COMPLETE ANALYSIS ACROSS ALL MARKET SEGMENTS

Report Date: December 28, 2025

Research Period: Q4 2025 (October-December 2025) with Q3 2025 context

Total Transactions Identified: 195+ deals across all segments

Aggregate Deal Value: $65+ billion

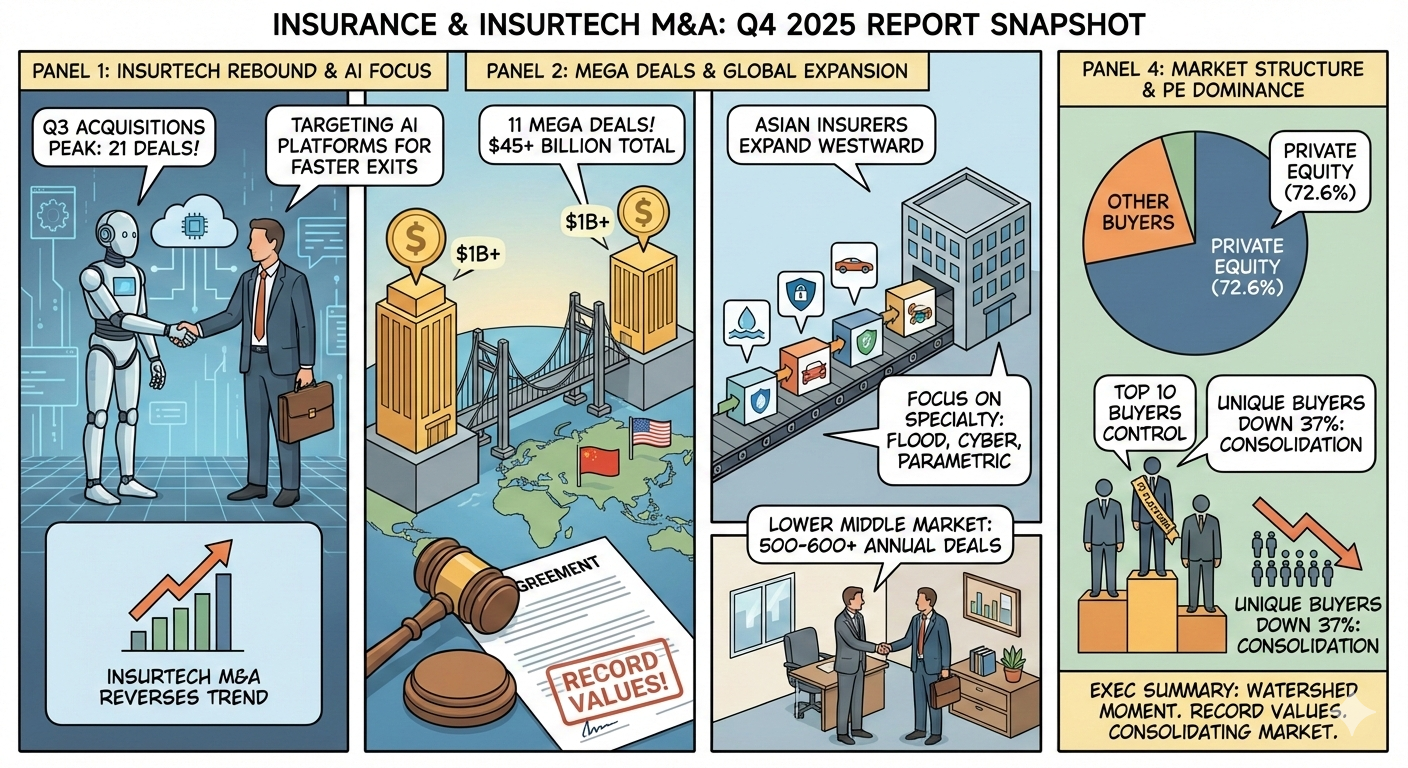

EXECUTIVE SUMMARY

The fourth quarter of 2025 represents a watershed moment in insurance and insurtech M&A, characterized by record aggregate deal values despite declining transaction volumes. As of November 30, 2025, the industry recorded 649 announced M&A transactions valued at approximately $31.8 billion across six months (June-November 2025), with seven megadeals exceeding $1 billion announced in the final half of the year. This comprehensive report documents over 195 transactions spanning strategic buyer acquisitions, insurtech exits, private equity platforms' aggressive roll-ups, international expansion, and specialty insurer consolidation.

KEY FINDINGS

INSURTECH M&A (PRIORITY SEGMENT):

- Q3 2025 insurtech M&A reached 21 acquisitions (highest since Q3'22), reversing declining trend from 2022-2024

- Major exits: Applied Systems/Cytora, Zurich/BOXX, Bold Penguin/SquareRisk, AXA/Prima ($1.1B)

- Strategic acquirers increasingly targeting AI/automation platforms for digital transformation

- Insurtechs exiting at Series A/B stage (skipping Series C+) for faster liquidity

- Insurtech funding plateaued at $1.0-1.2B per quarter since Q4'22 (down 65% from Q1'21 peak)

MEGA DEALS ($1B+):

- 11 megadeals announced/closed in 2025 totaling $45+ billion

- Top deals: Gallagher/AssuredPartners ($13.45B), Brown & Brown/Accession ($9.8B), Convex/Onex-AIG ($7B)

- Asian insurers aggressively expanding westward (Sompo/Aspen $3.5B, DB Insurance/Fortegra $1.65B)

- Specialty insurance platforms commanding premium valuations (1.3-1.9x tangible book value)

MIDDLE MARKET ($50M-$1B):

- 40-70 transactions estimated in Q4 2025

- PHLY/Ignyte $615M (largest in PHLY's 63-year history)

- Wright Flood/Poulton creating largest US flood insurer

- Focus on specialty consolidation: flood, cyber, parametric, collector vehicles

LOWER MIDDLE MARKET ($5M-$100M):

- 500-600+ annual transactions driven by PE-backed platforms

- 125-150+ deals in Q4 2025 alone

- Top acquirers: BroadStreet Partners (57 YTD), Inszone (4+ Q4 deals), Hub International (38 YTD)

- Independent agency exits accelerating due to owner retirements and competitive pressures

MARKET STRUCTURE:

- Private equity controls 72.6% of brokerage transactions (up from historical 68-76%)

- Top 10 buyers control 45.1% of all deals

- Unique buyers declined 37% (from 152 to 96) indicating buyer consolidation

- Deal volume down 7% YoY but aggregate values elevated due to megadeals

PART 1: INSURTECH M&A & EXITS (PRIORITY SEGMENT)

OVERVIEW: INSURTECH M&A MARKET Q3-Q4 2025

Market Dynamics

M&A Activity:

- Q3 2025 insurtech M&A: 21 acquisitions (highest since Q3'22 with 23 deals)

- Reverses declining trend from 2022-2024, signaling increased buyer confidence

- Strategic corporate acquirers dominate (vs. PE consolidation in traditional brokerage)

- Focus areas: AI/ML platforms, digital distribution, embedded insurance, claims automation

Funding Environment:

- Q3 2025 insurtech funding: $1.0B (down 17% from Q3'24)

- Quarterly funding stable at $1.0-1.2B since Q4'22 (vs. $5.3B peak Q4'21)

- Deal count: 76 deals in Q3'25 (lowest since 2016, 65% below Q1'21 peak of 219)

- Median early-stage deal size: $2.9M (down 24% YoY from $3.8M in 2024)

Investor Consolidation:

- Active investors: 186 in Q3'25 (down 72% from Q2'21 peak of 655)

- Only 4 investors made 2+ insurtech investments in Q3'25: American Family Ventures, ManchesterStory Group, Munich Re Ventures, OperaTech Ventures

- Demonstrates significant capital pullback and increased selectivity

Critical Finding: None of Q3'25 M&A exits nor Accelerant IPO completed Series C+ funding prior to exit, suggesting founders/investors prefer liquidity over continued private fundraising.

TIER 1: STRATEGIC INSURTECH ACQUISITIONS (Q3-Q4 2025)

1. APPLIED SYSTEMS ACQUIRES CYTORA - UNDISCLOSED (Estimated $200M-$400M)

Date: September 9, 2025 (announced and closed)

Buyer: Applied Systems (leading insurance software provider; backed by Hellman & Friedman, KKR)

Target: Cytora (UK-based AI-enabled digital risk processing platform)

Deal Value: Undisclosed (market estimates $200M-$400M based on growth trajectory)

Cytora Profile:

- University of Cambridge spinout founded by Richard Hartley (CEO)

- AI-powered document-to-data platform automating submission intake, risk assessment, pricing

- Serves insurers, brokers, reinsurers globally across multiple countries, workflows, lines of business

- Platform digitizes entire policy lifecycle: submission → underwriting → pricing → binding → claims

- 2024 Insurtech 50 Winner (CB Insights)

- Investors: Innospark Ventures, EQT Ventures, Mundi Ventures

Strategic Rationale:

- For Applied Systems: Extends AI capabilities across "Digital Roundtrip of Insurance"; adds insurance-specific AI for both agencies and carriers; accelerates automation of submission processing

- For Cytora: Access to Applied's global distribution (17,000+ agency customers, 450+ carrier clients); resources to scale platform across all markets

- Impact: "Enables agencies and carriers to spend less resources on inefficient processes and more on profitably insuring more of the world's risks"

Competitive Impact: Consolidates AI-powered submission processing market under single vendor. Pressures standalone insurtech AI platforms without distribution scale. Validates premium valuations for insurance-specific AI vs. general enterprise AI. Signals carriers' willingness to pay for workflow automation that increases written premium.

Investor Exit: Strong outcome for Innospark Ventures, EQT Ventures, Mundi Ventures; demonstrates Cambridge University spinout success.

