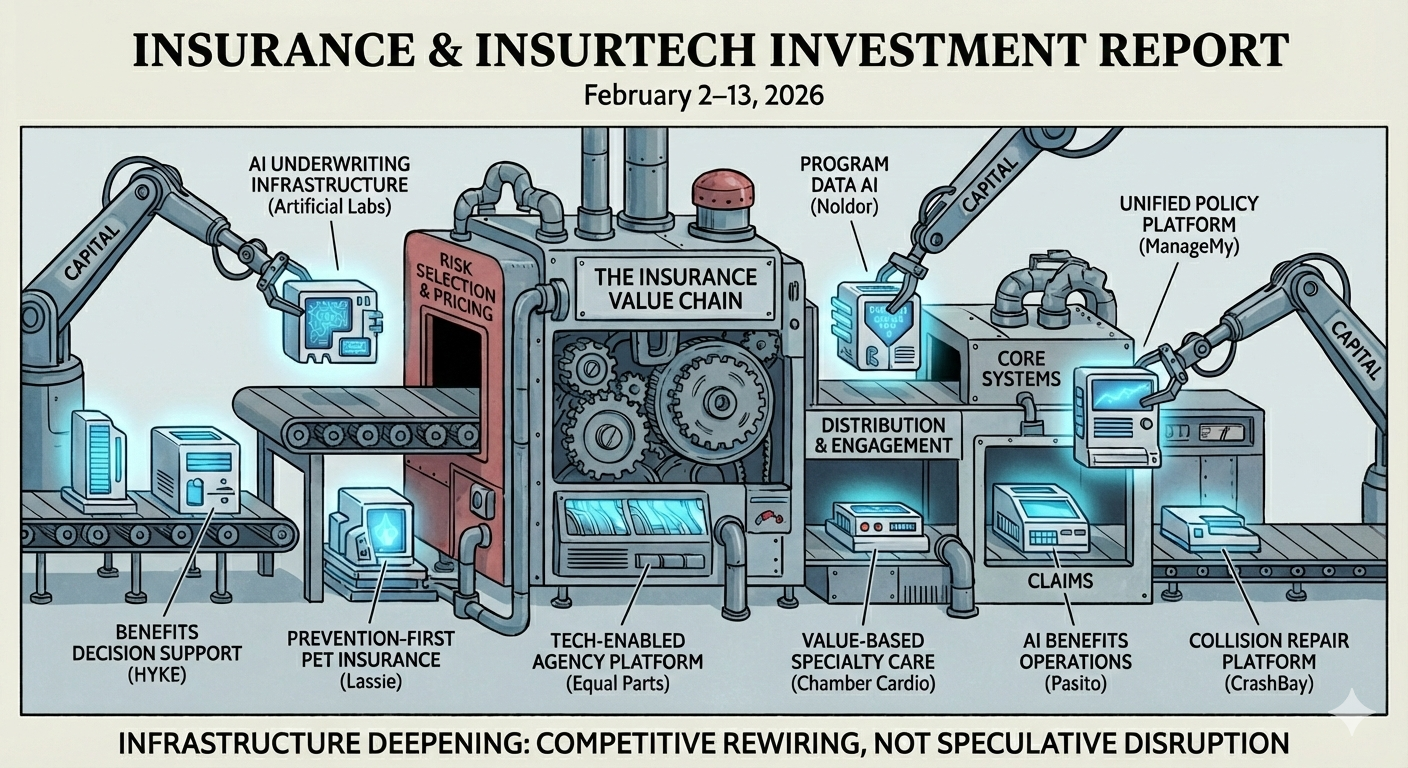

Infrastructure Deepening Across Underwriting, Distribution and Value-Based Care

The second week of February did not produce headline-grabbing mega-rounds. Instead, it delivered something arguably more consequential: capital flowing into infrastructure.

Across underwriting engines, policy systems, agency platforms, benefits operations, specialty care, and claims, investors backed companies that sit at structural control points in the insurance value chain. The throughline is clear—capital is concentrating around platforms that either (1) improve risk selection and pricing precision, or (2) control distribution and workflow integration.

This is not speculative disruption. It is competitive rewiring.

Artificial Labs — Algorithmic Underwriting Goes Mainstream

$45M Series B | AI underwriting infrastructure | UK specialty & commercial P&C | February 1–3, 2026

Artificial Labs provides algorithmic underwriting and risk-pricing tools for commercial carriers and Lloyd’s-market syndicates. This Series B, led by CommerzVentures, signals institutional conviction that underwriting automation is no longer experimental—it is operational infrastructure.

