Last weekend I got punched in the face. Twice. Karate practice has been a great source for insights and life lessons. In one of my recent posts I wrote about changing the kata and the mindset as a company re-positions itself in the market. Today I want to tell you about the lessons I learned over the weekend.

Ducktape - a karateka's best friend. [Shotokan Karate of America - CalTech special training 2016]

A major part of the SKA practice includes winter and summer special training events. Special training is a long weekend of intense training that pushes you to the edge of your abilities and usually your toughest opponent is you. No, I didn't punch myself.

One of the benefits of special training is to practice and face karatekas from other dojos. In sanbon-kumite (three strikes sparring) I faced another black belt. Both of us ranked as nidan. Quick estimation - I am a head taller than him, at least 10 years older than him and he has a well groomed big mustache. We bowed, and before I managed to move in, his fist found my chin. Since I was working on getting-in (irimi) I decided to try getting-in again and stretched myself tall so his fist would need to travel longer to its destination. He moved, I moved, and his fist found my nose. No worries - only blood, nothing broken. Sanbon-kumite is a three continuous strikes engagement, my opponent managed to hit me and cause pain. Yet, he didn't knocked me out and I was able to navigate successfully his other two consecutive strikes and counter attack. One of the seniors that observed the engagement commented: "try to block." I didn't want to change my internal goal for the practice, but I didn't want to get hit in the face for the third time. So, I adapted my internal goals to meet the threat.

Lessons for the insurance companies:

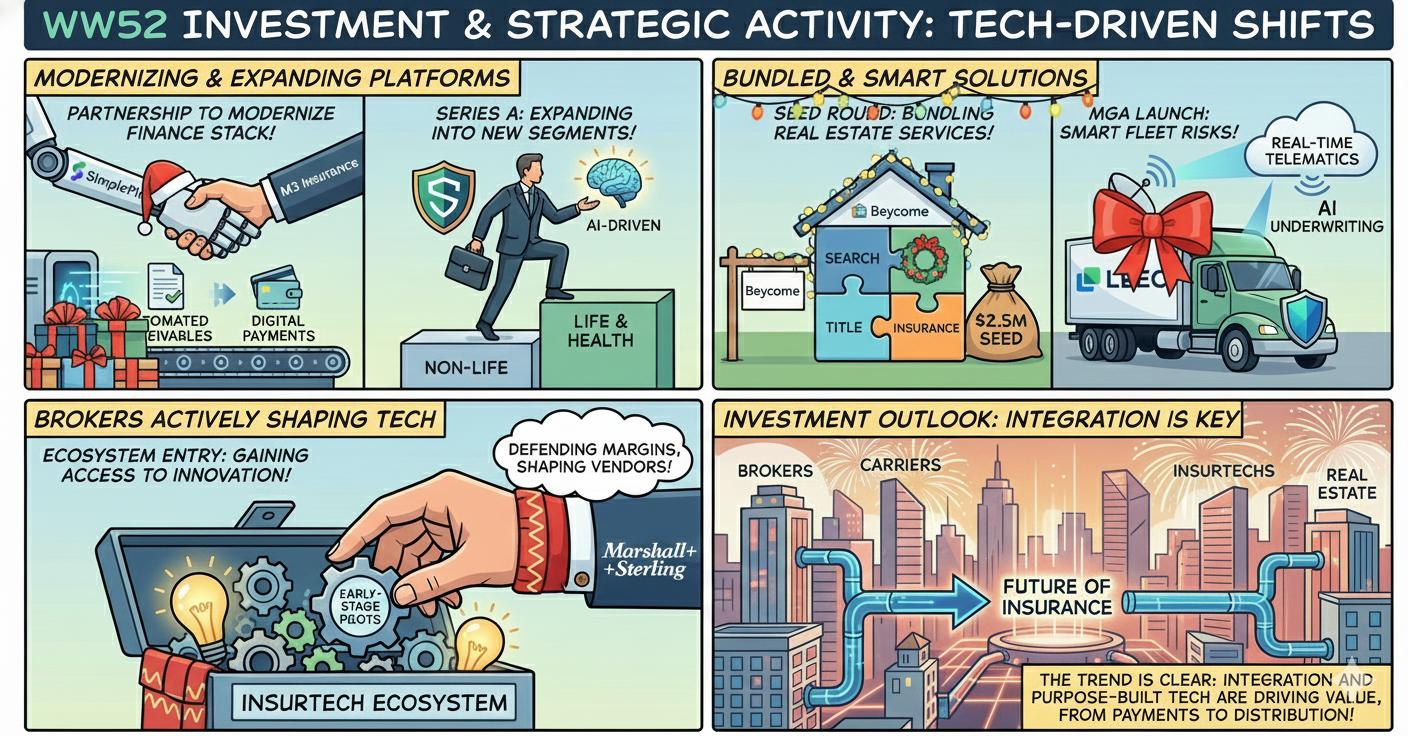

- Don't under estimate InsurTech startups. Some of them are hipsters that can respond to your customers faster and better than you can.