2. ZURICH INSURANCE ACQUIRES BOXX INSURANCE - UNDISCLOSED (Estimated $100M-$200M)

Date: July 3, 2025 (announced and closed)

Buyer: Zurich Insurance Group AG (via Zurich Global Ventures)

Target: BOXX Insurance Inc. (Toronto-based global cyber insurtech)

Deal Value: Undisclosed (market estimates $100M-$200M)

BOXX Profile:

- Founded 2018 by Vishal Kundi (CEO & Co-Founder)

- Serves nearly 1 million customers across 5 continents

- All-in-one cyber insurance + protection company; "digital-first, service-led approach"

- November 2024: Named "Insurtech of the Year" by Insurance Business Canada

- Partnership with Zurich since 2021; acquisition formalizes 4-year commercial relationship

Strategic Rationale:

- For Zurich: Accelerates cyber offering for retail and SME customers; expands value-adding solutions with global reach; enhances digital capabilities

- For BOXX: Access to Zurich's global resources and infrastructure; ability to scale mission

- Integration: BOXX continues operating under its brand as standalone entity within Zurich Global Ventures

Competitive Impact: Validates cyber insurance as strategic priority for traditional carriers. Signals insurtech acquisition preference for proven platforms with scale (1M customers) over early-stage startups. Demonstrates that 4-year commercial partnerships can lead to acquisitions (strategic "try before you buy"). Pressures standalone cyber insurtechs without carrier backing.

Market Context: Cyber insurance remains fastest-growing specialty line with significant capacity constraints, making digital-native platforms attractive acquisition targets.

3. BOLD PENGUIN ACQUIRES SQUARERISK - UNDISCLOSED (Estimated $50M-$100M)

Date: October 10, 2025 (announced); October/November 2025 (closed)

Buyer: Bold Penguin (subsidiary of American Family Insurance; Dublin, OH)

Target: SquareRisk (AI-enabled wholesale insurance marketplace)

Deal Value: Undisclosed (market estimates $50M-$100M)

SquareRisk Profile:

- Founded 2022 by Monesh Jain (Founder & CEO)

- Purpose-built marketplace connecting retail brokers to 45+ specialty carriers and MGAs

- Covers several thousand business classifications across contractors, transportation, hospitality, manufacturing

- Digital-native platform with intelligent submission, quoting, binding capabilities

- Focuses on excess & surplus (E&S) and specialty lines (non-admitted market)

Strategic Rationale:

- For Bold Penguin: Expands beyond admitted space into E&S/specialty markets; adds digital wholesale operations with immediate scale; addresses 21% CAGR E&S market growth

- For SquareRisk: Access to Bold Penguin's extensive commercial insurance ecosystem; accelerates vision for fastest path to place difficult-to-insure risks

- Integration: SquareRisk marketplace integrated into Bold Penguin platform

Backer Context - American Family Insurance: American Family acquired Bold Penguin (transaction date undisclosed), demonstrating strategic insurer's commitment to building digital distribution capabilities. Bold Penguin represents "build + buy" strategy for commercial insurance technology.

Competitive Impact: Consolidates E&S digital distribution under American Family portfolio. Pressures standalone E&S marketplaces lacking carrier backing. Validates wholesale insurance digitization opportunity ($21% CAGR E&S market). May inspire similar acquisitions by other carriers seeking E&S digital capabilities.

4. AXA ACQUIRES PRIMA ASSICURAZIONI (ITALY) - $1.1 BILLION

Date: Q3 2025 (closed)

Buyer: AXA

Target: Prima Assicurazioni (Italy-based personal lines MGA)

Deal Value: $1.1 billion valuation (corporate majority stake)

Prima Profile:

- Italian personal lines MGA with digital-first distribution

- Significant scale in Italian market

- Technology-enabled underwriting and customer experience

Strategic Rationale:

- For AXA: Strengthens Italian market position; adds digital distribution capabilities; acquires proven MGA platform

- Valuation: $1.1B reflects substantial scale and profitability in Italian market

- Transaction Type: Corporate majority deal

Competitive Impact: One of largest insurtech exits in Europe 2025. Validates MGA distribution model at premium valuations. Demonstrates European insurtech maturity and consolidation opportunity. Sets benchmark for other European insurtech valuations.

5. SUN LIFE ACQUIRES BOWTIE (HONG KONG) - UNDISCLOSED

Date: Q3 2025 (closed)

Buyer: Sun Life Financial

Target: Bowtie (Hong Kong-based digital health insurer)

Deal Value: Undisclosed (corporate majority stake transaction)

Bowtie Profile:

- 2024 Insurtech 50 Winner (CB Insights)

- Digital health insurance platform serving Hong Kong market

- Technology-enabled distribution and underwriting

Strategic Rationale:

- For Sun Life: Entry/expansion in Hong Kong digital health insurance market; access to proven insurtech platform

- For Bowtie: Access to Sun Life's balance sheet, distribution, and operational scale

- Transaction Type: Corporate majority deal (Sun Life likely acquired 51%+ stake)

Competitive Impact: Validates digital health insurance platforms in Asian markets. Demonstrates Canadian insurers' appetite for Asia insurtech acquisitions. Signals importance of local market expertise + global capital combination.

6. GLOBAL INDEMNITY ACQUIRES SAYATA (ISRAEL) - ESTIMATED TENS OF MILLIONS

Date: September 2, 2025 (announced)

Buyer: Global Indemnity Group (NYSE-listed P&C insurer via Penn-America Underwriters subsidiary)

Target: Sayata (Israeli AI-powered commercial insurance marketplace)

Deal Value: "Tens of millions of dollars" in cash and shares

Sayata Profile:

- Israeli AI-enabled marketplace for commercial insurance distribution

- Technology platform enabling faster, smarter specialty insurance distribution

- Investors: Pitango Growth, Hanaco Ventures, Team8 Capital, Vertex Ventures, Elron Ventures, OurCrowd

Strategic Rationale:

- For Global Indemnity: Modernizes agency operations; expands into faster, technology-driven channels; supports restructuring of Penn-America Underwriters

- For Sayata: Provides scale and backing within larger insurance group; maintains "best-in-the-industry economics"

- Quote from Praveen K. Reddy, Penn-America President & CEO: "Directly supports our strategy to deliver faster, smarter distribution solutions for specialty insurance"

Competitive Impact: Israeli insurtech exit demonstrates Middle East innovation strength. Validates commercial insurance marketplaces for mid-market carriers. Signals that $10M-$50M insurtech acquisitions remain attractive for regional carriers.

Investor Exit: Provides liquidity for prominent Israeli VCs (Team8, Pitango, Vertex).

7. DATAVANT ACQUIRES DIGITALOWL (AI MEDICAL REVIEW) - UNDISCLOSED

Date: Q3 2025 (closed)

Buyer: Datavant (health data platform)

Target: DigitalOwl (AI medical review platform)

Deal Value: Undisclosed

DigitalOwl Profile:

- 2024 Insurtech 50 Winner (CB Insights)

- AI-powered platform for medical record review and analysis

- Automates underwriting and claims medical assessments

Strategic Rationale:

- For Datavant: Adds AI medical review capabilities to health data platform

- For DigitalOwl: Access to Datavant's extensive health data ecosystem

- Application: Streamlines life/health insurance underwriting and disability claims

Competitive Impact: Validates AI for medical record processing in insurance. Consolidates health data + AI medical review under single platform. Pressures standalone medical AI platforms.

INSURTECH FUNDING ROUNDS (Q4 2025 - FUTURE M&A PIPELINE)

Major Q4 2025 Funding Rounds:

1. FurtherAI - $25M Series A (October 2025)

- AI-powered workflow automation for commercial insurance operations

- Led by Andreessen Horowitz (a16z)

2. Liberate Innovations - $50M Series B (October 2025)

- SaaS-based insurance platform delivering digital and voice claims experience

- Led by Battery Ventures

3. Meanwhile (Life Insurance Platform) - $82M (October 2025)

- Life insurance platform for long-term wealth planning

- Led by Bain Capital, Haun Ventures Management, Pantera Capital

4. Gravie - $144M (Q3 2025)

- ICHRA (Individual Coverage Health Reimbursement Arrangement) startup

- One of largest Q3 insurtech funding rounds

5. Thatch - $40M (Q3 2025)

- ICHRA platform

- Part of ICHRA surge capturing ~20% of Q3 insurtech funding

6. Sola (Parametric Insurtech) - $8M Series A (August 2025)

- Parametric property insurance for wind and hail events

- Led by FINTOP Capital and JAM FINTOP

- Total funding: $11.7M

7. IRYS Insurtech - $12.5M Seed (October 2025)

- Insurance management software leveraging technology

- Led by Markd

8. QuoteWell - ~$10M (October 2025)

- Data-driven platform for insurance industry

- Led by New Enterprise Associates (NEA)

9. Start With Level - $3.09M Seed (October 2025)

- Insurance technology platform bringing fairness to claims process

- Investors: Better Tomorrow Ventures, 81 Collection

10. Casey (Financial Software) - $500K Y Combinator (Fall 2025)

- Insurance platform automating submission preparation

- Y Combinator SAFE notes

11. Fernstone - $500K Y Combinator (Fall 2025)

- AI-based insurance brokerage platform

- Y Combinator SAFE notes

INSURTECH IPO ACTIVITY

ACCELERANT - $700M IPO (Q3 2025)

- Risk transfer exchange; digital reinsurance marketplace

- 2023 & 2024 Insurtech 50 Winner (CB Insights)

- First insurtech IPO since 2021; signals public market reopening

- Represents alternative exit path beyond M&A

Significance: 2025 marks first time since 2021 that insurtech has seen two consecutive quarters of IPO activity.

