Executive Summary

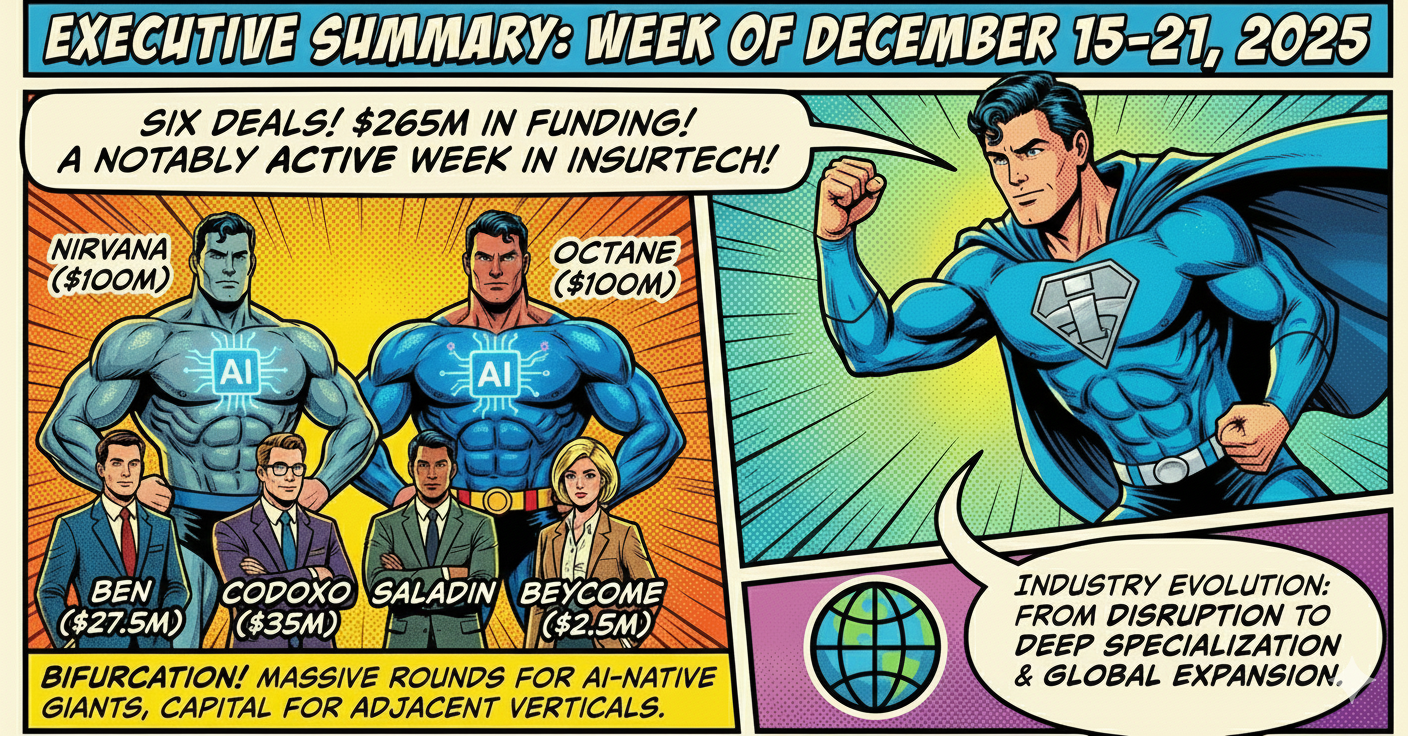

The week of December 15-21, 2025, delivered six substantive insurance and insurtech investment announcements totaling $265M in disclosed funding, representing a notably active week in a sector characterized by multiyear funding lows. The cohort reveals a sharp industry bifurcation: massive rounds ($100M+) flowing to AI-native, category-defining platforms with proven unit economics (Nirvana, Octane), while adjacent verticals—health insurance operations, employee benefits, embedded insurance in fintech and proptech—attract capital at meaningful scale. The week showcases the insurance technology sector's evolution from "disruption" narrative toward deep specialization in high-friction operational domains. Notably, geographic expansion into Vietnam (Saladin) signals emerging market insurtech gaining venture-scale validation.

