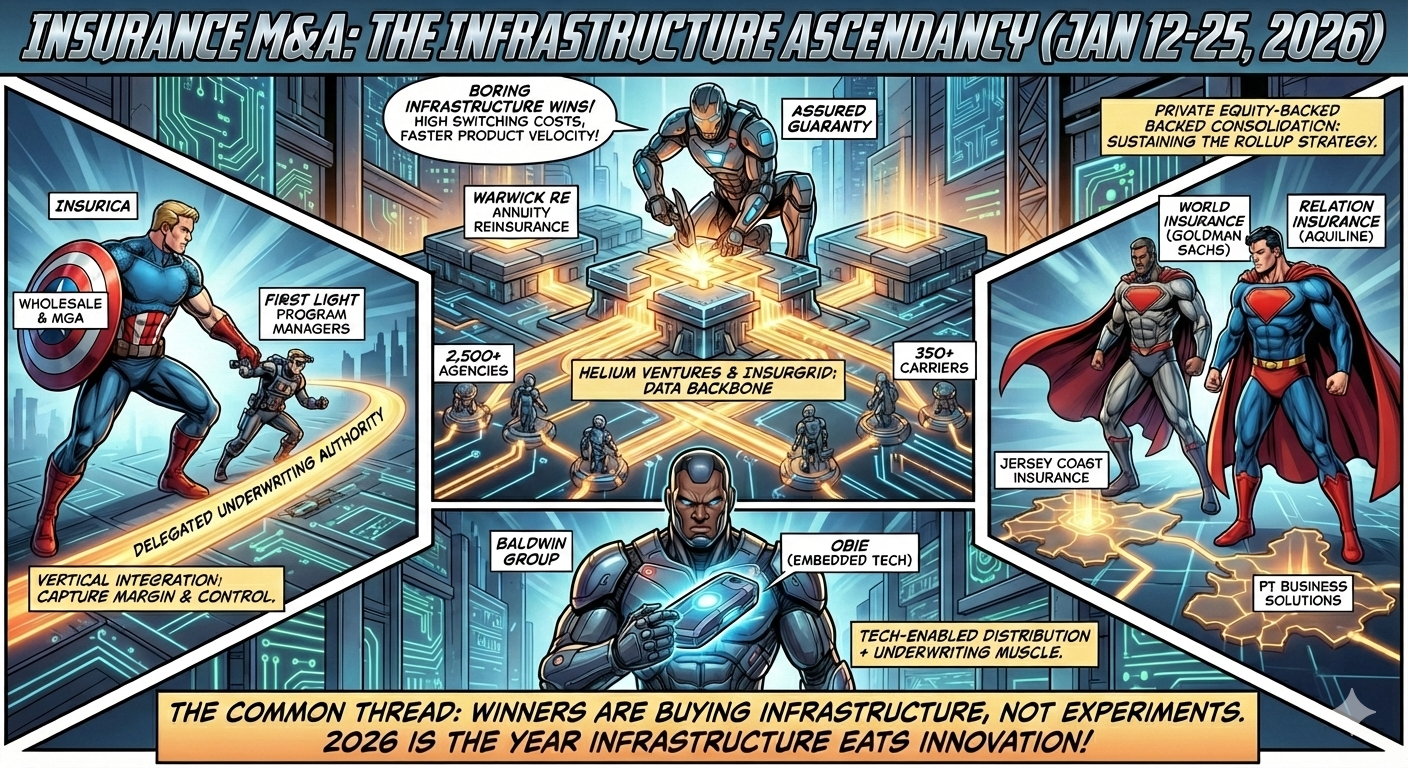

The two-week period from January 12–25, 2026 captured seven discrete insurance and InsurTech M&A transactions, spanning embedded distribution technology, regional brokerage consolidation, wholesale specialty platforms, and reinsurance infrastructure. Despite a 12% decline in overall 2025 insurance agency M&A volume—695 deals versus 787 in 2024—strategic acquirers sustained momentum in early 2026, targeting proven platforms with recurring revenue, specialty expertise, and geographic expansion opportunities.

