional bank lockboxes. Why it matters: This reinforces the shift toward insurance-native fintech. Large brokers are increasingly choosing purpose-built platforms over generic payment rails to reduce operational drag and improve client experience.

• Dec 22 (Closed / PR) — Saladin | Series A Led by SBI Ven Capital, Kyobo Securities, and NTUitive, with participation from Monk’s Hill and Peak XV (undisclosed multi-million round). Saladin is expanding from non-life into life and health insurance, enhancing AI-driven claims and personalization, and scaling B2B2C embedded distribution across Vietnam. Competitive set: Igloo, PasarPolis, Sunday, traditional bancassurance models. Why it matters: Southeast Asia continues shifting away from agent-heavy life distribution toward digital and embedded models—putting pressure on insurers with high fixed agency costs.

• Dec 22 (News) — Beycome | Seed Round $2.5M seed round led by InsurTech Fund. Beycome is scaling a tech-first real estate platform that bundles property search, closing, title, and insurance into a single transaction. Competitive set: Opendoor, Redfin, traditional brokerages, standalone title agencies. Why it matters: Real estate is emerging as a high-intent insurance distribution surface. Insurance becomes a feature of the transaction—not a downstream add-on.

• Dec 22 (Window) — LEEO | MGA Launch & Capital Backing Backed by Battery Ventures, Foundation Capital, and Aquiline (amount undisclosed). Formerly Fairmatic, LEEO is rebranding and doubling down on AI-driven underwriting and real-time telematics for commercial auto fleets. Competitive set: Nirvana, Koffie, Progressive, Travelers. Why it matters: Competition for high-quality fleets is intensifying. Carriers without real-time telematics risk adverse selection as MGAs dynamically cherry-pick safer risks.

• Dec 22 (Window) — Marshall+Sterling | Ecosystem Entry Marshall+Sterling joined BrokerTech Ventures to gain access to early-stage insurtech pilots, co-development opportunities, and preferential distribution rights. Competitive set: Gallagher, Hub, Brown & Brown. Why it matters: Large brokers are no longer passive technology buyers. They are actively shaping the vendor ecosystem to defend margins and long-term relevance. |

Timing note: Some announcements (e.g., SimplePin/M3) were published after Christmas but originated during the WW52 cycle. Others circulated quietly before surfacing in trackers and trade press.

Key Themes & Strategic Signals

1. Commercial Auto Is Entering Its “Data Arms Race” Phase

The launch of LEEO—backed by Battery and Aquiline—is more than a cosmetic rebrand of Fairmatic. It reflects a structural shift toward profitability-first MGAs in one of the industry’s most punishing lines.

Commercial auto underwriting is no longer about annual pricing—it is about continuous behavioral scoring.

Why it matters: MGAs like LEEO and Nirvana don’t just price risk; they manage it in-policy. Fleets are effectively told: improve driving behavior or pay more next month. That changes renewal dynamics, loss ratios, and capital efficiency.

Competitive pressure: Traditional carriers anchored to 12-month rating cycles will increasingly absorb the worst risks as telematics-driven MGAs siphon off the best fleets.

2. Real Estate Is Becoming a Primary Insurance Distribution Channel

Beycome’s $2.5M seed round is modest in size but significant in implication—especially given InsurTech Fund’s leadership.

Real estate transactions are high-intent, high-trust, and time-compressed. Platforms that control the transaction can insert insurance before a broker referral ever occurs.

Why it matters: When insurance is bundled into closing workflows, CAC collapses and attachment rates spike.

Competitive pressure: Title insurers, P&C carriers, and traditional brokers must either integrate upstream or risk being disintermediated by transaction-centric platforms that own the customer moment.

3. Brokers Are Moving From Buyers to Architects

Marshall+Sterling’s entry into BrokerTech Ventures underscores a quiet but important shift: brokers are no longer waiting for vendors to pitch them.

They are co-investing, piloting early, and shaping product roadmaps.

Why it matters: Technology selection is becoming a strategic advantage, not a procurement exercise.

Competitive pressure: Brokers that rely solely on vendor demos will fall behind peers that gain early access to differentiated tools—and preferential economics—through ecosystem participation.

Bottom Line

Even in a holiday-shortened, low-volume week, the signals are clear:

- Capital continues to favor platforms embedded in workflows, not standalone tools

- Commercial auto remains a battleground where data quality determines survival

- Insurance distribution is steadily migrating to adjacent transactions—real estate, payments, and platforms brokers don’t control by default

As we close out 2025, the market is not broadening. It is concentrating.

And that concentration is increasingly predictable.

#insurance #Insurtech #Funding #VC