Disclosed Funding Amounts: December 15-21, 2025 Insurance/Insurtech Deals

Deal-by-Deal Breakdown

1. Nirvana Insurance – $100M Series D

Announcement Date: December 17–19, 2025

Investors: Valor Equity Partners (lead); Lightspeed Venture Partners, General Catalyst (continuing)

Target: Nirvana Insurance (California)

Amount: $100M equity at $1.5B post-money valuation

Company Overview:

Nirvana operates an AI-native "operating system for insurance" focused exclusively on commercial trucking, the most complex and data-rich segment of commercial auto insurance. The platform integrates real-time telematics (30B+ miles of historical driving data), machine learning-powered underwriting, and claims automation to fundamentally reshape how fleets are priced, monitored, and insured.

Use of Funds:

Scale AI-driven underwriting and claims automation platform

Expand customer acquisition (currently serving "thousands" of motor carriers)

Deepen telematics data moat and real-time loss prevention capabilities

Grow team (approximately 200 employees, roughly doubled year-on-year)

Enhance product capabilities enabling fleets to reduce accident frequency and severity before they occur

Business Model & Competitive Advantage:

Nirvana's differentiation rests on three layers: (1) proprietary 30B+ mile dataset that enables granular, predictive risk pricing; (2) AI underwriting that processes continuous behavioral signals rather than annual snapshots; (3) embedded loss prevention (alerting drivers to unsafe behavior, recommending route changes, identifying maintenance gaps). This "prevention-first" approach inverts the traditional insurance value chain from "price the risk you inherit" to "help reduce the risk itself."

Competitive Landscape:

Traditional commercial auto carriers (Allstate, GEICO commercial, Progressive commercial, NCCI-rated specialty carriers) and legacy trucking insurers compete primarily on brand, distribution, and underwriting sophistication built on annual loss triangles and broad risk segmentation. Emerging competitors include other commercial-lines insurtechs (e.g., Clearcover for personal auto, but scaled to commercial), telematics-enabled MGAs, and captives operated by fleet operators themselves. However, none combine Nirvana's depth of telematics, speed of underwriting iteration, and operational integration at scale.

Impact on Competition:

Pricing pressure: Nirvana's real-time, behavior-based pricing creates a widening gap between its quote accuracy and incumbents' annual-cycle models. Fleets seeking pricing precision will increasingly gravitate toward Nirvana, forcing competitors to match or rationalize margin compression.

Loss ratio risk: By cherry-picking the safest fleets (those with continuous monitoring and willingness to engage in loss prevention), Nirvana improves its loss ratios while traditional carriers experience adverse selection in the residual pool.

Operational transformation urgency: Competitors must either build comparable telematics and AI capabilities (requiring 3–5 years and significant capex) or face structural margin erosion as Nirvana matures.

Capital access signal: The $100M Series D at $1.5B valuation—nearly doubling the $830M valuation from March 2025—signals to other commercial insurtech founders and investors that the "flight to quality" thesis is real. Scaled, AI-native commercial platforms attract mega-rounds; horizontal or generalist insurtechs struggle to fundraise.

Valuation Insight:

Nirvana's near-doubling in 9 months reflects investor confidence in the company's ability to capture profitable market share in a $250B+ U.S. commercial auto market. The valuation implies either that Nirvana is on a clear path to $500M+ ARR (applying late-stage SaaS multiples), or that investors are pricing in significant acquisition premium from strategic buyers (carriers, reinsurers, or large brokers).

2. Ben – $27.5M Series B

Announcement Date: December 16, 2025

Investors: Mercia Ventures (lead); Atomico, Cherry Ventures, DN Capital, Seedcamp (existing); QuantumLight Capital/Nik Storonsky (new)

Target: Thanks Ben Ltd. (London)

Amount: $27.5M (£20.8M) equity

Company Overview:

Ben is an AI-native employee benefits administration platform serving multinational and mid-market enterprises across 140+ countries. The platform consolidates fragmented, country-by-country benefits delivery (health, pensions, insurance) into a unified, AI-powered experience for employers, employees, brokers, and insurers.