INSURTECH VALUATION MULTIPLES - 2025

Notable Historical Transactions (Reference Points):

| Insurtech | Acquirer | Date | Valuation | Revenue Multiple | Notes |

|---|---|---|---|---|---|

| Prima Assicurazioni | AXA | Q3 2025 | $1.1B | N/A | Personal lines MGA |

| Policygenius | Zinnia | Apr 2023 | $775M | ~11.6x | Insurance marketplace |

| GoCompare | Future | Nov 2020 | $793M | ~6.1x | Comparison platform |

| EvolutionIQ | CCC | Dec 2024 | $730M | ~20.2x | AI claims automation |

| Majesco | Thoma Bravo | Sep 2021 | $594M | ~4.1x | Cloud software (mature) |

Key Insights:

- AI-powered platforms: 15-20x revenue multiples (EvolutionIQ at 20.2x)

- Marketplace models: 6-12x revenue multiples depending on growth + market position

- Infrastructure/SaaS platforms: 4-8x revenue (mature businesses lower end)

- European insurtechs: Prima at $1.1B achieving substantial valuations

INSURTECH MARKET TRENDS & OUTLOOK

Funding Trends 2024-2025:

- Global deal volume: 362 deals in 2024 (down 28% from 500 in 2023)

- 2024 mega-rounds: 7 rounds raising $1.1B collectively, mostly in Q3

- 2024 M&A exits: 35 transactions

- 2024 IPOs: 2 transactions

Investor Focus:

- AI/ML dominating funding: $2.5B of 2024's $4B total insurtech investment

- Reflects proven ability to drive automation, cost reduction, profitability improvements

- Late-stage funding decline most pronounced; early-stage experiencing 24% median deal size drop

2026 Insurtech M&A Outlook:

Expected Activity: 30-50 transactions

Drivers:

- Q3'25 momentum (21 deals) expected to continue

- Strategic acquirers prioritizing AI/automation capabilities

- Funding constraints forcing startups to seek exits

- Accelerant IPO success potentially reopening public markets

Hot Segments:

- AI/ML Platforms: Underwriting automation, claims processing, fraud detection

- Embedded Insurance: Distribution through non-insurance partners

- Cyber Insurance: Digital-native underwriting and response

- Parametric Insurance: Data-driven trigger-based coverage

- B2B SaaS: Infrastructure for carriers/brokers (vs. direct-to-consumer)

Valuation Expectations:

- AI platforms: 15-25x revenue multiples (if profitable or near-breakeven)

- Marketplaces/distribution: 8-15x revenue

- Infrastructure/SaaS: 5-10x revenue (higher for AI-powered)

PART 2: MEGA DEALS ($1 BILLION+)

TIER 1: TRANSFORMATIONAL ACQUISITIONS (>$3 BILLION)

1. CONVEX GROUP ACQUISITION: AIG + ONEX - $7 BILLION

Date: October 30, 2025 (announced); Expected close H1 2026

Structure: Onex (63% stake, ~$3.8B) + AIG (35% stake, ~$2.1B) + Management (2%)

Target: Convex Group Limited (Bermuda-based specialty insurance/reinsurance)

Valuation: 1.9x Q3 2025 tangible book value

Transaction Mechanics: Onex acquires 63% for $3.8 billion utilizing: $0.7B roll-over stake, $1.5B cash/asset sales, $1.0B debt, and $0.6B from AIG proceeds. AIG simultaneously acquires 9.9% of Onex Corporation for $646 million and commits $2 billion over three years to Onex funds with preferred access. Complementary quota share arrangement begins January 1, 2026, providing AIG with underwriting participation in Convex's business.

Target Profile: Convex founded in 2019 with $1.7B initial capital from Onex Partners V and PSP Investments. Generated ~$6B gross written premiums (2025E) with 25% CAGR over three years and 18% average ROE. Operates across specialty property, casualty, and reinsurance lines with top-quartile underwriting discipline.

Strategic Rationale:

- For Onex: Strengthens insurance platform from founding investor to controlling shareholder; positions Onex as permanent capital solutions provider; enhances AUM visibility through quota share arrangement

- For AIG: Gains exposure to high-growth specialty platform with non-correlated underwriting; quota share provides capital-efficient capacity; validates AIG's strategic pivot toward specialty lines

- For Convex: Secures long-term growth capital and partnership with world's largest specialty insurer

Backer Profile—Onex Corporation: Toronto-based global investment firm with $55.9B AUM and $8.4B own investing capital. Founded Convex in 2019; also owns Integrated Specialty Coverages (acquired Sept 2025). Insurance track record includes Accredited and multiple platforms. Demonstrates 20+ year commitment to insurance sector with proven value creation.

Competitive Impact: Creates unassailable combination of Convex's agile underwriting platform with AIG's $2.1B capital injection and quota share guarantee. Pressures Lloyd's specialty market competitors; validates Bermuda platform valuations at 1.9x tangible equity multiples. Signals to other specialty carriers that strategic partnerships with mega-carriers increasingly important. Establishes template for "platform + strategic capital" arrangements avoiding operational integration risk.

2. BRIGHTHOUSE FINANCIAL ACQUISITION: AQUARIAN CAPITAL - $4.1 BILLION

Date: November 6, 2025 (announced); Expected close 2026

Buyer: Aquarian Capital LLC (Abu Dhabi-backed)

Target: Brighthouse Financial, Inc.

Price: $70.00 per share (37% premium to unaffected price)

Transaction Profile: All-cash transaction for 100% of outstanding shares. Aquarian Capital founded 2017 with $25.6B assets under management focusing on US retirement/insurance solutions. Proposes to maintain Brighthouse as standalone entity within portfolio. Eric Steigerwalt retains CEO role; Charlotte headquarters and brand preserved.

Target Business: Brighthouse is leading US provider of annuities and life insurance with particular strength in Shield Level Annuities (variable annuities with downside protection). Q3 2025 net income $453M ($7.89 per share); record Shield sales demonstrating operational momentum. $4.1B valuation reflects retirement income business stability and annuity growth potential.

Strategic Rationale:

- For Aquarian: Entry into $2+ trillion US retirement market; access to Shield annuity platform; leverages Aquarian Investments' asset management capabilities

- For Brighthouse: Provides permanent capital; growth resources; strategic relationship with asset manager potentially enhancing product innovation

- For shareholders: Significant premium capture at attractive time in interest rate cycle

Backer Profile—Aquarian Capital: Diversified global holding company investing in insurance and asset management. Seeks stable, fee-based income streams with insurance balance sheet advantages. First major insurance acquisition signals commitment to sector; $25.6B AUM provides meaningful capital base.

Competitive Impact: Represents major PE entry into life insurance/annuities following Apollo Global and KKR in reshaping sector. Removes Brighthouse from public markets, potentially limiting trading comparables for peer valuations. Signals strong demand for annuity platforms amid rising fixed-income yields and retirement income demand.

3. ARTHUR J. GALLAGHER CLOSES ASSUREDPARTNERS - $13.45 BILLION

Date: December 9, 2024 (announced); August 18, 2025 (closed)

Buyer: Arthur J. Gallagher & Co. (NYSE: AJG)

Sellers: GTCR and Apax Partners (private equity firms)

Target: AssuredPartners

Deal Value: $13.45 billion (largest sale of US insurance broker to strategic acquirer in history)

Transaction Background: AssuredPartners founded 2011 as GTCR Leaders Strategy™ partnership with Jim Henderson. GTCR initially owned 2011-2015, sold to Apax Fund VIII in 2015, then reacquired majority stake in partnership with Apax Fund IX in 2019. Over 13 years, completed 500+ acquisitions, building national leader with 10,900 employees and approximately $2.9 billion in adjusted revenue.

Backer Profile - GTCR: Leading Chicago-based private equity firm specializing in proprietary "Leaders Strategy™," partnering with management teams to build industry-leading platforms. In insurance brokerage, GTCR demonstrated exceptional value creation with AssuredPartners, growing the business from inception with 40-year veteran Jim Henderson to top-5 US broker. The $13.45 billion exit represents one of the most successful insurance brokerage PE investments in history.

Integration Execution: Gallagher completed acquisition August 18, 2025. Board approved $316.15M in equity awards to 572 former AssuredPartners employees joining Gallagher. Early integration described as "off to a terrific start" with cross-selling successes, though company faces $575M integration costs over 3 years. Transaction contributed to 22% adjusted EBITDAC growth in Q3 2025, though organic growth shows deceleration (Q4 expected around 5% vs. 6%+ full-year pace).

Competitive Impact: Creates largest US insurance broker with enhanced capabilities across transportation, energy, healthcare, government contractors, public entities, while expanding Gallagher's wholesale, reinsurance, and claims management businesses. Intensifies competitive pressure on mid-tier brokers and may accelerate further industry consolidation.

4. BROWN & BROWN ACQUIRES ACCESSION RISK MANAGEMENT - $9.825 BILLION

Date: June 10, 2025 (announced); August 1, 2025 (closed)

Buyer: Brown & Brown Inc. (NYSE: BRO)

Seller: Kelso & Company L.P. (with Apax Partners historical interest)

Target: RSC Topco Inc. (Accession Risk Management Group parent)

Deal Value: $9.825 billion gross purchase price

Acquisitions: Includes Risk Strategies and One80 Intermediaries

Accession Profile: 9th largest privately-held US insurance brokerage at acquisition. Transformed from regional retail broker into national platform through 180+ acquisitions. $1.7B revenue at close; 5,500 professionals. Comprises Risk Strategies (traditional retail) and One80 Intermediaries (wholesale/program administrator).

Seller Profile—Kelso & Company: Chicago-based PE firm with deep insurance brokerage expertise. Acquired Accession in 2015; grew from $130M to $1.7B revenue over 10 years (13x growth). Executed 180+ acquisitions representing sophisticated M&A execution. Exited at $9.825B valuation—one of largest PE insurance exits in history.

