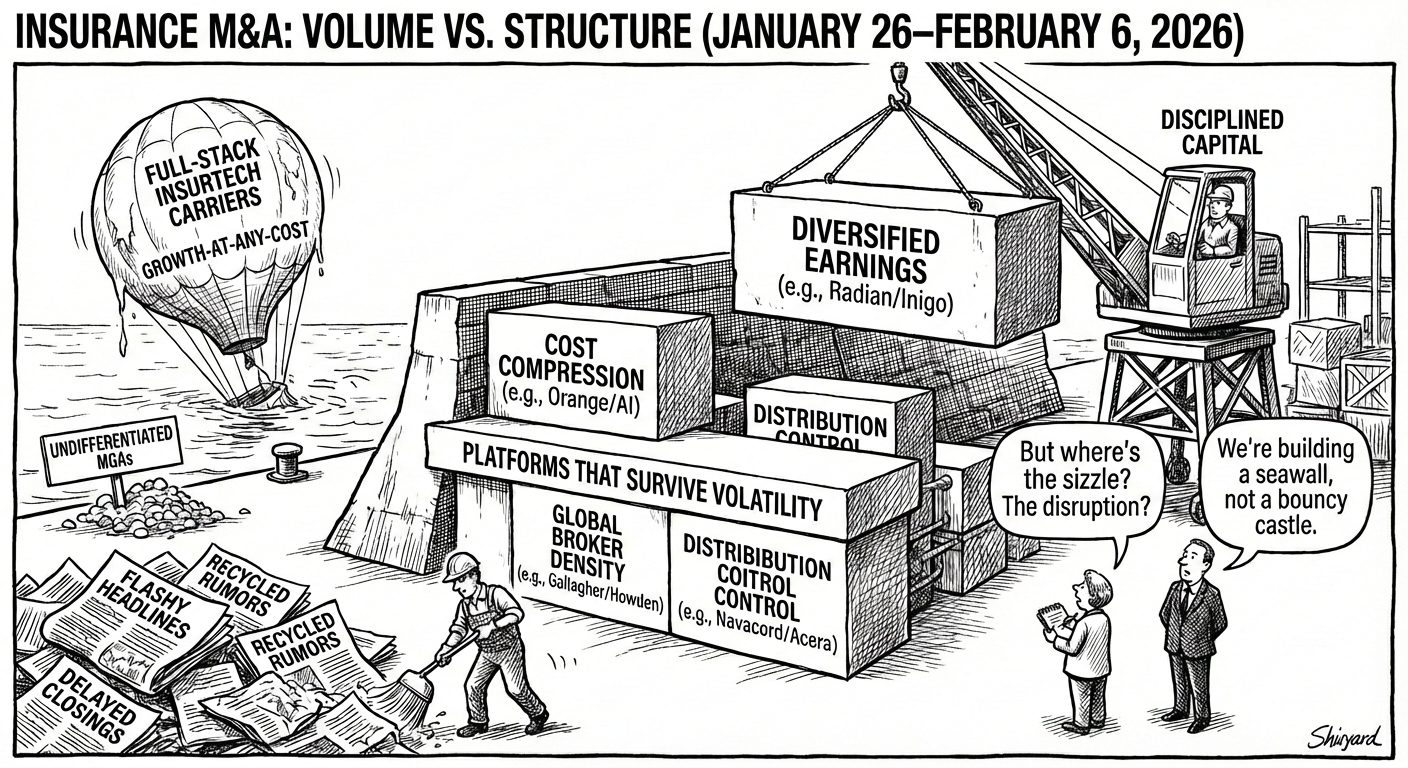

From January 26 to February 7, 2026, insurance and InsurTech M&A blended headline carrier moves with targeted distribution and tech plays. Meiji Yasuda and Radian closed multi‑billion‑dollar acquisitions that push them deeper into US term life and Lloyd’s specialty, while Zurich advanced an £8B bid for Beazley that could reshape the global cyber and specialty landscape. At the same time, WTW’s purchase of tech‑enabled broker Newfront, a string of regional roll‑ups by Hilb, WalkerHughes, Novacore, FMIG, Howden, Gallagher, Olea and K2, and intra‑InsurTech deals like HPN–Orange and Akur8–Matrisk show capital flowing toward distribution control, specialty underwriting and embedded AI capabilities

Late December is typically a dead zone for announcements. This year was different.