Use of Funds:

Accelerate product roadmap and AI capabilities (benefits eligibility, compliance automation, personalized recommendations)

Expand go-to-market in Europe and North America (currently strongest in EMEA)

Deepen channel partnerships with brokers and benefits consultants

Scale enterprise customer base (growing 10x since last round in August 2022)

Business Model & Traction:

Ben charges SaaS-style per-employee-per-month (PEPM) fees for platform access, plus transaction fees on benefits enrollment and administration. Customers include enterprise-scale companies (Mondelez, Zalando, Trainline, Deliveroo, Octopus Energy). The company has achieved 10x revenue growth since its Series A in August 2022, indicating strong unit economics and product-market fit in the multinational employer segment.

QuantumLight Capital Investment Significance:

The entry of QuantumLight Capital (founded by Revolut co-founder Nik Storonsky) is particularly telling. This signals fintech-to-insurtech crossover capital and suggests Ben is exploring embedded insurance models or API-driven insurance distribution through fintech platforms—a potential growth vector beyond traditional benefits channels.

Competitive Landscape:

Ben competes against (1) legacy HCM/HR platforms with benefits modules (Workday, SAP SuccessFactors, BambooHR) that handle benefits as a feature; (2) specialized benefits admin platforms (Namely, Guidepoint, Catch); (3) brokers managing country-level benefits manually (Marsh, Aon, Willis Towers Watson); (4) localized benefits platforms in specific countries (Caya in Germany, Zenefits-like consolidators).

Most competitors are either horizontal HR systems with weak benefits depth or regional platforms without global reach. Ben's differentiation: AI-powered, compliance-aware, global-by-design, employee-centric UX.

Impact on Competition:

Broker margin erosion: Ben automates benefits administration and eligibility workflows that brokers historically managed manually. Large brokers (Aon, Marsh) may partner rather than lose business; smaller brokers face disruption.

Platform consolidation: As Ben scales, enterprises reduce the number of vendors (fewer HR tools, fewer benefits platforms). This "choosing sides" pressure forces competitors to innovate or get displaced.

Insurance distribution shift: Ben's platform becomes a potential distribution channel for insurers (health, life, disability). Insurers may negotiate direct integrations with Ben, disintermediating brokers and consultants.

Global standardization: Ben's 140-country compliance engine sets a new standard for multinationals. Competitors without global depth are increasingly marginalized in multinational accounts.

3. Codoxo – $35M Series C

Announcement Date: December 16–19, 2025 (announced Dec. 17, published Dec. 18–19)

Investors: CVS Health Ventures (lead); Echo Health Ventures (new); Sands Capital Management, 111 West Capital, Brewer Lane Ventures, Wipro Ventures, 450 Ventures, QED Investors (existing)

Target: Codoxo (Duluth, Georgia)

Amount: $35M Series C (oversubscribed); total lifetime funding >$75M

Valuation: Not disclosed

Company Overview:

Codoxo (formerly FraudScope, founded 2017) operates an AI and generative AI-powered healthcare payment integrity platform. Its flagship innovation, "Point Zero Payment Integrity," intervenes BEFORE claims are submitted to prevent errors upstream, rather than detecting and recovering them post-payment. The platform serves national health plans and covers 80M+ lives.

Use of Funds:

Scale deployment of Point Zero Payment Integrity powered by generative AI

Accelerate product innovation in GenAI applications (clinical chart reviews, policy compliance automation, provider education)

Expand customer base among national health plans (Anthem, Humana, Cigna, UnitedHealth, regional Blues plans)

Deepen AI capabilities across pre-claim, prepay, and postpay workflows

Address $300B+ annual U.S. healthcare fraud, waste, and abuse (FWA)

Business Model:

Codoxo operates as a B2B2C SaaS platform, with health plans paying per-patient-per-month or per-claim-processed fees. The platform generates ROI claims of $60+ PMPY (per member per year) in cost savings through prevented payment errors. Revenue is recurring and linked to plan membership scales.