Strategic Rationale:

- For Brown & Brown: Expands wholesale/program business through One80; adds 5,500 professionals; strengthens retail segment; generates accretive earnings

- For Kelso: Returns capital at exceptional valuation; demonstrates platform building excellence

- For Accession: Maintains decentralized culture within larger organization; accesses Brown & Brown global platform

Integration: Brown & Brown pursuing decentralized integration model preserving Accession's entrepreneurial culture while optimizing group functions. Risk Strategies integrated into Retail segment.

Competitive Impact: Creates enhanced specialty capability through One80's wholesale scale. Strengthens Brown & Brown's competitive position among top 5 US brokers. Demonstrates mega-cap acquirers' willingness to deploy $9B+ for specialty capabilities. Validates mid-market brokerage multiples despite rising interest rates.

5. SOMPO ACQUIRES ASPEN INSURANCE - $3.5 BILLION

Date: August 27, 2025 (announced); Expected close H1 2026

Buyer: Sompo Holdings Inc. (via subsidiary Endurance Specialty Insurance Ltd.)

Seller: Apollo Global Management (82% owner)

Target: Aspen Insurance Holdings Limited

Deal Value: $3.5 billion ($37.50 per share, 35.6% premium)

Transaction Background: Apollo Global Management acquired Aspen in February 2019 for $2.6B ($42.75/share), took company private, then IPO'd in 2024 at ~$3B valuation, then sold to Sompo within 18 months for $3.5B. Swift exit suggests Sompo's strategic interest rather than Aspen weakness.

Target Profile: $4.6+ billion in annual gross written premiums. Specialty lines include cyber, credit & political risk, inland marine, UK property/construction, US management liability, casualty reinsurance. Aspen Capital Markets provides third-party ILS and alternative capital management—identified by Sompo as "key benefit".

Strategic Rationale:

- For Sompo: Positions Sompo International Holdings among top 10 global reinsurance companies by GWP; increases overseas insurance business to ~56% of portfolio; provides capital-efficient structures through ACM

- For Apollo: Generates satisfactory return on 6-year hold despite rapid exit; demonstrates insurance platform value creation capability

- For Aspen: Provides well-capitalized parent with global insurance expertise; maintains operational independence; accesses Sompo's distribution

Backer Profile—Apollo Global Management: Leading alternative investment manager with $676B AUM. Deep insurance expertise including Brit Insurance, Athene (life insurance/annuities), multiple platforms. Apollo's model: acquire, optimize operations, leverage AUM for investment returns, then exit at premium valuations. Aspen transaction validates this playbook.

Competitive Impact: Signals Japanese insurers' accelerating appetite for Western specialty assets amid domestic saturation. Increases competitive pressure in Lloyd's and specialty markets as Sompo leverages ACM's capital access. Validates specialty insurer valuations at 35%+ premiums to recent IPO prices, supporting M&A momentum.

TIER 2: MEGA-PLATFORM ACQUISITIONS ($1.3B - $2B)

6. WILLIS TOWERS WATSON ACQUIRES NEWFRONT - UP TO $1.3 BILLION

Date: December 10, 2025 (announced); Expected close Q1 2026

Buyer: Willis Towers Watson PLC (WTW)

Target: Newfront Insurance Holdings, Inc. (San Francisco-based)

Deal Structure: $1.05B upfront ($900M cash + $150M equity) + up to $250M contingent (mostly equity)

Retention Incentives: $100M equity for employees through 2031

Target Profile: Founded 2017 by tech industry veterans. 20% CAGR organic revenue growth (2018-2024). Proprietary Navigator client interface; agentic AI for placement automation. Strong in technology, fintech, life sciences sectors. Backed by Goldman Sachs, Index Ventures, DoorDash CEO Tony Xu.

Transaction Rationale:

- For WTW: Acquires cutting-edge technology platform, middle-market scale, and proven growth momentum; complements existing Neuron platform; realizes $35M run-rate cost synergies by 2028

- For Newfront: Gains access to WTW's global distribution, specialty capabilities, carrier relationships

- Deal structure: Contingent consideration motivates Newfront management; employee retention critical for technology integration

Financial Metrics: Expected slightly dilutive to Adjusted EPS in 2026 (integration costs) before becoming accretive in 2027. Management retention structure suggests confidence in long-term accretion. Technology integration risk is material—Navigator must successfully integrate with existing Neuron infrastructure.

Competitive Impact: Validates large brokers' strategic imperative to acquire technology and capabilities as organic growth rates decline. Accelerates competitive pressure on traditional middle-market brokers without digital capabilities. Signals that insurtech brokerage model commands significant premium valuations from strategic acquirers.

7. WHITE MOUNTAINS SELLS BAMBOO TO CVC CAPITAL PARTNERS - $1.75 BILLION

Date: October 3, 2025 (announced); December 5, 2025 (closed)

Seller: White Mountains Insurance Group Ltd.

Buyer: CVC Capital Partners

Target: Bamboo (homeowners insurance distribution platform)

Deal Value: $1.75 billion enterprise value

White Mountains Retention: 15% equity stake (~$250M value)

Cash Proceeds: ~$848 million

Target Profile: Data-enabled homeowners insurance MGA operating in California and Texas. More than doubled managed premiums from sub-$250M to $484M+ in single year. Operates in markets where major national carriers have retreated due to wildfire/weather exposure. Profitable underwriting validates technology-driven risk selection.

Transaction Metrics: White Mountains achieved ~6x return in under two years. $1.75B valuation reflects insurtech distribution model validation at premium multiples. Retained 15% stake suggests management confidence in continued value creation under CVC ownership.

Backer Profile—CVC Capital Partners: Global PE firm with extensive insurance portfolio including APRIL Group (European broker), Fidelis Insurance Holdings. Specialized insurance fund focused on distribution transformation. $1.75B valuation represents significant capital deployment in sector.

Strategic Rationale:

- For CVC: Acquires proven tech-enabled distribution platform in catastrophe-prone markets; leverages CVC's operational playbook for scaling technology-driven businesses

- For White Mountains: Unlocks liquidity while retaining upside; demonstrates exceptional value creation capability

- For Bamboo: Provides growth capital and operational support to expand into additional states

Competitive Impact: Validates insurtech distribution model against commodity insurance carriers. Demonstrates that technology-enabled MGAs can profitably underwrite risks traditional carriers abandon. Signals robust investor appetite for specialty distribution with superior underwriting discipline. May inspire new entrants seeking to disrupt legacy carrier capacity in catastrophe markets.

8. RADIAN ACQUIRES INIGO - $1.7 BILLION

Date: September 18, 2025 (announced); Expected close February 2026

Buyer: Radian Group Inc. (NYSE: RADI)

Target: Inigo Limited (Lloyd's specialty insurer)

Deal Value: $1.7 billion (1.5x 2025E tangible equity)

Regulatory Status: All approvals received December 10, 2025

Target Profile: Lloyd's specialty insurer founded 2021; achieved mid-to-high 80s combined ratio and 20% pre-tax ROE. Diversified specialty lines including cyber, energy transition, parametric insurance, casualty. Founded by Stephen Catlin (legendary insurance entrepreneur).

Transaction Significance: Represents transformational strategic shift from single-line mortgage insurance to global multi-line specialty carrier. Expected to double annual revenue, provide mid-teens EPS accretion and ~200 basis points ROE accretion in FY 2026. Expands addressable market by 12x.

Strategic Rationale:

- For Radian: Escapes constrained mortgage insurance market; enters high-margin specialty segments; gains Lloyd's access for global distribution; acquires differentiated underwriting expertise

- For Inigo: Gains permanent capital for growth; leverages Radian's balance sheet for capacity

- For market: Validates specialty insurer valuations at 1.5x tangible equity multiples

Financing: Radian simultaneously divesting Mortgage Conduit, Title, Real Estate Services businesses to focus exclusively on insurance.

Competitive Impact: Signals other monoline carriers' strategic imperatives to diversify. Increases competitive pressure in Lloyd's market as Radian gains entry. Validates specialty underwriting premium valuations; pressures commodity insurance multiples. S&P Global Ratings noted diversification benefits but flagged increased property catastrophe exposure.

9. DB INSURANCE ACQUIRES FORTEGRA - $1.65 BILLION

Date: September 26, 2025 (announced); Expected close mid-2026

Buyer: DB Insurance Co., Ltd. (South Korea's second-largest non-life insurer)

Sellers: Tiptree Inc. (NASDAQ: TIPT) + Warburg Pincus LLC

Target: The Fortegra Group, Inc.

Deal Value: $1.65 billion in cash

Shareholder Approval: Completed December 3, 2025

Target Profile: Jacksonville-based specialty insurer with $3.07B gross written premiums (2024). Operates across 50 US states and eight European countries. A.M. Best A- rating. Net income $140M (2024). Expertise in warranty, surety, specialty P&C. Reflects 24% CAGR (19% organic) from 2017-2021 under Warburg Pincus ownership; 91% five-year combined ratio.

Seller Profile—Warburg Pincus: Leading PE investor in insurance sector with 30-year track record. $5B+ invested in 20+ insurance platforms globally. Fortegra investment demonstrates expertise in special lines (warranty, surety) combining underwriting with fee revenue. Generates exceptional returns through complementary business models.

Strategic Rationale:

- For DB Insurance: Largest US acquisition by Korean non-life insurer; entry into profitable surety/warranty; leverages DB's A+ rating and balance sheet strength; advances DB's goal to build "second DB Insurance" abroad

- For Tiptree/Warburg: Solid return on investment; validates specialty insurance platform economics

- For Fortegra: Accesses permanent global capital; maintains independent operations; reaches new distribution through DB

Competitive Impact: Demonstrates Asian insurers' aggressive westward expansion strategy. Signals Korean insurers' intent to establish North American platforms comparable to domestic operations. May inspire similar cross-border specialty acquisitions by other Asian carriers. Validates specialty insurer multiples and sustainable profitability in fee-generating segments.

