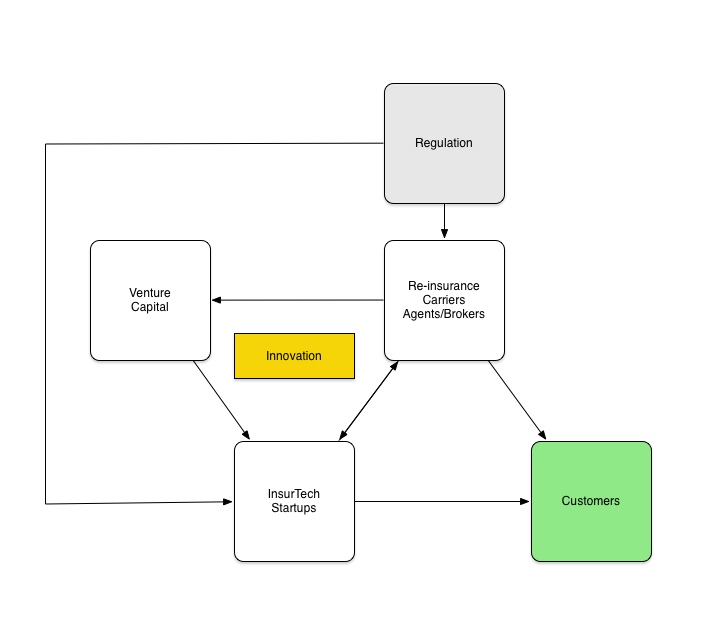

2017 has been an interesting year for InsurTech. I would define it as the year that InsurTech took another step from adolescence towards adulthood. I define "adolescence" as the time that the youth exhibits exploration, rebellious and self-definition behavior. The players in the industry are still figuring out the rules of the game, they are defining the frameworks and the majority do not know what to do with it all.

My dear friends Shefi and Avi from Coverager gathered the following information on investors and investment in the global insurance industry. For additional information and segmentation by continents. Checkout Shefi's article.