Platform Capabilities (AI/GenAI-Powered):

Pre-claim provider education and intervention (prevents errors before submission)

Payment integrity across prepay and postpay workflows

GenAI-powered clinical chart and medical record reviews (automating credential review)

Provider contract and medical policy compliance audits

Fraud, waste, and abuse (FWA) detection

Data mining across provider, claims, and clinical data

Competitive Landscape:

Codoxo competes against (1) traditional post-payment audit vendors (Cotiviti, Conduent, HealthEdge, Change Healthcare, Optum), which dominate historical market; (2) dedicated FWA platforms (SAS Fraud & Security, FICO Healthcare Fraud); (3) claims review services (MedReview, MCMC); (4) in-house payer teams; (5) emerging AI-driven cost containment platforms.

Most competitors operate in the post-payment domain: detecting denials, appealing claims, recovering overpayments. Codoxo's shift to pre-claim prevention is conceptually different and operationally challenging for incumbents to replicate.

Impact on Competition:

Structural threat to post-payment vendors: If Codoxo successfully prevents claims errors pre-submission, the volume flowing to post-payment systems declines. Cotiviti, Conduent, and others face revenue headwinds unless they acquire or build pre-claim capabilities.

CVS Health Ventures validation: CVS's lead investment is particularly significant. CVS owns Aetna (major health plan). If CVS standardizes Codoxo across Aetna, other national plans face competitive pressure to match (or risk higher claim costs). This creates a virtuous cycle for Codoxo.

GenAI as table stakes: Codoxo's GenAI integration (chart reviews, policy audits) raises the bar for AI sophistication. Competitors using legacy rules engines or basic ML risk commoditization.

Payer switching costs: As plans adopt Codoxo, they integrate it into claims workflows. Switching costs increase, making Codoxo "sticky" and reducing competitive threat from new entrants.

4. Saladin – Series A (Undisclosed Amount)

Announcement Date: December 11–16, 2025 (announced Dec. 11–12, published through Dec. 16)

Investors: SBI Ven Capital (via joint fund with Kyobo Securities and NTUitive) (lead); Monk's Hill Ventures, Peak XV Partners, ICMG (existing and new)

Target: Saladin (Vietnam/Singapore)

Amount: Series A, undisclosed (estimated $15–25M based on investor profiles)

Company Overview:

Founded in 2022, Saladin is a digital-first insurance brokerage and multi-channel distribution platform operating in Vietnam. The company builds B2B2C embedded insurance solutions for enterprises (payment platforms, travel, healthcare, e-commerce) while maintaining a direct-to-consumer agent network. Saladin partners with 15 leading Vietnamese insurers and has served nearly 1M unique customers. Its agent network (Saladin Pro) includes 15K+ registered partners.

Use of Funds (Post-Series A):

Expand beyond non-life insurance into life insurance (term life, health protection)

Introduce life insurance offerings tailored for online/digital distribution and B2B2C embedding

Strengthen customer journey across claims and service operations

Leverage AI to improve productivity, personalization, and trust in digital insurance interactions

Deepen enterprise partnerships in health, term life, and travel insurance

Scale training and financial literacy for agent network (Saladin Pro)

Business Model:

Saladin operates as a hybrid distribution platform: (1) B2B2C embedded insurance in partner ecosystems (payments, travel, healthcare); (2) direct agent network (Saladin Pro); (3) potential future own-branded products. Revenue comes from commissions on policies sold and, increasingly, from platform fees and premium financing.

Market Context:

Vietnam's insurance market has historically faced regulatory headwinds (restrictions on bancassurance sales, industry consolidation). However, the market is experiencing digital transformation and regulatory reform aimed at modernization and international standards. Saladin benefits from this macro tailwind and is positioned to capture share as customers shift to digital-first, embedded purchasing.