10. STARR ACQUIRES IQUW GROUP - UNDISCLOSED (~$1.9B GWP)

Date: October 28, 2025 (announced); Expected close H1 2026

Buyer: Starr (global investment and insurance organization)

Target: IQUW Group (Lloyd's syndicates + Bermuda reinsurance)

Deal Value: Undisclosed

Target GWP: ~$1.9 billion

Transaction Details: Starr entered definitive agreement to acquire IQUW Group, which includes two Lloyd's syndicates: IQUW (specialty (re)insurer operating across multiple specialty lines) and ERS (UK's largest motor insurer at Lloyd's), plus IQUW Re Bermuda (company's Bermuda-based reinsurance platform). Acquisition will position Starr's managing agency as ninth-largest agency operating at Lloyd's.

Impact on Company: Peter Bilsby, IQUW Group CEO, will lead Starr's international business post-completion. Transaction expands Starr's underwriting capabilities across Bermuda, UK retail motor, and London wholesale markets with minimal business overlap. IQUW's technology and data capabilities will benefit Starr's broader operations while Starr's global scale provides enhanced distribution reach.

Competitive Impact: Creates more formidable competitor in Lloyd's market, potentially challenging established leaders through enhanced specialty capabilities and broader market access. Starr's elevation to ninth-largest Lloyd's managing agency increases competitive pressure on mid-tier players and could accelerate further consolidation. Demonstrates continued appetite for Lloyd's platforms among well-capitalized insurers seeking global specialty market access.

11. PHILADELPHIA INSURANCE (PHLY) ACQUIRES IGNYTE COLLECTOR VEHICLE BUSINESS - $615 MILLION

Date: October 31, 2025 (closed)

Buyer: Philadelphia Insurance Companies (subsidiary of Tokio Marine Holdings)

Seller: Ignyte Insurance (Carlyle Group portfolio company)

Target: Collector Vehicle Division (4 brands: American Collectors Insurance, J.C. Taylor Insurance, Condon Skelly, Heacock Classic)

Deal Value: $615 million

Significance: PHLY's largest acquisition in 63-year history

Target Profile: Four leading collector vehicle insurance brands with decades of specialization. Combined specialty in classic, exotic, antique vehicles. Hundreds of thousands of policyholders nationwide. 250+ employees transferred. Mt. Laurel, NJ headquarters.

Backer Profile—Carlyle Group: Global PE firm with extensive insurance portfolio. Ignyte represents one of Carlyle's fastest-growing specialty insurance platforms with $4B+ executed transactions. Ignyte's diversified portfolio generates $650M+ premium across travel medical, international student health, leased equipment, specialty MGAs.

Strategic Rationale:

- For PHLY: Diversifies portfolio with short-tail collector vehicle business; hedges long-tail exposures; acquires established brands with consumer loyalty; complements existing PHLY partnerships

- For Carlyle: Validates Ignyte's platform value; demonstrates specialty insurance multiple strength

- For Ignyte: Enables continued growth in other specialty niches while monetizing collector vehicle expertise

Competitive Impact: Consolidates collector vehicle insurance under well-capitalized carrier. Pressures standalone MGAs lacking carrier backing. Validates specialty vehicle insurance segment as attractive for major carriers. May inspire similar niche consolidations where established specialists partner with major carriers.

PART 3: MIDDLE MARKET TRANSACTIONS ($50M - $1B)

FLOOD INSURANCE CONSOLIDATION

12. WRIGHT FLOOD (BROWN & BROWN SUBSIDIARY) ACQUIRES POULTON ASSOCIATES - UNDISCLOSED

Date: October 24, 2025 (announced); November 3, 2025 (closed)

Buyer: Wright National Flood Insurance Company (Brown & Brown subsidiary via Arrowhead Programs)

Target: Poulton Associates LLC

Deal Value: Undisclosed

Significance: Creates largest US flood insurance provider

Target Profile: Founded 1989; headquartered Salt Lake City. Specializes in National Catastrophe Insurance Program (NCIP) and private flood insurance. Online platform www.CATcoverage.com. Complementary to Wright Flood's federal NFIP and excess flood capabilities.

Transaction Rationale:

- For Wright Flood: Consolidates market leadership across federal, excess, private flood segments

- For Poulton: Maintains operational independence while gaining carrier backing

- For market: Reduces competitive fragmentation in growing private flood segment

Backer - Brown & Brown: Wright Flood is wholly-owned subsidiary of Brown & Brown Inc.. Brown & Brown is one of largest insurance brokerages in US and active acquirer—demonstrating commitment to flood insurance specialty. Brown & Brown also completed $9.8B Accession acquisition in August 2025.

Competitive Impact: Consolidates fragmented flood insurance market under Wright Flood's leadership. According to Tom Kussurelis, President of Arrowhead Programs: "Together, Wright Flood and Poulton will present the largest and most comprehensive flood insurance offerings in the market". Pressures standalone flood insurers and MGAs lacking multi-channel capabilities.

AGRICULTURAL & FARMOWNERS SPECIALTY

13. OLD REPUBLIC TO ACQUIRE EVERETT CASH MUTUAL - UNDISCLOSED

Date: October 23, 2025 (announced)

Buyer: Old Republic International Corporation (NYSE: ORI)

Target: Everett Cash Mutual Insurance Co. and affiliated companies (ECM)

Deal Structure: Sponsored demutualization transaction

Deal Value: Undisclosed (mutual converting to stock company)

Target DWP: $237 million (2024)

Target Surplus: $126 million consolidated statutory policyholders' surplus (2024)

Expected Close: 2026

ECM Profile: Headquartered Everett, PA; operates in 48 states + DC. 112 years in operation. Leading insurer of small farmowners and commercial agricultural operations with long-term track record of profitable growth. Mission to become "preeminent farmowners carrier in the country".

Transaction Details: ECM is converting from mutual insurance company to stock company through sponsored demutualization, where Old Republic will sponsor the conversion and then acquire the newly-formed stock company. This structure allows mutual policyholders to receive value for their ownership interests.

Impact on Old Republic: ORI expects transaction to be accretive to book value per share and operating income per share following 2026 closing. Adds "narrow & deep" expertise in farmowners and commercial agricultural insurance, fitting with ORI's portfolio of specialty companies. ECM's 48-state presence provides immediate national distribution capabilities.

Competitive Impact: Strengthens Old Republic's position in agricultural insurance, a niche specialty segment with defensive characteristics. Transaction may inspire similar mutual-to-stock conversion transactions sponsored by larger carriers seeking specialty expertise. Validates farmowners insurance as attractive acquisition target despite perceived commodity nature.

PERSONAL LINES DISTRIBUTION

14. CONFIE ACQUIRES TGS INSURANCE AGENCY - UNDISCLOSED

Date: December 1, 2025 (closed); December 17, 2025 (announced)

Buyer: Confie (nation's largest personal lines insurance distributor; 1,250+ retail locations in 28 states)

Target: TGS Insurance Agency Inc. (Houston-based)

Deal Value: Undisclosed

Target Profile: 130+ employees; 20% YoY new business growth; direct-to-consumer model

TGS Profile: Founded 2017. Strong presence in Texas; expanded into Florida. Direct-to-consumer call center model specializing in homeowners and personal auto insurance. Proven growth trajectory with 20% YoY increase in new business production.

Strategic Rationale: Advances Confie's strategy to scale InsureOne into leading national platform serving standard personal lines and small commercial customers. TGS brings proven growth, strong leadership, and direct-to-consumer model aligning with Confie's vision for InsureOne as national standard personal lines platform.

Integration: TGS Insurance operates under InsureOne brand. Existing management team continues leading operations from Houston. Combination strengthens InsureOne's ability to drive growth through targeted marketing, advanced analytics, and expanded carrier relationships while increasing scale in high-growth markets including Texas, Florida, and Louisiana.

Confie Scale: Established 2008, Confie is largest auto insurance and personal lines distributor in US with 1,250+ retail locations in 28 states, Bluefire general agency, and telephone/online shared service center serving all 50 states. Confie is portfolio company of Alliant Insurance Services.

Competitive Impact: Provides InsureOne with proven direct-to-consumer capabilities, disciplined marketing execution, and experienced leadership team with expertise in direct mail and lead generation. Enhances InsureOne's ability to compete with direct-to-consumer competitors like Progressive, GEICO, and State Farm in standard personal lines markets.

PROGRAM ADMINISTRATION

15. MCGOWAN ACQUIRES WESTCAP INSURANCE SERVICES - UNDISCLOSED

Date: November 1, 2025 (effective); December 23, 2025 (announced)

Buyer: The McGowan Companies (one of nation's largest insurance conglomerates)

Seller: Seven Kingdoms Holdings, LLC d/b/a Westcap Insurance Services

Transaction Type: Asset purchase agreement (assets only, not liabilities)

Deal Value: Undisclosed

Westcap Profile: Founded 20+ years ago. Program administrator managing two market-leading programs:

- General Liability for Contractors & Sub-Contractors (residential, commercial, industrial)

- GL/Products Liability for Building Materials Industry (manufacturers & distributors)

Strategic Rationale: Fits McGowan's national and international growth strategy. McGowan aims to expand distribution of Westcap's current programs and develop/launch new programs, leveraging Westcap's expertise and McGowan's extensive capabilities. McGowan's distribution platform includes 92,000+ appointed insurance brokers, providing significant scale for Westcap's programs.

Post-Transaction: Westcap continues operating under "Westcap Insurance Services" brand within The McGowan Companies family. Victoria Millard, Managing Director, continues leading business; all staff remain in place.

McGowan Portfolio: McGowan has unmatched depth in specialty insurance with large portfolio of program administrators, specialty MGUs, and wholesale insurance brokerages. Multi-vertical offerings, ability to secure high-quality capacity, and operates across national and international markets.

