On Tuesday, January 10th 2017, Daniel Schrier from Fjord, an Accenture company, joined the InsurTech Los Angeles Meetup group for a conversation about design thinking, innovation trends and opportunities from a design and creative perspective. Daniel's talk covered a lot of ground and left the audience with many questions that we hope to cover in our future events.

Today, customer brand loyalty is low. One of the challenges companies face is meeting customer expectations. The reason is that companies assume that they meet customer expectation by measuring customer satisfaction, usually by extrapolating NPS and tNPS scores. It is hard to measure the gap between expectations and satisfaction. Where there is a challenge there is an opportunity. New InsurTech companies take on the challenge of meeting customer experience expectations. They do that by observing the popular non-insurance applications e.g. Uber and applying the UX principals to an insurance application.

Trends

Trends/Intelligent Automation

Machines and Artificial Intelligence will be the newest recruits to the workforce, bringing new skills to help people do new jobs, and reinventing what's possible.

The first step, before we jump into the "smart" and the AI, is simple automation. I find that there are many opportunities to automate the tools and help the workforce. The insurance space is composed not only of agents, adjusters, underwriters, actuators and customer support but also of marketers, engineers, operations, IT support and much more. Products that can increase an agency efficiency, or call center turn around, will provide value to the industry.

Trends/Liquid Workforce

Insurance companies must look at technology not only as a disrupter but also as an enabler. The technology will enable to transform the people, projects, and organization into a highly adaptable and change ready enterprise.

Trends/Platform Economy

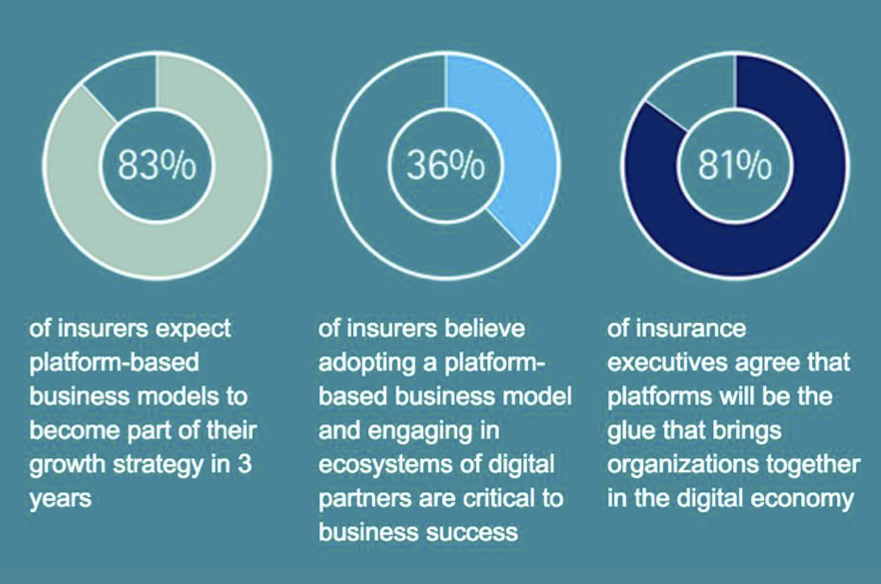

The strategic use of technology to create platform business models is driving growth opportunities is the rapidly expanding digital economy and for insurers.

Trends/Predictable Disruption

Fast emerging digital ecosystems create the foundation for the next big wave of enterprise disruption in insurance.

Forward thinking insurance companies have the line of sight to redefine their role and positioning in the market. Today there is an opportunity, if not a need, to change how carriers create and deliver insurance products. In future posts, I will address the value over and position of the new InsurTech companies Lemonade, Trov and Metromile.

The survey above raised several questions during our conversation with Daniel. One of the questions was "83% of insurers recognize that IoT will introduce change to the industry. Yet, only 51% of insurers plan to pursue digital initiatives with new partners. Are the insurers planning to grow IoT capacity in-house? Work with old partners? Or, ignore it completely?