Competitive Landscape:

In Vietnam, Saladin competes against (1) traditional brokers (offline, relationship-driven); (2) incumbent insurers' direct distribution; (3) bancassurance partnerships (through banks); (4) emerging digital competitors (nascent; Saladin is among the earliest at scale); (5) international brokers entering Vietnam (Marsh, Aon, WTW).

Most competitors rely on offline distribution, face regulatory constraints on digital innovation, and lack AI-driven personalization. Saladin's digital-native, API-first architecture is materially different.

Impact on Competition:

Digital distribution shift: As Saladin scales embedded insurance (via payment platforms, travel sites, e-commerce), it removes friction from insurance purchasing and builds distribution moats that traditional brokers cannot match. Incumbents forced to digitize or lose market share.

Agent network leverage: Saladin's 15K+ agent network (Saladin Pro) is a hybrid asset. Unlike pure-digital players, Saladin offers human touch at scale. This makes it competitive against both pure-digital entrants and offline brokers.

Market expansion signal: Saladin's Series A in a challenging regulatory environment signals that venture capital sees Vietnamese insurtech as attractive despite headwinds. Other Vietnamese insurtechs (and regional competitors in Thailand, Indonesia, Philippines) will attract increased VC attention.

International player response: Global brokers (Marsh, Aon, WTW) and insurers (AIA, Prudential) operating in Vietnam may accelerate digital transformation initiatives or consider Saladin partnerships/acquisitions to avoid disruption.

5. Octane – $100M Series F

Announcement Date: December 15–17, 2025

Investors: Valar Ventures (lead); Upper90 (existing major investor)

Target: Octane (lending platform, consumer finance)

Amount: $100M equity, Series F

Valuation: Not disclosed; prior funding suggests multi-billion valuation

Company Overview:

Octane is a fintech lending platform specializing in recreational vehicle financing (powersports, RVs, marine). The platform finances purchases of motorcycles, ATVs, boats, RVs, and related vehicles. Octane's differentiation: it bundles financing with integrated insurance products, creating a unified protection solution for recreational vehicle buyers.

Use of Funds:

Scale operations and dealer network (expand geographic footprint and dealer partnerships)

Enhance core lending technology and underwriting platform

Integrate and expand embedded insurance offerings (protection products bundled with financing)

Deepen consumer engagement and fintech capabilities

Business Model & Insurance Integration:

Octane generates revenue from (1) finance charges on loans; (2) insurance commissions and underwriting profits on bundled protection products. The insurance component is embedded into the financing workflow: as a consumer finances a vehicle, they simultaneously select and enroll in insurance coverage (usually in partnership with third-party insurers or, increasingly, through Octane's own underwriting or MGA partnerships).

Competitive Landscape:

Octane competes against (1) traditional captive finance from OEM (manufacturer) dealers (Honda Financial Services, Harley-Davidson Credit, etc.); (2) bank financing (Wells Fargo, Bank of America auto lending); (3) specialty finance (Ally, CarMax financing); (4) standalone insurance sold separately.

The key differentiation is embedded insurance—combining financing and protection into a single, streamlined purchase reduces friction and increases insurance penetration rates.

Impact on Competition:

Embedded insurance acceleration: Octane's $100M raise signals investor confidence in the embedded insurance thesis. As fintech platforms increasingly bundle insurance, traditional standalone insurance distribution faces pressure. Customers prefer "one-stop shopping."

Insurance partnerships required: Incumbent insurers must decide: partner with Octane and share underwriting profits, or lose distribution entirely. This creates partnership urgency and potential margin compression.

Consumer behavior shift: Buyers financing recreational vehicles through Octane have near-zero friction to also enrolling in insurance (vs. shopping separately). This raises insurance attachment rates industry-wide but concentrates distribution in Octane's hands.

Recreational vehicle insurance market consolidation: As Octane grows, it becomes a major player in recreational vehicle insurance distribution. Specialty carriers (AARP, etc.) face distribution pressure.