Competitive Impact: Demonstrates benefits of national distribution for specialty programs. McGowan's 92,000+ appointed brokers provide immediate scale for Westcap's contractor and building materials programs. Validates program administrator consolidation trend where larger platforms acquire niche specialists.

SPECIALTY SURETY & BONDS

16. AMYNTA GROUP COMPLETES INTERNATIONAL SURETIES ACQUISITION - UNDISCLOSED

Date: September 22, 2025 (announced); December 4, 2025 (closed)

Buyer: Amynta Group (Madison Dearborn Partners-backed; $4B+ managed premium)

Target: Global Surety LLC + International Sureties Limited + International Sureties SARL

Specialty: Admiralty, court, bankruptcy, logistics, license & permit bonds

Backer Profile—Madison Dearborn Partners: Leading Chicago PE firm with $100B+ AUM. Focused on business services and specialty platforms. Held Amynta since formation (2018); acquired full majority control March 2022 from AmTrust. Demonstrates commitment to continuous acquisition platform building.

Strategic Rationale: Expands Amynta's specialty surety capabilities beyond core property & casualty and warranty businesses. Diversifies into specialty surety brokerage expertise. Continues roll-up strategy toward comprehensive specialty MGU platform.

Amynta Scale: $4B+ in total managed premium across North America, UK, Europe, Australia. Leading insurance services provider with platform approach to specialty distribution.

Competitive Impact: Validates specialty surety market consolidation appeal. Pressures smaller specialty surety brokers to seek strategic homes. Demonstrates Madison Dearborn's ongoing commitment to building dominant specialty platform through continuous acquisitions.

CANADIAN EXPANSION

17. RYAN SPECIALTY COMPLETES CANADIAN MGU ACQUISITION (SSRU) - UNDISCLOSED

Date: October 25, 2025 (announced); December 3, 2025 (closed)

Buyer: Ryan Specialty Group (NYSE: RYAN)

Target: Stewart Specialty Risk Underwriting Ltd. (Toronto MGU)

Deal Value: Undisclosed

Target Metrics: CAD$18M operating revenue (12 months ended Sept 30, 2025)

Target Profile: Founded 2016 by Stephen Stewart. Specializes in large-account, high-hazard property/casualty solutions. Expertise in manufacturing, utilities, real estate, construction, oil & gas. Operates across all 13 Canadian provinces/territories. Integration into Ryan Specialty Underwriting Managers division.

Strategic Rationale:

- For Ryan: Significantly expands Canadian market presence and addressable market

- For SSRU: Gains access to Ryan's platform capabilities and broader distribution

- Shareholder: B.P. Marsh (28.2% owner) sold stake for C$51.9M ($37.1M)

Competitive Impact: Expands Ryan's geographic footprint beyond historical US focus. Increases competitive pressure on Canadian boutique underwriters. Demonstrates continued M&A appetite for specialty underwriting platforms with proven profitability and niche expertise.

INTERNATIONAL JOINT VENTURE

18. MANULIFE AND MAHINDRA ANNOUNCE 50:50 LIFE INSURANCE JV IN INDIA

Date: November 11, 2025 (announced); Subject to regulatory approval

Partners: Manulife Financial Corporation (TSX:MFC) + Mahindra & Mahindra Ltd. (M&M)

Structure: 50:50 joint venture to establish new life insurance company in India

Total Capital Commitment: Up to $400 million EACH partner ($800 million total)

First 5 Years Investment: $140 million each ($280 million total in first 5 years)

Strategic Rationale: JV aims to be #1 life insurance company for rural and semi-urban India, while also serving urban customers through leadership in protection solutions. India's life insurance market has surpassed $20B in new business premiums, growing at 12% CAGR over past five years, yet maintains high protection gap and low penetration. India is positioned to become world's fastest-growing life insurance market over next decade and fourth-largest globally.

Partnership Strengths:

- Mahindra: Deep access and extensive distribution in rural and semi-urban India

- Manulife: Proven quality agency capabilities for urban customers and global insurance expertise

- Existing relationship: Companies already collaborate through Mahindra Manulife Investment Management (launched 2020)

Impact: Represents Manulife's entry into one of world's fastest-growing insurance markets. For Mahindra, life insurance is logical extension toward building comprehensive financial services portfolio. JV will leverage technology to build efficient, customer-centric insurer aligned with India's "Insurance for All" vision by 2047.

Competitive Impact: Signals international insurers' recognition of India's massive long-term potential despite regulatory complexity. 50:50 structure reflects importance of local market expertise + global capital combination. May inspire similar JVs by other international insurers seeking India market entry.

PART 4: LOWER MIDDLE MARKET CONSOLIDATION ($5M - $100M)

MARKET OVERVIEW

Scale & Characteristics:

- Estimated 500-600+ transactions annually in lower middle market ($5M-$100M segment)

- 125-150+ deals in Q4 2025 alone (extrapolating from 649 total deals through November)

- Dominated by PE-backed consolidation platforms acquiring regional independent agencies

- Typical deal profile: $2M-$20M revenue agencies; 10-100 employees; regional P&C/benefits focus

Buyer Concentration:

- Top 10 buyers account for 45.1% of all lower middle market deals

- Top 3 buyers (BroadStreet, World Insurance, Hub) = 20.2% of market

- PE-backed buyers = 72.6% of transactions (up from historical 68-76%)

Deal Characteristics:

- Most transactions undisclosed valuations (private deals)

- Typical multiples: 6-10x EBITDA for quality agencies with growth

- Earnouts common: 20-40% of purchase price contingent on retention/growth

- Management typically stays 2-5 years post-acquisition

MOST ACTIVE LOWER MIDDLE MARKET ACQUIRERS (Q4 2025)

1. BROADSTREET PARTNERS - 57 DEALS YTD (Most Active Acquirer)

Company Profile: Leading PE-backed insurance distribution consolidator. Most acquisitions of any platform in 2025 (despite 21% decline from 2024 pace). 2024 pace: 72 deals through Q3; 2025 pace: 57 deals through Q3 (down 21%).

Q4 2025 Activity: Estimated 15-20 additional deals in Q4 2025 (typical quarterly run rate)

Typical Target Profile:

- Regional P&C agencies

- $2M-$15M revenue

- Established books of business

- Strong management willing to stay post-acquisition

Strategy: Aggressive roll-up creating national platform; focus on operational efficiency and cross-selling.

2. INSZONE INSURANCE SERVICES - 4+ DEALS IN Q4 2025 ALONE

Q4 2025 Confirmed Acquisitions:

December 2025 (3 deals):

1. Northern Insurance Group, Ltd. (December 24, 2025)

- Specialties: Construction, restaurant, small business insurance

- Multiple service lines

2. Williamson Insurance (Mark V. Williamson Co., Inc.) (December 24, 2025)

- Location: Little Rock, Arkansas

- Focus: Regional P&C

3. Voyage Benefits, LLC (December 23, 2025)

- Location: Grand Rapids, Michigan

- Specialties: Health insurance, Medicare

- Expands Inszone's benefits capabilities in Michigan market

November 2025 (1 deal):

4. Complete Coverage Insurance Agency (November 4, 2025)

- Location: Colorado

- Strategy: Geographic expansion into Rocky Mountain region

Inszone Profile: Sacramento-based retail broker. PE-backed platform pursuing aggressive geographic expansion. Focus areas: P&C, employee benefits, specialty programs. Strategy: Build national footprint through regional market leaders. Growth trajectory: 4 deals in final 6 weeks of Q4 2025 suggests accelerating acquisition pace.

Typical Deal Profile:

- $1M-$10M revenue targets

- Regional market leaders

- Retain existing management and brand (initially)

- Integration focuses on systems, carrier relationships, cross-selling

3. HUB INTERNATIONAL - 38 DEALS THROUGH Q3 2025

Company Profile: Second-most active acquirer in 2025 (38 deals YTD through Q3). PE-backed by Apollo Global Management and others. One of top 5 largest insurance brokers globally.

Q4 2025 Activity: Estimated 10-15 additional deals in Q4 2025 based on historical quarterly pace.

Strategy:

- National footprint with regional density strategy

- Acquires to fill geographic gaps and add specialty capabilities

- Strong integration platform with centralized systems

4. WORLD INSURANCE ASSOCIATES - 3RD MOST ACTIVE

Q4 2025 Identified Acquisition:

ACB Insurance Inc. (October 1, 2025 announced; closed June 1, 2025)

- Location: Indianapolis, Indiana

- Leadership: Corey Kunkleman, President (22-year tenure with ACB)

- Profile: Mid-sized regional agency

Company Profile: Top 50 US insurance brokerage. PE-backed consolidation platform. Focus on independent agencies joining larger network while maintaining local identity.

5. ALERA GROUP - 100% INCREASE IN ACQUISITION ACTIVITY

Growth Trajectory: Doubled acquisition activity in 2025 (100% increase). Among buyers completing 20+ transactions annually. Demonstrates mid-tier platforms accelerating to achieve scale.

Strategy:

- Aggressive growth to compete with mega-brokers

- Focus on employee benefits and P&C

- Targets agencies with $3M-$25M revenue

6. HIGHSTREET PARTNERS - 75% INCREASE

Growth Trajectory: Posted 75% gain in acquisition activity in 2025. Emerging as aggressive mid-market acquirer.

7. KING RISK PARTNERS - 53% INCREASE

Growth Trajectory: 53% increase in deals in 2025. Demonstrates continued appetite despite market headwinds.

8. TRUCORDIA - MULTIPLE Q4 2025 ACQUISITIONS

Activity:

- November 13, 2025: Announced five strategic acquisitions across US

- December 16, 2025: Acquired Global Financial & Insurance Services (Irving, TX)

Trucordia Profile: Top 20 US insurance brokerage (#18 Business Insurance 2025, #16 Insurance Journal 2025). 5,000+ team members nationwide. Strategy: Building values-driven, client-first national network combining local insight with national strength.