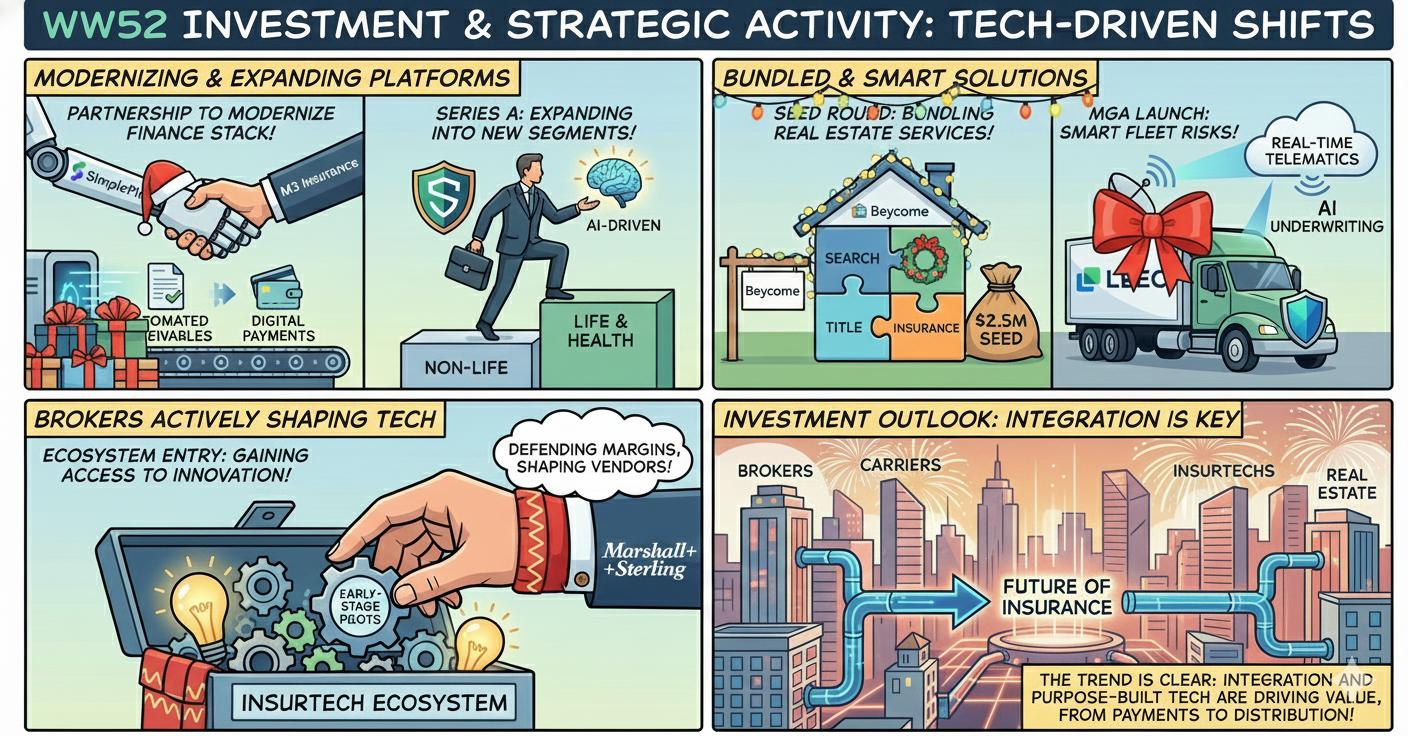

The investments' volume is stabilizing similar to the trend that we witnessed in FinTech (a CBInsight graph should be here.) An interesting fact is the amounts that the investors put into the more established companies such as Lemonade and DataRobot and the brand new startups. Why is it interesting? Very simple, SoftBank invested $120M series C in Lemonade and New Enterprise Associates invested $67M series C in DataRobot. Both investors understand the cost of doing business in the insurance industry and each investor has an investment strategy. Take a look at SoftBank's portfolio here. Lemonade needs the capital in order to grow as an insurance carrier to new territory leveraging its scalable core system, and DataRobot needs to expand its enterprise sales force.

The insurance companies and the reinsurance companies took several steps forward as well to embrace the change and opportunity that the newcomers bring. One indicator was the number of participants at Jay Weintraub's ITC2017 conference. 3,800 attended the conference, double the number of the ITC2016 conference. Another indicator is the increasing number of venture arms. In 2015, the European insurers had the lead with AXA, Allianz, and Aviva who created a venture arm and XL Catlin as the only US-based insurer with a venture arm. In 2016, additional US insurers founded their venture arm Nationwide $100M, Liberty Mutual $150M and Intact (Canada) $200. In 2017, Northwestern Mutual launched its venture arm and many others got the spotlight, for example, RGAx, Aflac ventures, and BlueCross ventures. Others increased the size, scope, and talent of their innovation team e.g. AIG.

The 2017 buzzwords and trends

We can't ignore the buzz words and trends that shaped 2017 tech world. I think that we can all agree that AI, blockchain, bitcoin, ICO, and bots were the 2017-Q3 Q4 buzzwords that eclipsed the Q1-Q2 buzzwords predictive analytics, big data, and customer engagement. Bear in mind that in many insurance companies the phrases "digital transformation", "agile", "mobile first" etc are work in progress and the mid-size agencies, who are a major player in the distribution channel, are not digitized as they should.

Not everything is Distribution or new insurance products. The SaaS, the DaaS and the smart compare engines that have done well. We can't go without mentioning CrapeData, DataRobot, PolicyGenius, and BoldPenguin.

2018 Predictions

1. CYBER INSURANCE

There are new and exciting hardcore technologies coming out from innovation centers and from the Cyber powerhouse Israel. The space is not defined enough for an underwriting, pricing and the standards that can provide significant recovery through the claims process. In 2018, we are going to see new insurance products that can address the combined risk of system and human. We are at the start of cyber insurance.

2. THE FALL OF BLOCKCHAIN

No, blockchain will not fall -- the excitement will wind down. The engine that drives the research and searches for revenue-driving applications will continue. We going to witness additional institutes (research and consortium) that will help the carriers to improve on internal processes.

3. SMART CITIES

In 2018 we are going to the chatter around Smart Cities. Why? Because Singapore, Dubai, Amsterdam, Barcelona and other cities are exploring the concept.

A smart city is an urban area that uses different types of electronic data collection sensors to supply information which is used to manage assets and resources efficiently. --Wikipedia

Insurance will benefit from smart cities in the future. Safer urban areas, better risk management, and easier CAT assessments. In the meanwhile, it is important to observe the IoT operation that will power the Smart City and the cyber security + cyber insurance that it may require.

4. ARE BOTS STILL A THING?

No, unless you don't have one.

5. API

Application Programming Interface (API) is THE 2018 prediction for me. Carriers know that the marginal cost of adding another "digital agent" can cost them millions if they don't have a modern API management system. Insurance companies want to work and receive business from the new InsurTech startups who registered as agents in all 50 states and with the agents who digitized their own business.

6. Agents

The core entrepreneurs of the insurance industry. The agents will have two paths to take (i) evolve to an InsurTech agency (ii) buy InsurTech services to make their agency more productive and more efficient. In 2018, the agents will be the buying force of InsurTech products.

7. Venture Life Cycle

In 2018, InsurTech startups are going to enter new stages of a venture's life cycle. Scale - startups are going to invest their series A and B and scale their operation, customer base and revenue. Acquisition - for market segment, technology and talent. Dissolve - because they had the wrong product, the wrong team, the wrong business model, or that their competitors were better.