6. Beycome – $2.5M Seed

Announcement Date: December 18–19, 2025

Investors: InsurTech Fund (lead); Pivot Ventures, Florida Opportunity Fund, RedShift Capital, Neer Venture Capital, Kima Ventures, Ignite Venture, Founders Future

Target: Beycome (proptech + real estate)

Amount: $2.5M Seed

Company Overview:

Beycome is an AI-powered real estate D2C (direct-to-consumer) platform that streamlines homebuying by bundling property search, financing, and title/insurance services into a unified marketplace. The company has completed ~20,000 transactions while bootstrapped to profitability before this raise. Beycome targets price-sensitive buyers and reduces friction across the entire transaction.

Use of Funds:

Deepen AI capabilities (property matching, price prediction, market analysis)

Expand nationwide (currently regional focus)

Scale title services and buyer insurance programs (embedded title and homeowners insurance)

Enhance the technology platform and customer experience

Business Model & Insurance Embedding:

Beycome generates revenue from (1) transaction fees/commissions on home sales; (2) title insurance and services (potentially underwritten by Beycome or partners); (3) embedded homeowners insurance. The company aims to become a one-stop solution, reducing buyer reliance on multiple service providers (agent, title company, insurance broker).

Competitive Landscape:

Beycome competes against (1) traditional real estate agents and brokers (Redfin, Zillow, Opendoor); (2) online title services (LandAmerica, Old Republic); (3) homeowners insurance carriers and brokers; (4) emerging fintech players bundling real estate services (Flyhomes, Knock).

Most competitors specialize in one function (brokerage, title, insurance). Beycome's bundled approach is less common and, if executed well, creates significant UX and cost advantages.

Why InsurTech Fund Lead is Significant:

InsurTech Fund's lead investment signals that embedded insurance in real estate transactions is a validated use case. This adds proptech to the list of verticals where insurance is being embedded (fintech lending, travel, payments, e-commerce). It also confirms that InsurTech Fund sees proptech+insurance combinations as part of the insurtech landscape.

Impact on Competition:

Title and insurance integration pressure: Traditional title and insurance providers have historically operated as separate services with different purchasing cycles. Beycome's bundling pressures both title and insurance carriers to integrate or face disintermediation.

Real estate agent margin compression: By enabling direct property transactions with embedded services, Beycome reduces reliance on traditional agents. This pressure is exerted on commission structures across the real estate industry.

Insurance attachment opportunities: Beycome's scale in real estate transactions provides a large funnel for insurance penetration. Competitors (other proptech platforms, insurers) must develop comparable embedded insurance capabilities or see customers acquire protection through Beycome.

Competitive Impact & Sector Themes

1. AI as Universal Requirement

All six deals emphasize AI and automation as core differentiators:

Nirvana: Real-time telematics + predictive underwriting

Ben: AI benefits eligibility, compliance, personalization

Codoxo: Generative AI for payment integrity and chart reviews

Saladin: AI-driven distribution, personalization, trust

Octane: AI-enhanced underwriting for recreational vehicle financing

Beycome: AI property matching and market analysis

This reinforces Q3 2025 sector data: AI-focused insurtechs attracted 74.8% of all insurtech funding. Competitors without AI differentiation increasingly marginalized.

2. Commercial P&C and Health Insurance Operations Leading

The week's cohort reflects a sector shift toward specialized, high-margin segments:

Commercial P&C: Nirvana (trucking), Saladin (multi-line in Vietnam)

Health Insurance Operations: Codoxo (payment integrity)

Employee Benefits Administration: Ben (multinational benefits)

Embedded Insurance: Octane (recreational vehicle financing), Beycome (real estate)

Consumer-facing life and health insurance insurtech funding has fallen sharply, while commercial and operational technology platforms attract disproportionate capital.

3. Embedded Insurance Momentum

Three of six deals (Octane, Beycome, Saladin) emphasize embedding insurance into adjacent workflows:

Insurance bundled with lending (Octane)

Insurance bundled with real estate transactions (Beycome)

Insurance embedded in payment, travel, healthcare ecosystems (Saladin)

This reflects a broader trend: insurance increasingly becomes a feature within fintech, proptech, and e-commerce platforms rather than a standalone product. Traditional insurers and brokers face distribution disintermediation if they cannot establish direct relationships or partnerships with these platforms.