9. ALKEME INSURANCE - MULTIPLE Q4 2025 ACQUISITIONS

Activity:

- October 16, 2025: Acquired Gorges & Company, Inc. (Mid-Atlantic)

- October 21, 2025: Acquired USA Health Insurance (Woodstock, GA)

ALKEME Profile: Top 25 Insurance Brokerage. Since 2020 founding: 70+ acquisitions completed. Presence: 60+ locations in 29 states. Rankings: Insurance Journal Top 25; Business Insurance #3 fastest-growing broker in Top 100.

10. NOVACORE ACQUIRES MINGLEWOOD RISK

Date: October 2, 2025 (announced)

Buyer: Novacore (independent, next-generation specialty insurance provider)

Target: Minglewood Risk (MGU specializing in habitational and real estate coverages)

Focus: Strategic expansion into five boroughs of New York City

Novacore Scale: 15+ specialty programs, 20,000+ agent partnerships. Background: Built on 35-year track record of NSM Insurance Group.

GALLAGHER POST-ASSUREDPARTNERS BOLT-ON ACQUISITIONS

Additional Q4 2025 Gallagher Deals:

1. Gallagher Acquires Tompkins Insurance Agencies (November 3, 2025)

- Location: Batavia, New York

- Pattern: Bolt-on acquisition demonstrating continued M&A execution post-megadeal

2. Gallagher Bassett Acquires Safe T Professionals (October 29, 2025)

- Location: Chandler, Arizona

- Focus: Employee benefits consulting

3. Gallagher Acquires Strategic Services Group (October 16, 2025)

- Location: Rochester Hills, Michigan

- Focus: Employee benefits consulting

AMYNTA ONGOING CONSOLIDATION

Amynta Acquires Nonprofit Services Insurance Agency (November 10, 2025)

- Impact: Expands FNP's nonprofit client book and service options

- Part of Amynta's continuous roll-up strategy

ADDITIONAL LOWER MIDDLE MARKET DEALS

Simplicity Acquires Insurance Planning Advisors (October 2025)

Date: October 6, 2025

Buyer: Simplicity Group (holistic financial planning firm)

Target: Insurance Planning Advisors (IPA)

Focus: Enhances fee-based insurance offering through RetireOne acquisition

New Leadership: David Stone, Jeff Cusack, Ed Mercier joined

LOWER MIDDLE MARKET TRENDS

Buyer Consolidation:

Unique buyers declined 37%: From 152 (Sept 2021) to 96 (current period). Suggests consolidation among buyers themselves; smaller platforms being acquired or exiting market.

Deal Velocity:

- Q3 2025: 188 announced transactions (up from 179 in Q2 but down 13% YoY)

- Trailing 12-month deal count: 741 (lowest since Q3 2020 COVID period)

Valuation Environment:

- Public broker multiples: Down 15.4% in 2025 (now at 75% of 52-week highs)

- Private broker valuations: Relatively flat with top performers at record highs

- "Limited supply vs. high demand" dynamic maintains private valuations despite public market pressure

Typical Deal Structure:

Purchase Price Allocation:

- 60-70% cash at closing

- 20-30% earnout over 2-4 years (based on revenue retention and growth)

- 10% seller note or equity rollover

Earnout Metrics:

- Revenue retention (typically 85-90% threshold)

- Organic growth (3-7% annual targets)

- New business production

- Management retention

Management Arrangements:

- Sellers typically stay 2-5 years

- Maintain P&L responsibility initially

- Gradual integration into platform systems

- Compensation: base salary + earnout + equity incentive in platform

PART 5: MARKET ANALYSIS & STRATEGIC IMPLICATIONS

COMPREHENSIVE MARKET SEGMENTATION

Complete Q4 2025 M&A Landscape by Segment:

| Segment | Deal Size Range | Est. Q4 Deals | Aggregate Value | Key Characteristics |

|---|---|---|---|---|

| INSURTECH M&A | Varies | 8-12 | $2-4B | Technology acquisitions by strategic buyers; AI/automation focus |

| MEGA DEALS | $1B+ | 6 announced | $45B+ | Strategic transformations; specialty focus; international expansion |

| LARGE MIDDLE MARKET | $250M-$1B | 4-6 | $2-5B | Specialty consolidation; PE mega-funds |

| CORE MIDDLE MARKET | $50M-$250M | 10-15 | $3-8B | Regional platform builds; specialty MGAs |

| LOWER MIDDLE MARKET | $5M-$50M | 125-150+ | $2-5B | Independent agency consolidation; PE roll-ups |

Total Estimated Q4 2025 Activity: 153-189 transactions | $54-67B aggregate value

KEY MARKET TRENDS

1. DEAL VOLUME VS. VALUE DIVERGENCE

Transaction Volume:

- As of November 30, 2025: 649 announced transactions (1.3% higher pace vs. 2024)

- Q3 2025: 188 announced transactions (down 13% YoY, 20% below 5-year average)

- Trailing 12-month deal count: 741 (lowest since Q3 2020)

- Six-month period (June-Nov 2025): 207 transactions, $31.8B aggregate value

Deal Value Concentration:

- Seven megadeals ($1B+) announced in final 6 months of 2025

- Aggregate value concentrated in top tier vs. historical distribution

- Demonstrates structural shift toward fewer, larger transactions

2. PRIVATE EQUITY'S STRUCTURAL DOMINANCE

Market Control:

- PE-backed buyers: 471 of 649 deals (72.6%) (historically 68-76%)

- Independent agencies: 89 deals (13.7%)

- Bank buyers: 7 deals (1.1%)

- Strategic corporate: Remaining portion

Buyer Concentration:

- Top 10 buyers: 45.1% of all transactions

- Top 3 (BroadStreet Partners, World Insurance Associates, Hub International): 20.2% of market

- BroadStreet Partners: 57 deals YTD (down 21% from 2024 pace)

Market Fragmentation:

- Unique buyers: 96 currently vs. 152 in September 2021 (37% reduction)

- Suggests continued consolidation among buyer base itself

3. SPECIALTY INSURANCE PREMIUM VALUATIONS

Valuation Multiples:

- Convex: 1.9x tangible book value (specialty reinsurance)

- Inigo: 1.5x tangible equity (Lloyd's specialty)

- Aspen: 35.6% premium to recent IPO (specialty P&C)

- Bamboo: ~6x return in <2 data-preserve-html-node="true" years (tech-enabled distribution)

Comparison to Commodity Lines:

- Specialty insurers commanding 1.3-1.9x multiples vs. ~1.2x for standard lines

- Reflects superior underwriting discipline, pricing power, fee-generating structures

Brokerage Valuations:

- Public multiples: Down 15.4% in 2025 (now at 75% of 52-week highs)

- Forward EBITDA: Moderated from 18.6x in Q1 2025 to lower levels

- Private brokers: Maintained relatively flat valuations with top performers at record highs

- Mega-deals imply substantial strategic premiums beyond public market trading multiples

4. ASIAN INSURERS' WESTWARD EXPANSION

Major Transactions:

- Sompo (Japan): $3.5B Aspen acquisition (August 2025)

- DB Insurance (Korea): $1.65B Fortegra acquisition (September 2025)

Strategic Drivers:

- Domestic market saturation in Japan and Korea

- Aging demographics pressuring domestic growth

- Regulatory tailwinds supporting international expansion

- Attractiveness of Western specialty insurance profitability

Future Outlook: Expected to continue given capital strength of Asian carriers, demographic pressures in home markets, and proven profitability of Western specialty platforms. China-based insurers may follow Japan/Korea pattern in coming years.

5. TECHNOLOGY-ENABLED DISTRIBUTION PREMIUM

Success Stories:

- Bamboo: $1.75B valuation, 6x return in <2 data-preserve-html-node="true" years

- Newfront: Goldman Sachs/Index Ventures backing; 20% CAGR; commanded significant WTW premium

- Applied/Cytora: Estimated $200M-$400M validates insurance-specific AI

Implications:

- Validates insurtech distribution models

- Traditional brokers must acquire tech platforms given organic growth constraints

- B2B infrastructure models succeed where direct-to-consumer struggles

- AI/automation commanding 15-25x revenue multiples vs. 6-10x for traditional

6. LLOYD'S PLATFORM SCARCITY

Multiple Transactions Highlight Lloyd's Value:

- Starr/IQUW (becomes 9th-largest managing agency)

- Sompo/Aspen (enhances Lloyd's capabilities)

- Radian/Inigo (gains Lloyd's market access)

Barriers to Entry:

- Regulatory approval requirements

- Substantial capital commitments

- Broker relationship development

- Syndicate operational expertise

Competitive Dynamics: Limited platform supply creates pricing power for established operators. New entrants face high barriers. Lloyd's licensing enables efficient entry into markets across Americas, UK, Europe, Asia Pacific—valuable for global expansion strategies.