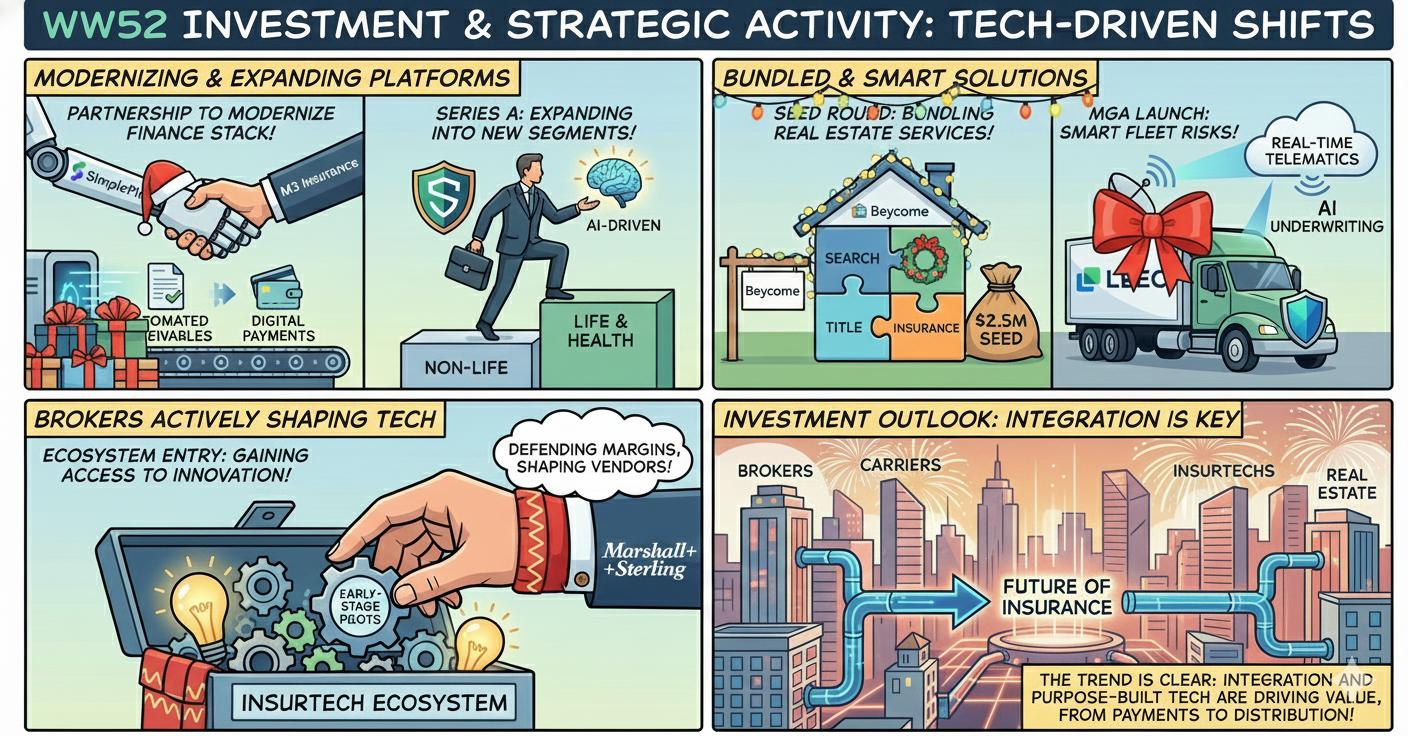

While primary dealmaking slowed, several material funding rounds, strategic partnerships, and ecosystem moves were formalized or surfaced during the holiday window—particularly across embedded real-estate insurance, commercial auto MGAs, and insurance-specific financial automation.

The pattern is consistent with broader 2025 dynamics: fewer announcements, but higher signal per deal, and capital continuing to flow toward platforms that control workflow, data, or distribution.

The 1996 movie ‘Scream’ taught us one thing: Don’t answer the phone! And much like the characters of that movie, so to insurers should heed this advice when engaging with Millennials.

A startup has a life but the people who breathe life into it…, well, they usually don't.

People like the idea of a startup. It is romantic. The excitement diminishes when they find out the extent of their responsibility and compensation. Basically, most people really want to work for Google. Google is a multibillion-dollar behemoth that has all the risk management tools and processes to support it. And yes! They still have all the perks and cool parties at the end of Google I/O.

Step Up

The entrance of startups to the insurance industry, nearly four years ago (2015), introduced a change, innovation, that made all the components, whether they are linear or passive, to react. The new teen spirit that the startup introduced acted as a step function that increased the value of the industry. The input may be a nice and clean function. It has a ripple effect that affects the entire pond until is converges on the new and higher level.