M&A Insurance & InsurTech Weekly Report January 1–11, 2026

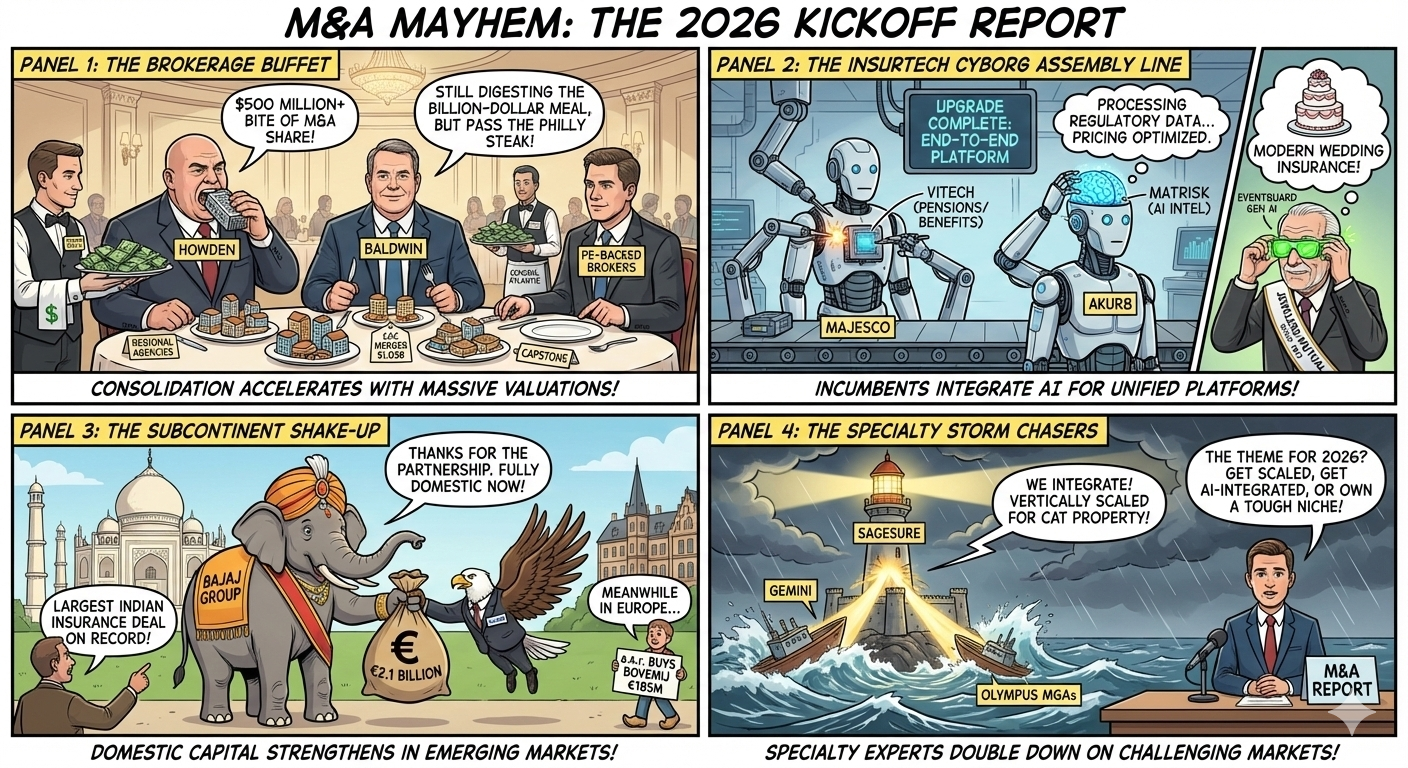

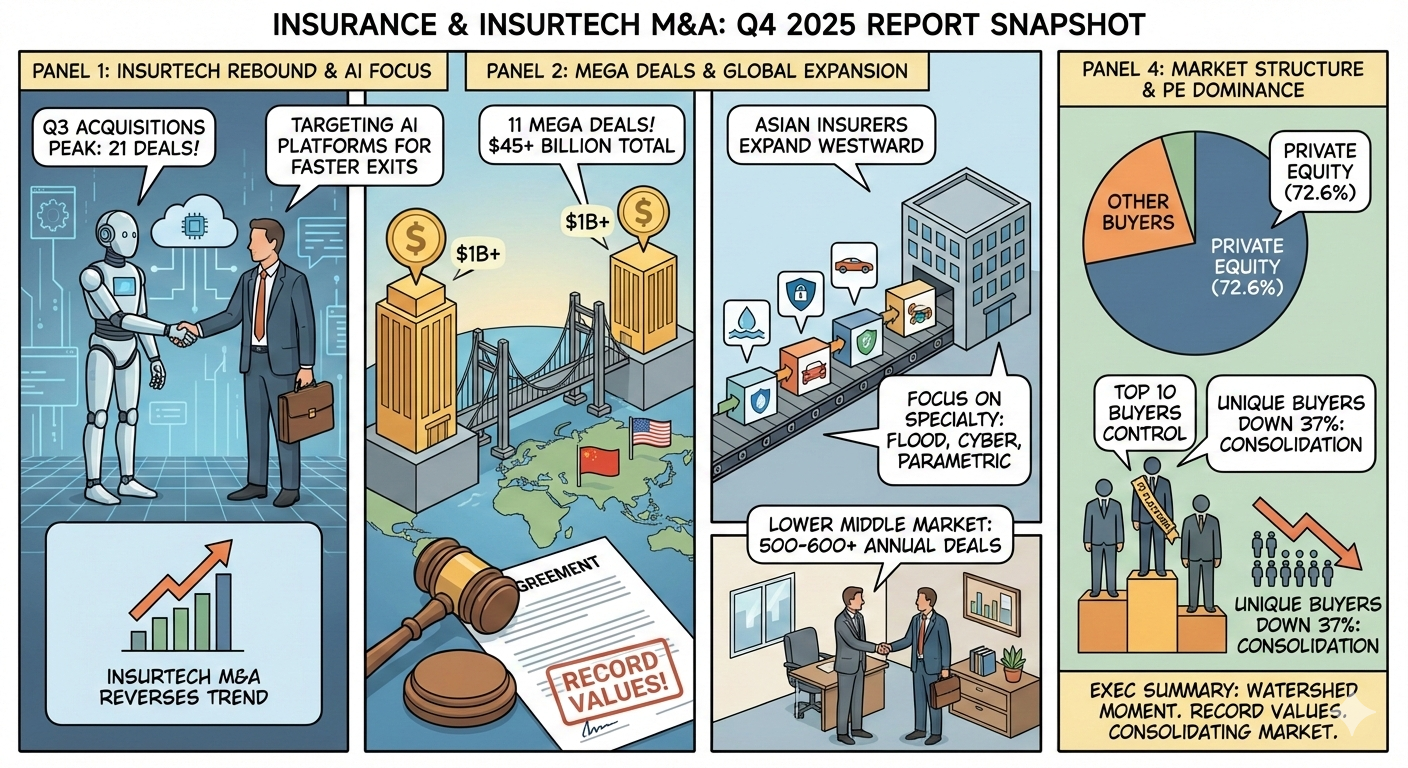

Another blockbuster week in insurance M&A: Howden drops $500M+ on US transactional liability powerhouse Atlantic Group, while Majesco and Akur8 double down on AI with Vitech and Matrisk acquisitions—fusing core platforms, pricing intelligence, and next-gen tech into operating systems for carriers. Bajaj closes India's largest-ever insurance deal (₹21,390 crore) to buy out Allianz and take full control of its insurance subs, while a.s.r. grabs Dutch mobility specialist Bovemij for €185M. On the distribution side, Baldwin (fresh off a $1B CAC merger) and Trucordia keep the consolidation flywheel spinning. And in a sign of the times: Jewelers Mutual acquires AI-powered MGA EventGuard, proving generative-AI distribution is no longer a concept—it's a growth lever for 110-year-old mutuals. The message? Scale, tech, and capability-driven M&A are rewriting the playbook across broking, tech, and underwriting.

#InsuranceMandA #InsurTech #PrivateEquity #Brokers #AI #India

M&A Insurance & InsurTech Quarterly Report 2025Q4

Q4 2025 marked a turning point in insurance and insurtech M&A, with fewer but significantly larger deals reshaping the market. Insurtech M&A surged to 21 transactions in Q3 2025—the highest level since Q3 2022—even as overall insurtech deal volume fell to just 76, the lowest count in years. At the same time, traditional insurance consolidation was dominated by megadeals such as Gallagher’s $13.45 billion acquisition of AssuredPartners, underscoring how scale, specialty capabilities, and technology are now central to competitive strategy across the sector.