4. Capital Concentration Among Winners

The two largest rounds ($100M each) went to Nirvana and Octane—both category-defining, AI-native platforms with proven unit economics and clear paths to dominance in their verticals.

Smaller seed and Series A rounds went to earlier-stage companies in emerging categories (Beycome in proptech+insurance, Saladin in Vietnamese digital distribution) or geographies (Vietnam).

This pattern—mega-rounds to scaled winners, modest rounds to early-stage specialists—is consistent with "flight to quality." Venture capital increasingly concentrates bets on companies with defensible moats, strong unit economics, and large addressable markets. Generalist or horizontal insurtechs face fundraising headwinds.

Special Cases & Standout Insights

Case 1: Nirvana's Valuation Acceleration in a Down Market

Nirvana's near-doubling in valuation (from $830M in March to $1.5B in December) within a period of overall sector funding decline is instructive. The round reflects investor conviction that:

Commercial trucking insurance is structurally underserved by traditional carriers' pricing and risk management capabilities.

Nirvana's telematics + AI moat is defensible and compounding as it accumulates more driving data and loss experience.

The company is on a clear path to profitability and scale, justifying mega-round valuations typically reserved for SaaS unicorns.

Nirvana is a case study in "flight to quality": when venture capital retreats, it concentrates in obvious winners. This dynamic pressures all other insurtechs to demonstrate similarly compelling unit economics or face extended fundraising droughts.

Case 2: CVS Health Ventures Validating Pre-Claim Payment Integrity

CVS Health Ventures' lead in Codoxo's Series C is a watershed moment for healthcare payment integrity platforms. Why?

CVS owns Aetna, a major national health plan. CVS's investment signals internal conviction that Codoxo's Point Zero approach is superior to in-house or competitor solutions.

If Codoxo is deployed at scale within Aetna, other national plans face competitive pressure. Codoxo's $60+ PMPY cost savings claims directly impact underwriting margins.

The pre-claim intervention model represents a paradigm shift for the industry. Post-payment vendors (Cotiviti, Conduent) must respond by building or acquiring pre-claim capabilities. This pressures their legacy business models.

Codoxo's round is less about fintech disruption and more about operational transformation within existing insurance institutions. This suggests the highest-impact insurtechs increasingly target operational efficiency and cost reduction for incumbent payers and insurers, rather than attempting to displace them entirely.

Case 3: Emerging Market Validation – Saladin in Vietnam

Saladin's Series A in a challenging regulatory environment (Vietnam) signals that venture capital sees emerging market insurtech as attractive despite macro headwinds. Key implications:

Digital transformation in Asia is accelerating. Vietnam's regulatory reforms and push toward digitalization create tailwinds for digital-native insurance.

Saladin's hybrid model (B2B2C embedded + direct agent network) works well in markets with limited creditcard/digital payment penetration but growing smartphone adoption. This model may be replicable across Southeast Asia, South Asia, and Africa.

International competitive response expected. Saladin's success will attract attention from larger regional insurtech players (Singapore, Indonesia) and global brokers. Expect consolidation and partnerships in Vietnamese insurtech within 24 months.

2025 Macro Context: Why This Week Matters

The six deals announced in December 15–21 occur within a specific macro context:

Overall insurtech funding in 2025 is ~$3.9–4.0B, down 75% from the 2021 peak but stabilizing at $1.0–1.1B per quarter.

Deal count is at multiyear lows, but average deal size is elevated. This is "barbell" capital allocation: mega-rounds to proven winners, minimal activity for early-stage generalists.

AI-focused insurtechs captured 74.8% of Q3 2025 funding, while consumer-facing (life, health) insurtech fell sharply. Commercial P&C and operational technology platforms are attracting the bulk of investor attention.

Geographic diversification is emerging. Historically, U.S. dominance was near-absolute. The week's inclusion of Saladin (Vietnam) suggests emerging market insurtech is gaining traction and capital.