Why it matters

- Underwriting leverage. Specialty markets built on manual expertise are now adopting algorithmic decision layers.

- Broker workflow integration. AI-assisted placement tools reduce friction between broker and carrier.

- Scalable pricing precision. Capital accelerates expansion into additional lines and geographies.

Competitive impact

- Syndicates and specialty carriers reliant on manual underwriting face margin compression.

- Internal carrier data-science teams must now compete with venture-backed specialists.

- Smaller underwriting-tech vendors risk being outscaled.

Bottom line: Algorithmic underwriting is shifting from augmentation to structural dependency.

**Founders:**Co‑founded by David King and Johnny Bridges; current CEO is Damian Arnold Investors: CommerzVentures (lead), Move Capital, existing institutional backers.

Noldor — Program Data Becomes Strategic Infrastructure

$10M Seed / Early Growth | MGA program-data AI platform | US | Early February 2026

Noldor builds AI-based data infrastructure for program administrators and carriers. Backed by the DESCOvery group at D.E. Shaw, the company sits at a crucial pain point: fragmented MGA data.

Why it matters

- Loss-ratio transparency. Normalized program data surfaces hidden underwriting drivers.

- Expense ratio pressure. Automation reduces manual reporting overhead.

- Quant capital influence. D.E. Shaw backing signals confidence in data defensibility.

Competitive impact

- Carriers must raise expectations for data hygiene and analytics rigor.

- Smaller program-data vendors face capital and capability gaps.

- MGAs increasingly evaluated on data sophistication, not just growth.

Bottom line: In program business, data quality is becoming a valuation multiplier.

Founders: Founded by John Horneff; current CEO is Scott Quiana Investors: DESCOvery (D.E. Shaw), additional strategic investors.

ManageMy — Core Systems Reposition for AI Era

$45M Growth Capital (incl. $20M Series B) | Unified policy-lifecycle platform | Global | February 10–11, 2026

ManageMy provides an end-to-end platform enabling insurers and brokers to sell, underwrite, service, and administer policies on a single system. The round includes $20M co-led by Ventura Capital and OCVC, with additional strategic capital.

Why it matters

- Core-system consolidation. Unified lifecycle control replaces fragmented legacy stacks.

- AI-native enhancement. Embedded AI shifts the platform from admin tool to decision engine.

- International expansion. Growth beyond domestic markets increases competitive pressure globally.

Competitive impact

- Guidewire-adjacent ecosystems and Duck Creek–style platforms must accelerate AI deployment.

- Smaller core vendors risk consolidation or niche specialization.

- Brokers increasingly expect unified workflow integration.

Bottom line: Core systems are no longer back-office utilities—they are strategic control layers.

Founders: Founded by Sean O’Connor (also co‑founder of Zilch) together with a founding team; led by Co‑founder and CEO Stephen Collins Investors: Ventura Capital, OCVC (Sean O’Connor), BNF, additional strategic backers.

Distribution, Benefits & Agency Platforms

HYKE — Decision Support as Carrier-Controlled Engagement Layer

Strategic Investment (Amount Undisclosed) | Benefits decision-support platform | US/UK | February 12, 2026

HYKE provides personalized benefits-decision technology for employees. Aviva joins as a strategic investor with follow-on funding from Unum.

Why it matters

- Carrier-backed distribution leverage. Alignment with Aviva and Unum strengthens enterprise credibility.

- Guided experience over static enrollment. Personalized navigation raises UX expectations.

- Embedded engagement. Carrier distribution increasingly includes advisory technology.

Competitive impact

- Independent benefits-navigation vendors face longer enterprise sales cycles.

- Employers will expect personalization, not generic enrollment flows.

- Carriers without modern decision-support risk engagement erosion.

Bottom line: Benefits engagement is becoming a competitive differentiator, not a compliance function.

Investors: Aviva (new), Unum (follow-on).

Lassie — Prevention-First Pet Insurance Scales Across Europe

$75M Series C | AI-driven pet insurer | Europe | February 12, 2026

Lassie, headquartered in Sweden, operates a prevention-first pet insurance model active in Sweden, Germany, and France. The round was led by Balderton Capital with Felix Capital and others participating.

Why it matters

- Prevention economics. Shifts from reimbursement toward risk mitigation.