- Playing "big company" against a small startup may draw blood, from you.

- Most of the time the startup has only the first punch to play with.

- Adjust your internal objectives and incentives to support your external goals.

- Adjust your modus operandi base on the external threat. If you need to block, block! It doesn't matter that blocking is a simple technique and less elegant than Irimi.

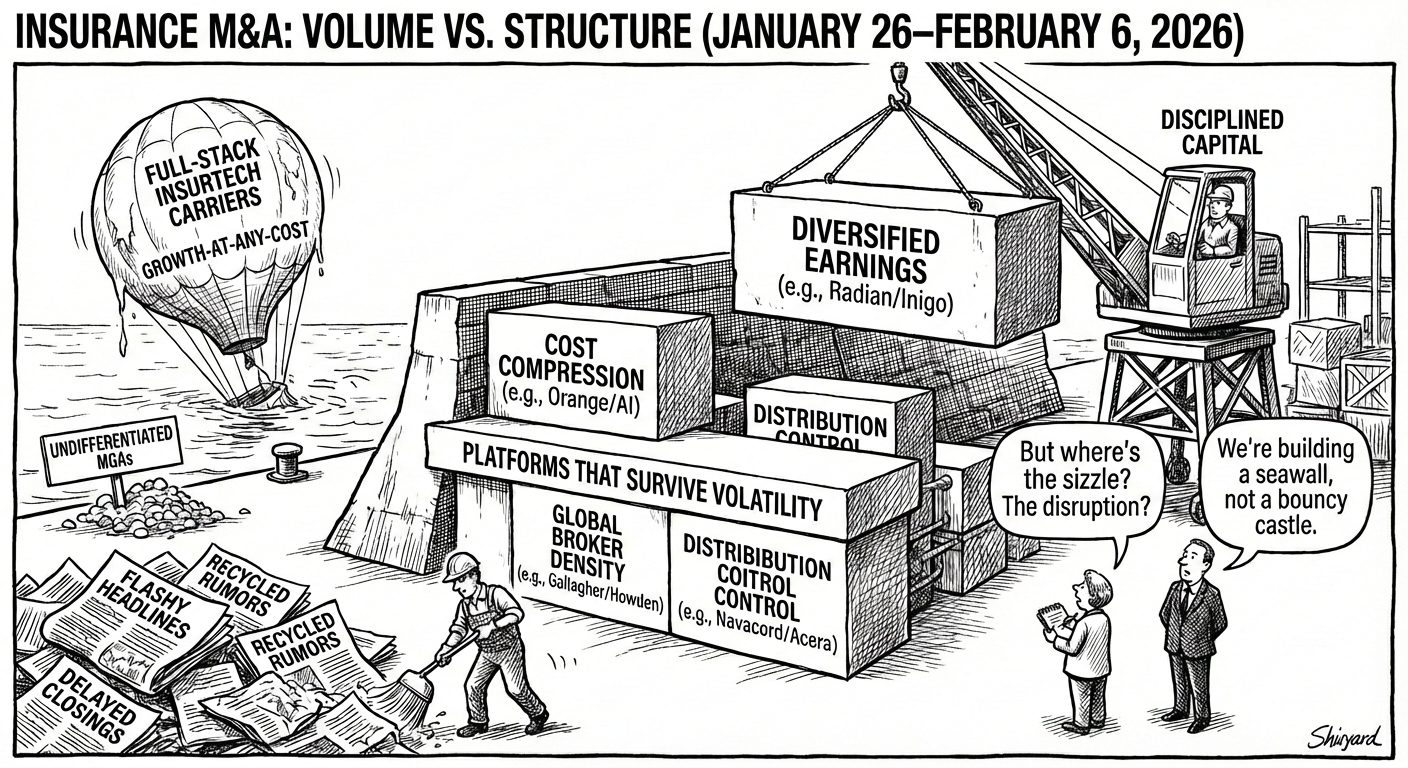

- Think M&A

Lessons for InsurTech startups:

- Be fast!

- Have a long reach than perceived.

- Create an awesome diversion. Grow a mustache if you can pull it off.

- Hit where it hurts.

- Think M&A

![Ducktape - a karateka's best friend. [Shotokan Karate of America - CalTech special training 2016]](https://images.squarespace-cdn.com/content/v1/5812f656414fb57ae8dfca17/1487053792127-DJCTOTMODNB4QK8YPYCX/santa_monica_st_winter_2016.jpg)