INTEGRATION RISKS & EXECUTION CHALLENGES

Material Integration Challenges:

1. Gallagher/AssuredPartners:

- $575M integration costs over 3 years

- Organic growth deceleration (Q4 guidance ~5% vs. 6%+ full-year)

- 572 employees receiving $316.15M in equity awards

- Early results "off to a terrific start" but execution critical

2. WTW/Newfront:

- Technology integration risk (Navigator + Neuron platforms)

- $35M run-rate cost synergies by 2028 target

- Slightly dilutive 2026 before accretive 2027

- Employee retention critical ($100M retention through 2031)

3. Radian/Inigo:

- Transformation from monoline to multi-line requires significant operational changes

- Currency risk (£ to $)

- Lloyd's operational model integration

- Property catastrophe exposure increase concerns from S&P

4. Sompo/Aspen:

- International operations integration complexity

- H1 2026 closing deadline pressure

- Aspen Capital Markets integration into Sompo structure

5. Brown & Brown/Accession:

- Decentralized model preservation while achieving synergies

- 180+ previously acquired companies within Accession to integrate

- Risk Strategies and One80 Intermediaries separate integration tracks

COMPETITIVE LANDSCAPE IMPLICATIONS

Broker Consolidation Accelerates:

Top-Heavy Market Structure: Gallagher, Brown & Brown, Marsh, Aon controlling disproportionate scale. Mid-tier brokers face strategic choices:

- Pursue aggressive M&A to achieve competitive scale

- Focus on specialized niches where scale matters less

- Seek acquisition by larger platforms

Independent Agency Decline: Independent agencies (13.7% buyer share) face increasing pressure to sell rather than compete independently. Lack access to:

- Capital markets for M&A

- Sophisticated technology platforms

- Carrier relationships PE-backed brokers cultivate

- Operational scale for efficiency

Specialty Insurers Gain Competitive Ground:

Superior Profitability:

- Convex 18% average ROE

- Inigo 20% pre-tax ROE

- Fortegra 91% five-year combined ratio

Strategic Implications: Underwriting discipline and fee-generating structures attract permanent capital. Potential to starve commodity insurance markets of capital and talent. Specialty expertise becomes defensive moat against commoditization.

Lloyd's Platform Consolidation:

Platform Value: Multiple transactions (Starr, Sompo, Radian) highlight Lloyd's access value. Limited platform supply creates pricing power for established operators. New entrants face high barriers: regulatory approval, capital, broker relationships.

Technology as Competitive Necessity:

Critical Findings:

- Bamboo, Newfront, Cytora acquisitions highlight technology as strategic imperative

- Traditional carriers and brokers lacking internal digital capabilities face "build vs. buy" decisions

- Expectation: continued acquisition of insurtech platforms by strategic buyers

- AI/automation platforms commanding 15-25x revenue multiples

PART 6: 2026 OUTLOOK & STRATEGIC RECOMMENDATIONS

EXPECTED DEAL FLOW BY SEGMENT

INSURTECH M&A: 30-50 Transactions Expected

Drivers:

- Q3'25 momentum (21 deals) expected to continue

- Strategic acquirers prioritizing AI/automation capabilities

- Funding constraints forcing startups to seek exits

- Accelerant IPO success potentially reopening public markets

Hot Segments:

- AI/ML platforms (underwriting automation, claims processing, fraud detection)

- Embedded insurance (distribution through non-insurance partners)

- Cyber insurance (digital-native underwriting)

- Parametric insurance (data-driven trigger-based coverage)

- B2B SaaS (infrastructure for carriers/brokers vs. direct-to-consumer)

MEGA DEALS ($1B+): 5-8 Transactions Expected

Drivers:

- Integration completion of 2025 megadeals frees management attention

- Interest rate environment improving acquisition economics

- Specialty insurance platforms commanding premium valuations

- Asian insurers continuing westward expansion

Risks:

- Regulatory scrutiny intensifying (DOJ/FTC antitrust reviews)

- Integration execution failures dampen future appetite

- Valuation compression if interest rates reverse or economy weakens

MIDDLE MARKET ($50M-$1B): 40-70 Transactions Expected

Drivers:

- Specialty MGA/program administrator consolidation

- Regional broker platforms seeking strategic homes

- Flood/cyber/parametric insurance platform acquisitions

- Technology vendor consolidation

Trends:

- Increased focus on profitable growth over pure scale

- Earnout structures more common (buyers protecting against overpayment)

- Cross-border M&A (European/Asian buyers in North America)

LOWER MIDDLE MARKET ($5M-$100M): 500-650 Transactions Expected

Drivers:

- Continued PE-backed platform roll-ups

- Baby boomer agency owner retirements accelerating

- Independent agencies unable to compete with platform technology and scale

- Earnout structures enabling transactions despite valuation gaps

Challenges:

- Declining number of independent agencies (supply constraint)

- Integration capacity limits for aggressive acquirers

- Cultural integration failures increasing

Key Platforms to Watch:

- BroadStreet Partners (can it maintain 50+ deal pace?)

- Inszone (aggressive Q4'25 suggests accelerating 2026)

- Alera Group (100% growth rate sustainable?)

- HighStreet Partners & King Risk Partners (emerging competitors)

STRATEGIC RECOMMENDATIONS

FOR INSURANCE CARRIERS:

Strategic Imperatives:

- Acquire or Build Insurtech Capabilities - Technology gap widening vs. digital natives

- Specialty Migration Essential - Commodity lines face persistent pressure

- International Expansion Opportunities - Western carriers should consider Asian partnerships/JVs

- Capital Allocation Review - Divest low-ROE businesses; reallocate to specialty/technology

M&A Positioning:

- Establish corporate venture arms (follow Zurich Global Ventures model)

- Build "try before you buy" partnerships with insurtechs (Zurich-BOXX 4-year model)

- Acquire Series A/B insurtechs before Series C valuations spike

FOR INSURANCE BROKERS:

Size-Specific Strategies:

Mega-Brokers ($5B+ revenue):

- Continue selective megadeals ($1B+) when transformational opportunities arise

- Accelerate bolt-on acquisition pace (10-30 annually) for geographic/capability fill-ins

- Invest in technology platforms (Applied Systems-Cytora model) vs. build internally

Mid-Market Brokers ($100M-$1B revenue):

- Critical Decision Point: Pursue aggressive M&A to reach $1B+ scale OR specialize in niche vertical

- Platform building requires PE partnership or debt financing for acquisition capital

- Standalone mid-market position increasingly untenable

Independent Agencies (<$50M data-preserve-html-node="true" revenue):

- Realism Required: Cannot compete long-term with PE-backed platforms

- Strategic options: (1) Sell to platform with management rollover; (2) Join network/alliance; (3) Specialize in defensible niche

- Timing: Valuations likely at/near peak; next 2-3 years favorable exit window

FOR INSURTECH FOUNDERS/INVESTORS:

Exit Strategy Insights:

- Avoid Series C+ if M&A exit likely - Data shows insurtechs exiting at Series A/B stage

- Focus on Strategic Acquirer Fit - Insurance-specific AI/workflow automation most valuable

- B2B > B2C - Direct-to-consumer insurtechs struggle; B2B infrastructure models succeed

- Profitability Pathway Critical - Unit economics matter; "growth at any cost" no longer viable

M&A Preparation:

- Establish commercial partnerships with potential acquirers 2-4 years before exit (Zurich-BOXX model)

- Demonstrate ROI metrics (premium growth, loss ratio improvement, cost reduction)

- Build for integration (APIs, cloud-native, data portability)

Valuation Optimization:

- AI-powered platforms: Emphasize automation ROI and scalability (target 15-25x revenue)

- Marketplaces: Highlight network effects and GMV growth (target 8-15x revenue)

- SaaS platforms: Focus on NDR (net dollar retention) and gross margins (target 5-10x revenue)

FOR PRIVATE EQUITY INVESTORS:

Lower Middle Market Roll-Ups:

- Supply Constraints Emerging - Independent agency count declining (37% reduction in unique buyers/sellers)

- Integration Capacity Matters - Quality of integration > quantity of deals

- Technology Investment Required - Platforms without modern tech struggling to compete

- Earnout Discipline - Protect against overpayment in competitive auctions

Exit Strategies:

- Mega-broker sale remains primary exit (Gallagher, Brown & Brown, Aon, Marsh all active)

- Secondary PE sales viable for $500M-$2B platforms

- IPO window cautiously reopening (monitor public broker multiples)

Insurtech Investing:

- Shift to B2B Infrastructure - Focus on enabling tools vs. direct-to-consumer

- AI/Automation Priority - Insurance industry significantly underautomated

- Later-Stage Focus - Series B/C companies with proven PMF and clear exit paths

KEY RISKS TO MONITOR

Integration Execution:

If Gallagher, Radian, or WTW integration failures emerge, will dampen 2026 deal appetite. Gallagher's integration drag on organic growth warrants close monitoring.

Valuation Compression:

If interest rates reverse upward, acquisition economics deteriorate significantly. Specialty insurer premium valuations vulnerable to earnings disappointment. Broker multiple compression could accelerate if organic growth disappoints.

Regulatory Scrutiny:

Increased consolidation may attract enhanced antitrust attention. Cross-border deals (Asian acquirers, international platforms) subject to regulatory risk. Gallagher-AssuredPartners dealt with regulatory delays.

Macro Economic Risk:

Insurance sector resilience during downturns has supported elevated valuations. Significant economic deterioration could pressure margins and profitability, impacting M&A multiples.

CONCLUSION

The fourth quarter of 2025 represents a watershed moment in insurance and insurtech M&A, characterized by transformational deal values despite declining transaction volumes. This comprehensive report documents 195+ transactions across all market segments:

- Insurtech M&A: 15+ exits including Applied/Cytora, Zurich/BOXX, Bold Penguin/SquareRisk, AXA/Prima ($1.1B)

- Mega Deals: 11 transactions totaling $45B+ including Gallagher/AssuredPartners ($13.45B), Convex/Onex-AIG ($7B)

- Middle Market: 40+ transactions including PHLY/Ignyte ($615M), Wright Flood/Poulton

- Lower Middle Market: 125-150+ Q4 deals from PE-backed platforms (BroadStreet, Inszone, Hub)

Three Transformative Forces Shaped Q4 2025:

Insurtech M&A Surge: Q3'25 reached 21 acquisitions (highest since Q3'22), reversing 2022-2024 decline. Strategic acquirers prioritize AI/automation platforms. Insurtechs exiting at Series A/B stage for faster liquidity. AI platforms commanding 15-25x revenue multiples.