- High engagement model. Frequent customer interaction strengthens retention.

- European scale ambitions. Capital supports deeper continental penetration.

Competitive impact

- Traditional pet insurers focused on claims reimbursement face pricing pressure.

- Engagement-driven models increase customer lifetime value expectations.

- Prevention data becomes underwriting asset.

Bottom line: Pet insurance is evolving from reactive coverage to behavioral risk management.

Investors: Balderton Capital (lead), Felix Capital, Inventure, Passion Capital, Stena Sessan.

Equal Parts — Technology-Enabled Agency Consolidation

$23M Series A (≈$50M acquisition capacity incl. debt) | Independent agency platform | US | February 10, 2026

Equal Parts acquires and modernizes independent agencies, positioning itself as both exit solution and operating platform.

Why it matters

- AI-enhanced roll-up. Technology becomes part of the value proposition.

- Aggressive acquisition roadmap. Targeting 25 agencies in 2026.

- Premium scale ambition. $1B in premium within 24 months.

Competitive impact

- PE-backed consolidators must differentiate beyond capital.

- Agency sellers increasingly compare tech enablement, not just multiples.

- Traditional roll-ups risk margin compression.

Bottom line: Agency aggregation is evolving from financial engineering to operational modernization.

Investors: Inspired Capital (lead), Equal Ventures, Max Ventures, Genius Ventures.

Chamber Cardio — Value-Based Specialty Care Aligns With Payers

$60M Series A | Cardiovascular value-based platform | US | February 7, 2026

Chamber Cardio partners with health plans and cardiologists to manage heart disease under value-based care models. Led by Frist Cressey Ventures with strong insurance-linked participation.

Why it matters

- Payer integration. Direct alignment with health-plan incentives.

- AI-enabled workflow. Identifies high-risk patients and closes care gaps.

- Specialty focus. Cardiovascular care represents high-cost exposure.

Competitive impact

- Health plans may prefer external specialized platforms over internal builds.

- Competing specialty-care vendors must deepen data integration.

- Insurance-linked investors signal strategic interest beyond pure healthcare.

Bottom line: Value-based specialty platforms are becoming risk-management tools for payers.

Investors: Frist Cressey Ventures (lead), General Catalyst, AlleyCorp, American Family Ventures, Optum Ventures, Healthworx Ventures, HSBC Innovation Banking (debt).

Pasito — Agentic AI Enters Benefits Operations

$21M Series A | AI-native benefits operations platform | US | February 3, 2026

Pasito is building an AI-native workspace that transforms unstructured plan and census data into a unified benefits data layer.

Why it matters

- Agentic AI deployment. Pre-configured AI agents automate quoting, enrollment, and support.

- Workflow compression. Reduces manual processing across carriers and brokers.

- Infrastructure positioning. Seeks to become operating layer, not just engagement tool.

Competitive impact

- Legacy benefits-admin vendors must adopt AI or risk obsolescence.

- Brokers may gain operating leverage—or lose relevance if carriers internalize automation.

- Enterprise sales anchored by insurer partnerships strengthen defensibility.

Bottom line: Benefits operations are becoming software-defined.

Investors: Insight Partners (lead), Y Combinator, MTech Capital.

Claims & Auto Infrastructure

CrashBay — Strategic Credibility in Auto Claims

Strategic Investment (Undisclosed) | Collision repair & claims platform | US | February 10–11, 2026

CrashBay strengthens its position through strategic backing and advisory involvement from former Nationwide claims executive Alan Demers.

Why it matters

- Industry credibility. Executive alignment signals insurer trust.

- Integration depth. Focus on claims-system connectivity.

- Network expansion. Scaling shop and fleet partnerships.

Competitive impact

- Rival DRP platforms must match integration depth.

- Carrier relationships become decisive competitive moat.

- Strategic capital may accelerate consolidation in claims-tech.

Bottom line: Claims infrastructure remains a quiet but decisive control point.

The common thread across this period is not “AI hype.” It is structural control.

Capital flowed toward companies that either improve underwriting precision (Artificial Labs, Noldor), consolidate core systems (ManageMy), reshape distribution (Equal Parts, HYKE), redefine engagement (Lassie, Pasito), or embed themselves into payer risk models (Chamber Cardio).

Insurance is not being disrupted at the edges. It is being re-engineered at its operational core.

That shift is slower than headlines suggest—but far more durable once complete.